Private Money Lenders | Hard Money Loans in Detroit, MI

Detroit is known for its rich history, lively vibe, and its thriving industries. The city has a lot of character thanks to the stunning installations and murals everywhere, as well as the general emphasis on arts and culture.

When it comes to real estate projects in the vibrant city of Detroit, securing adequate financing can be a significant challenge. That’s where Insula Capital Group has got your back! We are a leading private money lender with extensive experience in the Detroit market. Our mission is to provide tailored loan programs that empower clients to boost their real estate potential.

Learn more about the wonders of hard money lending in Detroit, MI.

Get in Touch

Connect With A Renowned Private Hard Money Lender In Detroit, MI

Choosing Insula Capital Group for your real estate financing needs in Detroit means gaining access to a range of exclusive benefits, including quick approval, low-interest rates, no junk fees, no pre-payment penalties, flexible repayment terms, and exceptional customer support. We believe that financing shouldn’t burden your real estate project, which is why our team works our rounds to provide customized hard money loan deals.

Schedule an appointment with our team to learn more about our hard money lending services in Detroit, MI.

Why Are Hard Money Loans an Excellent Choice

Hard money loans serve as incredibly powerful tools for savvy real estate borrowers. They’re especially handy when you’re dealing with a relatively bad credit score and time-sensitive deals on the horizon.

You can get hard money loans approved quickly based on asset value, and they also have flexible terms, making them excellent for diverse projects, including fix and flip investments and non-owner-occupied rentals.

Hard money loans are essentially a type of bridge financing where you can use them to bridge the gap until you have other financing options. This also works because hard money loans can be acquired with less rigorous underwriting, especially if you’re applying for a loan at Insula Capital Group.

Detroit’s Real Estate Statistics Worth Keeping An Eye On

- Population: 672,436

- Median Household Income: $44,121

- Unemployment Rate: 4.5%

- Homes for Sale: 5120

- New Listings: 850

- Average Home Prices: $115,642

- Median Home Value: $79500

- Median Sale Price: $80,000

- 1-Year Appreciate Rate: -3.6%

- Median Rent Price: $1450

- Price-To-Rent Ratio: 55.2

- Median Days On Market: 34

- Home Sold Above List Price: 5%

- Foreclosure Rate: 0.4%

- Median Property Tax: 2.5%

- Projected Growth Of The Real Estate Market: moderate growth with potential for specific neighborhoods to outperform

- Average ROI for Hard Money Loans: 10-15%

Detroit’s Real Estate Market

672,436

Population

5120

Homes for Sale

$115,642

Average Home Prices

-3.6%

1-Year Appreciation Rate

$44,121

Median Household Income

0.4%

Foreclosure Rate

Just Funded Projects

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

November 2021

Fix & Flip

Loan Amount

$106,500

After Repair Value$176,000

Purchase Price$62,000

Renovation Budget$60,000

Loan TypeFix & Flip

- After Repair Value$176,000

- Purchase Price$62,000

- Renovation Budget$60,000

- Loan TypeFix & Flip

Philidelphia, PA

November 2021

Fix & Flip

Loan Amount

$311,750

After Repair Value$495,000

Purchase Price$310,000

Renovation Budget$32,750

Loan TypeFix & Flip

- After Repair Value$495,000

- Purchase Price$310,000

- Renovation Budget$32,750

- Loan TypeFix & Flip

North Babylon, NY

November 2021

Fix & Flip

Loan Amount

$1,577,465

After Repair Value$2,487,500

Purchase Price$1,250,000

Renovation Budget$577,465

Loan TypeFix & Flip

- After Repair Value$2,487,500

- Purchase Price$1,250,000

- Renovation Budget$577,465

- Loan TypeFix & Flip

East Hampton, NY

November 2021

Fix & Flip

Loan Amount

$848,800

After Repair Value$831,000

Purchase Price$525,000

Renovation Budget$240,650

Loan TypeFix & Flip

- After Repair Value$831,000

- Purchase Price$525,000

- Renovation Budget$240,650

- Loan TypeFix & Flip

Jersey City, NJ

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Why Invest in Detroit, MI, Using Our Hard Money Loans?

If you’ve been unsure about investing in Detroit, we have quite a few reasons to convince you that Detroit should be on your investment radar.

For starters, it’s the perfect place for beginner investors because it’s affordable. This essentially means that Detroit might be the entry point that you’ve been looking for in real estate. You will invest with very little and receive high potential rental yields and substantial appreciation.

Additionally, it’s worth keeping it mind the city has a booming job market and a young population that’s growing stably. Thanks to them, the rental market in Detroit is thriving, and there’s a lot of space for success as a rental investor.

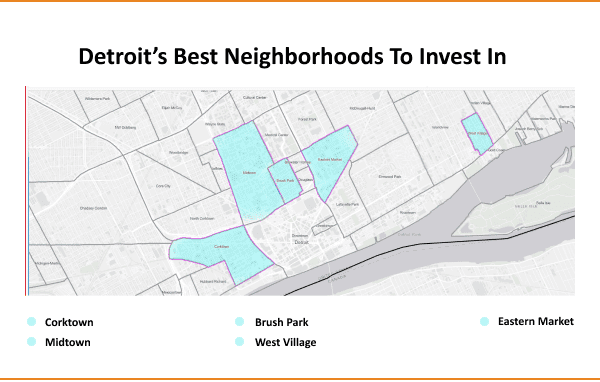

If you’re a seasoned real estate investor and have a knack for spotting diamonds in the rough, you’ve probably already realized the potential in some of Detroit’s neighborhoods like Midtown, Brush Park, and Corktown. These are hotspots that are experiencing rapid revitalization and have the potential for significant property appreciation.

Also, Detroit caters to various investor styles, so whether you’re looking for long-term investments, short-term investments, multi-unit buildings, or single-family rentals, the market has something for everyone!

Ready to apply for a Hard Money loan?

Frequently Asked Questions

If you want to apply for a new construction loan, you will have to use our online application form and submit relevant documents like detailed construction plans, project cost estimates, and financial statements.

Once you’ve completed the pre-qualification requirements and submitted relevant documents, we’ll review your application before we move toward loan processing and underwriting. Once everything checks out, we’ll give you the final approval and move toward closing.

We understand that circumstances can change, and you may wish to repay your loan early. We offer loan programs without any pre-payment penalties. Our loan specialists can provide you with detailed information on pre-payment penalties for specific loan programs. You can also visit our just-funded project section for more details.

We’re also very transparent when it comes to any loan fees or other related costs. There are no hidden charges, and everything is communicated to clients early on in the loan process.

A: Down payment requirements vary depending on the specific loan program and the details of your project. Our team will work closely with you to determine the appropriate down payment based on factors like the property type, location, and your financial qualifications.

If you’re interested in applying for a loan but aren’t sure about the down payment, feel free to consult with our team—we can definitely work something out!

Join Us Now!

At Insula Capital Group, we understand the urgency and importance of timely financing. This is why we’ve streamlined our loan approval process to be fast and efficient. We provide loan approvals within twenty-four hours and deliver the funds within five days. Our experienced team evaluates loan applications promptly, leveraging our deep understanding of the Detroit market to provide quick decisions.

Whether it’s new construction loans you’re looking for or fix and flip loans, we’ve got you covered. All of our loan plans can be tailored to your investment goals.

Get in touch with us today to discuss your asset-based lending options.