The process of securing new construction loans for real estate projects demands careful planning, meticulous preparation, and a clear understanding of the lender’s requirements. Whether you’re a seasoned developer or a novice in the world of real estate construction, the pursuit of financing for your project can be daunting.

To aid in this endeavor, we present ten crucial tips for successfully navigating the application process for a new construction loan in Massachusetts, offering the confidence needed to secure financing for your project.

1. Develop a Comprehensive Business Plan

Your business plan is the cornerstone of your construction project, encompassing intricate insights into the project’s scope, objectives, timelines, and budgeting. It should emphasize exhaustive market research, detailed financial projections, and a comprehensive risk mitigation strategy. This document is your chance to present a clear and strategic vision, showcasing a meticulous understanding of the project’s goals and a well-thought-out roadmap to achieve them.

A robust and detailed business plan instills confidence in lenders, highlighting your competence and readiness to manage and execute the project effectively.

2. Understand Loan Types and Requirements

Understanding the variety of loan types available is essential. Different lenders offer various terms and conditions for new construction loans, private money loans, or hard money loans. Each loan type comes with specific requirements, distinct interest rates, and expectations for collateral.

A comprehensive understanding of these options helps align your project’s unique needs with the most suitable loan type, ensuring that the financial structure harmonizes seamlessly with the project’s demands.

3. Choose the Right Lender

Selecting the right lender is pivotal. It involves thorough research to identify lenders specializing in construction financing. Assess their experience, success rates, and local market knowledge. Look for a lender that not only offers favorable terms but also demonstrates a strong understanding of new construction projects.

Finding a lender that aligns with your project’s vision and goals ensures a more successful and harmonious collaboration.

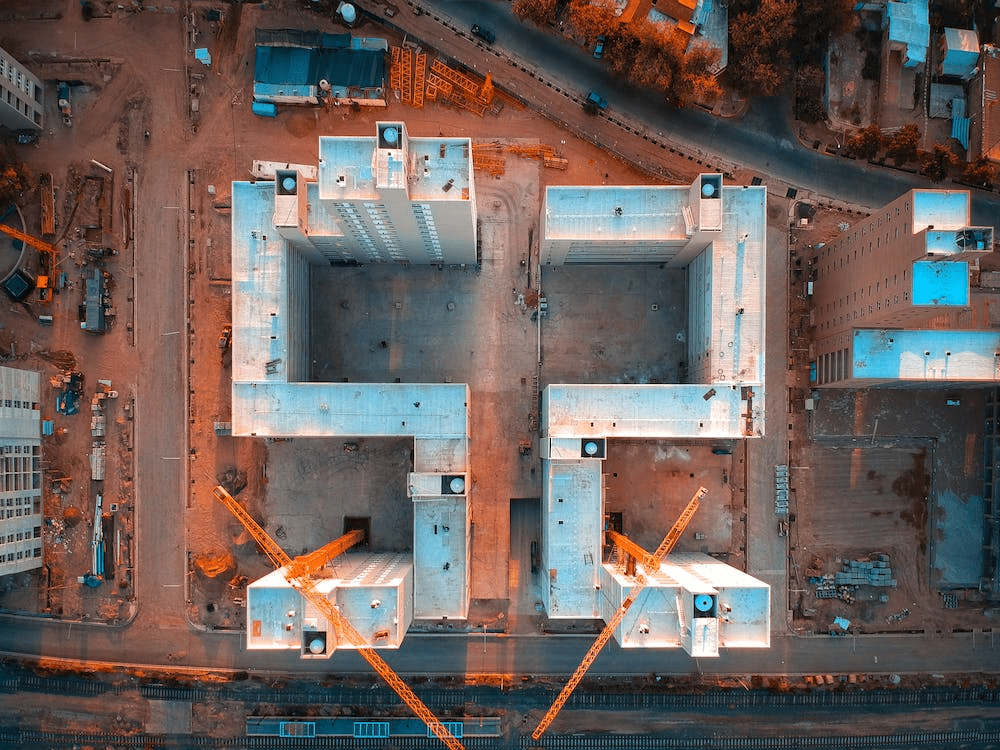

4. Prepare a Detailed Budget and Construction Plan

Crafting a comprehensive budget and construction plan is fundamental. This plan should meticulously detail all project expenses, covering aspects such as land acquisition, construction costs, permits, labor, and contingencies.

