New Construction Loans in Chattanooga, Tennessee

Get in Touch

Maximize Real Estate Potential with Tailored Financing Discover Chattanooga's Real Estate Market with Insula Capital Group

Chattanooga, TN, is a hub of opportunity for developers and investors looking to capitalize on the city’s burgeoning real estate market. Unlock the possibilities with Insula Capital Group’s new construction loans, skillfully crafted to strengthen and energize your construction projects in Chattanooga. By joining forces with us, you’ll tap into a world of growth and development, positioning yourself for success in Chattanooga’s exciting real estate landscape.

Bespoke Financing Options for Chattanooga Construction Ventures:

From residential properties to commercial spaces, our new construction loans in Chattanooga, TN, offer customized financing plans to accommodate your project’s specific needs. Our private money lenders work closely with you to create a loan plan that complements your construction goals, ensuring a seamless process.

Quick Funding for Timely Project Execution:

Keep your construction projects on schedule with our expedited funding solutions in Chattanooga, TN. Our efficient approval process and quick access to funds help you avoid costly delays and maintain project momentum.

Why Insula Capital Group is the Right Choice for Your Chattanooga Projects

- Innovative financing solutions:Apart from our new construction loans, we offer an array of financing options tailored to your project’s distinct requirements, such as bridge loans, mezzanine financing, and land acquisition support.

- Industry expertise:Our team of seasoned professionals leverages their in-depth knowledge of the real estate and construction sectors to guide you through every step of your construction journey.

- Exceptional client experience: At Insula Capital Group, we put our clients first, focusing on delivering personalized services and fostering long-lasting relationships to ensure your construction project flourishes in Chattanooga, TN.

How Insula Capital Group’s Hard Money Loans Facilitate New Construction Investors

Hard money loans are the standard for many real estate investors, especially those looking to take on fix and flip projects and new constructions. These loans are typically provided by private hard money lenders and secured by the property itself. They enable borrowers who may not qualify for traditional bank financing to acquire the necessary capital for their projects due to factors such as credit history or property condition.

Hard money loans are preferred for their speed and flexibility. Traditional bank loans often involve lengthy approval processes, whereas hard money lenders can typically fund loans much more quickly, sometimes within a matter of days. The rapid access to capital can make a huge difference for investors, considering the dynamic market in certain areas where timely decisions need to be made.

Hard money lenders are often more willing to finance projects based on the potential profitability of the property rather than strict borrower qualifications. New construction investors who may need financing for properties in need of building from scratch are some of the top candidates for acquiring hard money loans.

The Must Know Facts About the Chattanooga Market

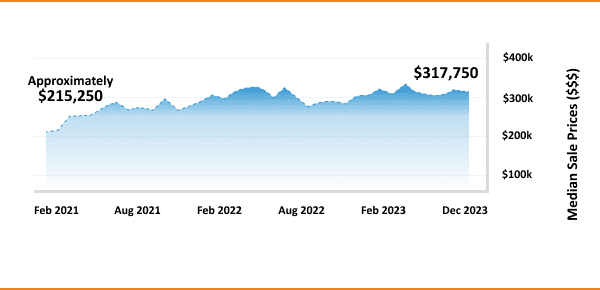

Despite how the Chattanooga market is progressing, investors are recommended to do their due diligence and research the particular sector they’re investing in. To streamline the process, we’ve listed some of the crucial numbers that investors will want to know about right away:

- Median Home Value:$288,088

- 1-Year Appreciation Rate:+23.0%

- Median Home Value (1-Year Forecast): +4.3%

- Median Rent Price:$1,149

- Price-To-Rent Ratio:16

- Unemployment Rate:3%

- Population:182,113

- Median Household Income: $47,165

The Real Estate Landscape In Arkansas

182,113

Population

$1,149

Median Rent Price

$288,088

Median Home Value

+23.0%

1-Year Appreciation Rate

$47,165

Median Household Income

16

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why New Construction Investors Should Consider Chattanooga For Their Investments

Investing in new construction real estate in Chattanooga presents compelling opportunities backed by the many developments in the area’s educational, business, and healthcare sectors. The city is home to several renowned educational institutions, including the University of Tennessee at Chattanooga and Chattanooga State Community College, leading to a skilled workforce and attracting talent to the area.

Chattanooga’s business environment is thriving, with a diverse range of industries contributing to its economy. The city has seen notable growth in sectors such as manufacturing, technology, and logistics, bolstering job creation and investment prospects for real estate developers.

Furthermore, Chattanooga boasts a robust healthcare ecosystem, with top-tier medical facilities like Erlanger Health System and CHI Memorial Hospital providing high-quality care to residents and attracting patients from across the region.

In recent years, Chattanooga has experienced significant population growth, with many individuals and families drawn to its affordable cost of living, vibrant culture, and outdoor recreational opportunities. According to the U.S. Census Bureau, the city’s population increased by over 10% between 2010 and 2020, indicating a steady influx of newcomers to the area.

Overall, the combination of strong educational institutions, a diverse business landscape, thriving healthcare facilities, and population growth make Chattanooga an attractive destination for new construction real estate investors seeking promising opportunities in the market.

Ready to apply for a fix & flip loan?

Frequently Asked Questions

New construction loans in Chattanooga, TN, can potentially include funds for land acquisition as part of the overall financing package. Contact us for more information on financing options that best suit your project’s requirements.

The approval process for new construction loans in Chattanooga, TN, varies based on factors such as project complexity and documentation. Our goal is to provide an efficient and timely approval process to minimize delays.

Prepayment penalties for new construction loans in Chattanooga, TN, depend on your loan agreement’s specific terms and conditions of. Contact us for more details regarding your unique financing plan.

Unlock the Full Potential of Chattanooga, TN's Real Estate Market

Elevate your construction projects in Chattanooga, TN, by partnering with Insula Capital Group and our bespoke new construction loans. Our adaptable financing solutions offer the robust support you need to transform your vision into a tangible reality.

Reach out to us today to discover financing options tailored to your specific needs and embark on a successful construction journey in Chattanooga’s dynamic real estate market.

Fill out our online application or check out just-funded projects now!