Private Money Lenders | Hard Money Loans in Atlanta, GA

Every real estate investor and developer can attest to Atlanta’s profitable real estate market!

As the Peach State’s most populous city and capital, Atlanta has always been a business hub. Real estate investors can invest in repairing or constructing many properties here. However, this city’s real estate development project costs can quickly exceed typical budgets despite proactive planning.

Luckily, there are simple ways to combat financial problems regarding real estate investment. You can obtain a hard money loan by getting specialized contracts from Insula Capital Group’s expert hard money lenders in Atlanta, GA!

Why Are Hard Money Loans The Best Way To Finance Real Estate Projects in Atlanta, GA

Flexibility in Financing

Unlike conventional loans that adhere to stringent criteria and require extensive documentation, hard money lenders are more concerned with the value of the underlying asset.

This means that borrowers with less-than-ideal credit scores or unconventional income sources can still secure financing based on the property’s potential.

Speedy Approval and Funding

Hard money lenders recognize the urgency in Atlanta’s fast-paced real estate market and pride themselves on their ability to expedite the loan approval and funding process.

While traditional lenders may take weeks or even months to approve a loan, hard money lenders can provide funding in a matter of days, allowing investors to seize lucrative opportunities without delay.

We typically approve loans within 24 hours and fund them within 5 business days!

Accessibility to Non-Traditional Borrowers

Traditional lending institutions typically have strict eligibility requirements that exclude certain categories of borrowers, such as self-employed individuals, foreign investors, or those with prior bankruptcies or foreclosures.

On the other hand, hard money lenders are more inclusive in their lending criteria, focusing primarily on the value of the property rather than the borrower’s financial history. This accessibility makes hard money loans attractive for a broader range of investors in Atlanta.

Strong Economic Growth

Atlanta boasts a robust and diversified economy driven by technology, healthcare, logistics, and finance sectors.

The city’s vibrant culture, affordable cost of living, and ample job opportunities attract people from across the country and worldwide, resulting in increased demand for housing and rental properties.

Affordable Housing Market

Atlanta offers relatively affordable housing options compared to other major metropolitan areas in the United States. This affordability makes real estate investment accessible to a broader range of investors and allows for favorable cash flow potential, especially in rental properties.

Thriving Rental Market

Atlanta’s growing population and a high proportion of renters contribute to a thriving rental market.

Investors can capitalize on this demand by purchasing rental properties and generating steady rental income, with the potential for attractive returns on investment.

Connect with Our Private Hard Money Lenders in Atlanta, GA, for Quick Approvals

We’ve designed our hard/private money loans to give you as much financial relief as you need on time.

The Insula Capital Group team understands that the last thing any investor wants is a delayed or insufficiently funded project. So, we offer curated new construction loans, fix & flip loans, residential rental programs, and multifamily/mixed-use loans to fulfill your borrowing needs.

With over 30 years in the industry, we’ve gained the experience to expedite our lending services and get you funded quickly. Once you submit your online application through our website, we will contact you for an initial interview and provide you a tailored contract.

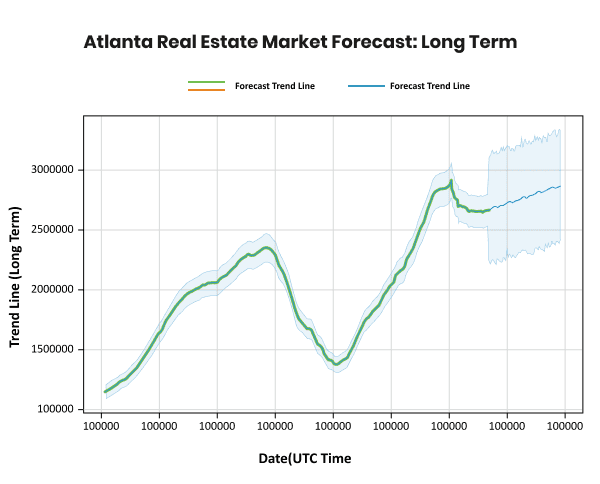

Some Facts and Figures About Atlanta’s Real Estate Markets

Our Verdict: Despite fluctuations in the broader economy, Atlanta’s real estate market has historically exhibited resilience and stability.

The city’s diversified economy, strong job market, and steady population growth continue to cement its position as one of the most desirable real estate markets in the United States.

Now, you won’t miss out on lucrative real estate opportunities due to lack of funding. Our hard money loans offer the perfect solution for investors seeking quick and flexible financing options.

Complete our online full application form to get started quickly!

Despite the positive state of the Orlando market, experts recommend that investors thoroughly investigate the market. To streamline the process, we’ve listed some of the crucial numbers that investors will want to know about right away:

- Atlanta City Population: 506,811

- Median Home Value: $323,827

- Annual Appreciation Rate: +6.8%

- Median Rent Price: $1,675

- Price-To-Rent Ratio: 14.6

- Foreclosure Rate: 1 in every 8,146

Atlanta Real Estate Landscape

506,811

Population

1 in every 8,146

Foreclosure Rate

$323,827

Median Home Value

+6.8%

Appreciation Rate

$1,675

Median Rent Price

14.6

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Trends In The Atlanta Real Estate Market

- Increased Focus on Secondary Cities: The pandemic has enabled more individuals to work remotely and relocate to alternative cities with lower living expenses while maintaining employment.

Consequently, homeowners are shifting away from expensive primary cities in favor of more affordable secondary cities such as Alpharetta and Warner Robins.

- Continued Price Appreciation: Among the most plausible predictions for the Atlanta real estate market, prices will likely continue to rise for the foreseeable future.

Limited inventory relative to current demand allows homeowners to push prices upward amidst stiff competition.

Coupled with a strengthening economy and low interest rates, this trend is expected to attract more buyers to the market.

Until inventory levels align with demand, price appreciation is anticipated to persist.

- Optimism Bolsters the Market Outlook: Despite challenges such as foreclosures and distressed properties that have affected the state, the Atlanta real estate market has a prevailing sense of optimism.

While Georgia has experienced a relatively high foreclosure rate, indications suggest that the worst may be behind, with optimism prevailing as the predominant outlook.

Despite economic setbacks, employment rates remain relatively stable, and the economy shows signs of improvement, which bodes well for homeowners seeking to emerge from financial hardship.

Need some inspiration to start your real estate dreams? Explore our recently funded projects that exemplify our devotion to propelling investor success.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Pre-qualification is not necessary for our hard money loans. However, pre-qualifying can help you negotiate better terms and close your loan faster. If you want to pre-qualify for any of our loan programs in Atlanta, GA, click here.

We calculate the loan-to-value (LTV) by dividing the loan amount by your property’s purchase price or appraised value. Our fix & flip loans have an LTV of up to 85%.

We offer hard money loans for the following residential rental properties:

- 1-4 Family

- Condominium

- Townhouse

- Planned Unit Development

Let’s Partner Up!

Insula Capital Group is one of the most trusted private money lenders in Atlanta, GA, for good reason. Our expedited services and flexible terms help borrowers receive financial relief when needed. Our just-funded projects can give you a glimpse into the quality of our services.

If you’re ready to get funded, pre-qualify today! You can also contact us for further details.