A well-detailed plan signifies a thorough analysis of the project’s financial requirements. It demonstrates responsible financial planning, instilling confidence in lenders regarding the project’s feasibility and your meticulous approach to financial management.

5. Showcase Experience and Expertise

Highlighting your experience and expertise in the real estate or construction industry is crucial. Demonstrating success in similar projects establishes credibility. Lenders prefer borrowers with a proven track record in handling construction challenges and delivering successful projects.

Displaying past achievements not only reduces the lender’s risk but also instills trust in your capabilities to manage complexities in new construction projects. Emphasizing your expertise communicates your ability to navigate challenges and boosts confidence in your capacity to oversee the construction effectively.

6. Provide Collateral and Equity

Lenders often require collateral and equity for new construction loans. Offering substantial collateral, such as the project’s land or other valuable assets, demonstrates commitment and lowers the lender’s risk. Presenting a significant equity stake further assures the lender of your personal investment and dedication to the project’s success.

A solid equity position showcases your financial commitment and aligns your interests with the project’s success, instilling confidence in lenders regarding your level of involvement and dedication.

7. Prepare All Necessary Documentation

Gathering and organizing all essential documentation is critical. This includes building plans, permits, financial statements, credit history, legal documents, and other requested materials. Thoroughly organized documentation expedites the loan application process, portraying professionalism and readiness.

Providing a complete and well-organized set of documents not only showcases preparedness but also streamlines the application process, presenting a favorable image to lenders and demonstrating your ability to handle and deliver required information promptly.

8. Be Realistic with Expectations

Maintaining transparency and realism regarding the project’s objectives, budget, timelines, and anticipated returns is essential. Setting achievable expectations demonstrates a prudent understanding of the construction venture and its associated risks and rewards.

Lenders appreciate borrowers who demonstrate a clear comprehension of the project’s realities and an ability to navigate uncertainties. Realistic expectations establish credibility and convey a well-informed approach, illustrating your capacity to navigate challenges and deliver achievable outcomes.

9. Maintain Clear Communication

Establishing and sustaining open and transparent communication channels with the lender throughout the application process is pivotal. Swift responses to queries and regular updates on the project’s progress foster trust and convey responsibility.

Consistent communication showcases a commitment to transparency and accountability, ensuring the lender is regularly informed about the project’s advancements. This not only reassures the lender but also demonstrates your responsible approach to managing the construction project.

10. Seek Professional Guidance

Engaging professionals like real estate attorneys, accountants, or financial advisors provides valuable insights. Their expertise covers legal, financial, and strategic aspects, ensuring comprehensive consideration. Professional guidance ensures all facets of the loan application process are addressed, enhancing the application’s credibility.

Seeking advice from these experts demonstrates a meticulous approach, minimizing potential oversights and reinforcing the application’s thoroughness. Their guidance provides critical insights, refining your application and ensuring it meets the highest standards demanded by lenders.

Apply For Our New Construction Loans in Massachusetts

Securing new construction loans in Massachusetts demands a strategic and comprehensive approach. By following these essential tips, investors and developers can significantly enhance their chances of successfully securing the necessary financing for their construction projects. Whether pursuing new construction loans, hard money loans, or private money loans in Massachusetts, a thorough understanding of the process and requirements can help in navigating this financial landscape.

When considering new construction loans in Massachusetts, explore reputable and experienced lenders like Insula Capital Group. We offer a range of financing options, including private money loans and new construction loans. Our tailored financial solutions and expertise in the industry provide the necessary support to help transform your construction aspirations into reality.

Contact us today to book an appointment with our specialists and apply for new construction loans.