Get Funded with Pennsylvania’s Leading DSCR Loan Lenders

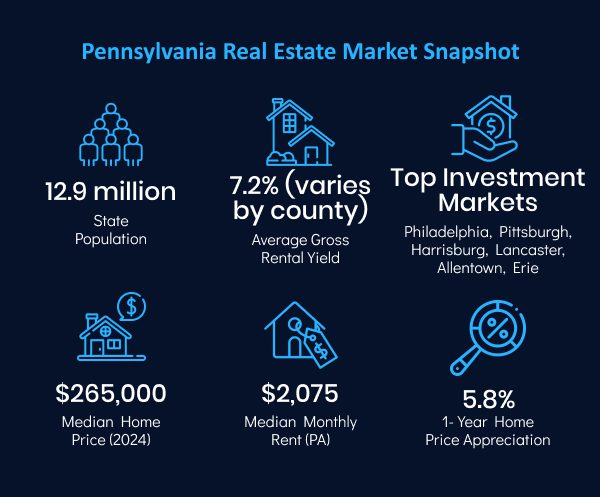

From Philadelphia’s bustling property market to Pittsburgh’s growing rental hubs and serene suburban towns in between, Pennsylvania offers compelling opportunities for real estate investors.

Whether you’re targeting long-term rentals, short-term vacation homes, or multi-unit developments, DSCR loans in Pennsylvania provide a streamlined, income-based financing solution to help you scale faster.

At Insula Capital Group, we specialise in DSCR rental loans that Pennsylvania investors rely on to purchase or refinance income-generating properties—without traditional income verification. Instead of tax returns or pay stubs, we qualify borrowers based on the Debt Service Coverage Ratio (DSCR) of the property itself, making our process ideal for self-employed investors, LLCs, and growing portfolios.

Your Trusted Pennsylvania DSCR Loan Lenders

Insula Capital Group is your go-to source for DSCR loan lenders in Pennsylvania, offering flexible terms, fast closings, and a borrower-first approach.

Our expertise in income-based lending allows us to help investors across the state—from Allentown to Erie—access capital that aligns with their goals and property cash flow.

We offer:

- No-Income Verification– Qualify based on rental income

- All Property Types Financed– SFRs, multifamily, condos, vacation rentals, and more

- Streamlined Closings– Close in as fast as 2–3 weeks

- Flexible Loan Terms– 30-year fixed, interest-only options available

- Custom Lending Structures– Tailored to your strategy

- Experienced Underwriting Team– Invest with confidence

With competitive DSCR loan rates in Pennsylvania, we make financing faster, easier, and focused on what matters: the profitability of your property.

How DSCR Loans Work in Pennsylvania

DSCR loans in Pennsylvania are designed for real estate investors who want to qualify based on property income rather than personal financials.

The key metric is the Debt Service Coverage Ratio, which compares the property’s monthly rental income to its monthly debt obligations.

A DSCR of 1.0 or higher is typically required, meaning the property generates enough income to fully cover its loan payment. This model removes the need for tax returns, W-2s, or complex income documentation, making it a favorite among investors with multiple properties or fluctuating personal earnings.

Use Pennsylvania DSCR mortgage programs if you:

- Own multiple rental properties

- Operate as an LLC or legal entity

- Are self-employed or have non-traditional income

- Need to close quickly without paperwork delays

- Are looking for refinance or cash-out options

Whether you’re buying your first duplex or scaling to 20+ units, we provide the capital you need to move fast and stay competitive.

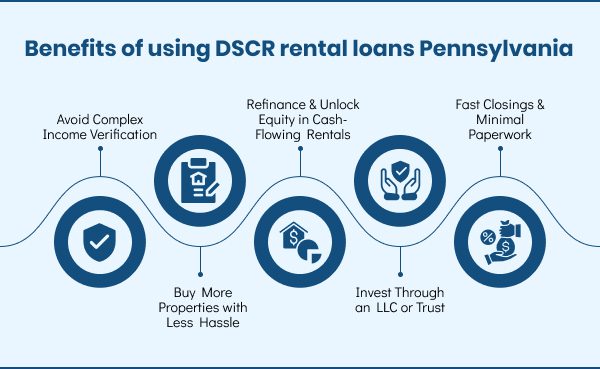

Why Choose DSCR Rental Loans in Pennsylvania?

Pennsylvania offers a rich mix of urban, suburban, and rural real estate markets that appeal to a wide range of investors. With a combination of affordable home prices, solid rental demand, and a strong regional economy, it’s an ideal market for DSCR rental loans in Pennsylvania.

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Just Funded Projects

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

December 2025

New Construction

Loan Amount

$650,000

After Repair Value$1,200,000

Purchase Price$500,000

Renovation Budget$606,950

Loan TypeNew Construction

- After Repair Value$1,200,000

- Purchase Price$500,000

- Renovation Budget$606,950

- Loan TypeNew Construction

Fulton, NY

Why Invest in Pennsylvania Real Estate?

Pennsylvania is a top-tier real estate market for both cash flow and appreciation. With large metros, suburban sprawl, college towns, and affordable housing prices, it offers something for every investor profile.

Top reasons to invest:

- Affordable Entry Points:Low property prices compared to NY, NJ, or DC

- High Demand for Rentals:Large student populations and blue-collar job markets

- Appreciating Markets:Especially in Pittsburgh, Allentown, and Scranton

- Tourism Appeal:Great for short-term rentals in Poconos and Amish Country

- Strong Infrastructure:Great highway access and regional transportation links

Use DSCR loan programs to take advantage of Pennsylvania’s growing rental demand and low competition in up-and-coming areas.

Ready to Apply for a DSCR Loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions for

DSCR Loans in Pennsylvania

Typical DSCR loan requirements in Pennsylvania include a minimum credit score of 620, a DSCR ratio of 1.0 or higher, a down payment of 20–25%, and a minimum loan amount of $100,000. No income or employment documents are needed.

DSCR loan rates in Pennsylvania vary based on your credit score, loan-to-value ratio, and property cash flow. Rates typically start in the 7–9% range, with interest-only options available.

Yes. We finance both long-term and short-term rentals, including vacation homes in areas like the Poconos, Lake Wallenpaupack, and Lancaster County.

Yes. First-time investors can qualify as long as the property generates sufficient rental income to meet DSCR guidelines. We also work with LLCs and small investment groups.

Absolutely. We offer both rate-and-term and cash-out refinancing through our Pennsylvania DSCR mortgage programs.

Apply Now for DSCR Loans in Pennsylvania

At Insula Capital Group, we know the Pennsylvania investment landscape—from rowhomes in Philly to multi-units in the Lehigh Valley. Our team of experienced DSCR loan lenders in Pennsylvania can help you structure the perfect financing solution for your goals.

We move fast, fund smart, and give you the leverage you need to grow your rental portfolio—without the hurdles of traditional bank financing. With flexible terms, competitive DSCR loan rates that Pennsylvania investors appreciate, and deep market knowledge, we’re here to support your next investment.

Apply now for a DSCR rental loan in Pennsylvania and take advantage of a financing process designed around your property—not your pay stubs. Whether you’re purchasing a new property, refinancing an existing one, or unlocking equity for your next deal, Insula Capital Group is your go-to lender.

Easy Steps to Get Funded

Receive a proof of funds

Get verification of your funding capacity.

Source a property

Find the right property to invest in.

Provide requested documentation

Submit essential documents for approval.

Close your Loan

Finalize the deal and secure your funding.