Flipping houses can be a game-changer for real estate investors, but securing the right financing is crucial. That’s where 100% rehab financing comes in! Imagine covering both your purchase and renovation costs without draining your savings. Sounds great, right? The role of bridge loans in house flipping is crucial in making this possible, offering quick and flexible funding that helps investors turn properties around fast.

Let’s see how 100% loan-to-cost (LTC) financing works and how it can supercharge your flipping strategy.

What Is 100% Loan-to-Cost Financing?

Simply put, 100% LTC financing covers the full cost of buying and renovating a property. Unlike traditional loans, which require a hefty down payment, this type of financing allows investors to leverage their capital efficiently. Instead of tying up cash in one project, you can spread your resources across multiple deals, maximizing profits.

The key benefits include:

✔ No upfront cash required for purchase or rehab

✔ Faster project turnaround times

✔ Greater leverage for scaling your business

✔ Reduced financial risk with efficient capital allocation

✔ More opportunities to grow your real estate portfolio

But how does this financing work, and who qualifies? Let’s break it down!

The Role of Bridge Loans in House Flipping

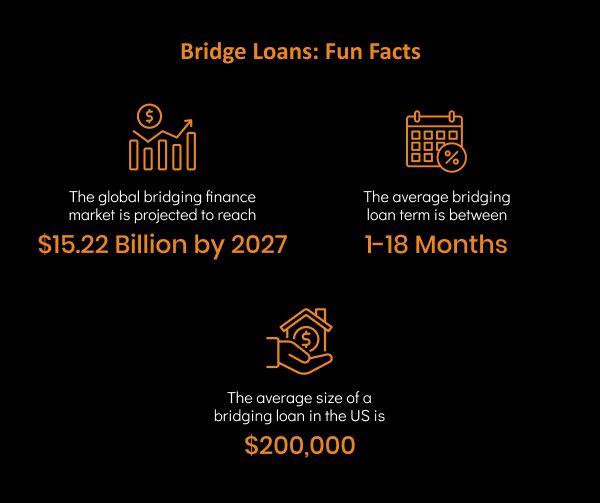

Securing 100% LTC financing often involves using bridge loans—short-term, asset-based loans designed for real estate investors. The role of bridge loans in house flipping is critical because they provide quick funding, allowing investors to close deals fast, renovate, and sell for a profit.

Unlike traditional bank loans, which come with lengthy approval processes, private mortgage lenders focus on the property’s value rather than the borrower’s credit score. This flexibility makes bridge loans an ideal option for fix-and-flip investors.

Why choose bridge loans?

- Fast funding (often within days!)

- No strict credit requirements

- Tailored for short-term investment strategies

- More flexible repayment terms

- Higher approval rates than traditional bank loans

How to Qualify for 100% Rehab Financing

So, how do you qualify for this game-changing financing? Lenders typically look at:

- The property’s after-repair value (ARV)– The estimated value after renovations.

- Your experience level– Seasoned flippers may have an easier time qualifying.

- A solid exit strategy– Whether it’s selling for a profit or refinancing into a long-term loan.

- A strong investment plan– Lenders want to see a detailed plan for renovations and resale.

Working with the right private money lenders is key. These lenders will assess your deal’s viability and structure a loan that fits your needs.

Traditional Loans vs. Hard Money Loans: Key Differences

When deciding on financing, it’s important to understand the differences between traditional loans and hard money loans for real estate.

Traditional bank loans take weeks or even months to process, requiring extensive credit checks and documentation. In contrast, hard money lenders approve loans in a matter of days, prioritizing the property’s value over the borrower’s credit history.

Additionally, traditional loans often require down payments of 20-30%, whereas private hard money lenders may offer 100% LTC financing with as little as 0-10% down. This makes fix and flip financing much more accessible to investors looking to move quickly in competitive markets.

If you need hard money construction loans, traditional lenders won’t move fast enough. Instead, private hard money lenders step in to provide quick, flexible funding.

Finding the Right Private Lenders for Your Rehab Project

Not all private lenders offer 100% LTC financing. To find the right partner, look for:

✔ Experience – Choose hard money lenders with a track record of funding successful flips.

✔ Transparency – Avoid lenders with hidden fees.

✔ Flexibility – Work with long-term private money lenders if you need extended financing options.

✔ Reliable funding sources – Ensure the lender has the financial stability to fund your deals.

✔ Customer support – Choose lenders who offer guidance and support throughout the process.

Whether you’re a seasoned investor or just getting started, partnering with the right fix and flip lenders makes all the difference.

Maximizing Profits with 100% LTC Financing

Using fix and flip bridge loans effectively can significantly boost your bottom line. Here’s how:

Invest in multiple properties – Instead of tying up all your capital in one deal, spread it across several flips.

Reduce out-of-pocket expenses – Keeping more cash on hand allows you to handle unexpected costs.

Increase project speed – Faster closings mean you can complete and sell properties quicker.

Improve ROI – Lower upfront investment leads to higher overall returns.

Leverage lender relationships – Building strong connections with private money lenders for home loans can open doors for better financing options in the future.

With private money lenders, you’re not waiting months for bank approval—you’re moving fast and scaling up.

Final Thoughts: Is 100% Rehab Financing Right for You?

If you’re serious about flipping houses and want to maximize leverage, then 100% loan-to-cost financing is a smart move. The role of bridge loans in house flipping is undeniable—they provide quick, flexible funding to help investors buy, renovate, and sell efficiently.

At Insula Capital Group, we specialize in hard money construction loan options, fix and flip loans, and hard money rental loans. Whether you need funding for your next flip or want to explore private lenders for real estate investors, we’ve got the solutions to help you succeed.

Ready to scale your real estate business? Contact Insula Capital Group today and let’s get your next project funded!