The real estate market is no stranger to change, and the recent shift to a high-interest rate environment has put every financing decision under a magnifying glass. For many investors, bridge loans remain an essential tool for seizing time-sensitive opportunities, funding construction projects, or bridging the gap between buying and selling property. However, with borrowing costs climbing, it’s natural to ask:

How High-Interest Rates Are Reshaping Bridge Loan Structures

When interest rates rise, the cost of capital goes up across the board, impacting both borrowers and lenders. Bridge loan companies have responded with adjustments that help make these loans viable despite higher costs.

One major shift is toward shorter durations. Instead of the traditional 12-24 month bridge loan terms, many lenders now offer short term bridge loans of 6-12 months. This reduces the interest expense and encourages quicker project turnaround.

Another trend is adjustable interest rates tied to benchmark indexes, giving bridge loan lenders protection from further rate increases while sometimes offering borrowers lower starting rates. While this can introduce some uncertainty, it also allows for more competitive initial pricing compared to fixed high rates.

Finally, customized repayment options such as interest-only payments during the loan term are becoming more common. This structure helps investors maintain cash flow while working on a project, even when borrowing costs are steep. Such flexibility is especially valuable in bridge loan financing for real estate construction or property acquisition.

Bridge Loans for Real Estate: Opportunity in a Tight Market

Even with higher interest rates, bridge loans for real estate purchases remain a valuable tool especially in competitive markets where speed is critical. Investors looking to secure residential or commercial bridge loans can still win deals by offering fast closings, something traditional financing often can’t match.

In hot markets like California, Florida, New York, and Texas, fast bridge loans enable buyers to act decisively when a property becomes available. This speed often offsets the higher borrowing costs by preventing missed opportunities or allowing for quick flips that generate profit before rates have too much impact.

For buyers meeting bridge loan requirements, this type of financing can also serve as a stepping stone to long-term funding at better rates once the property stabilizes or market conditions improve.

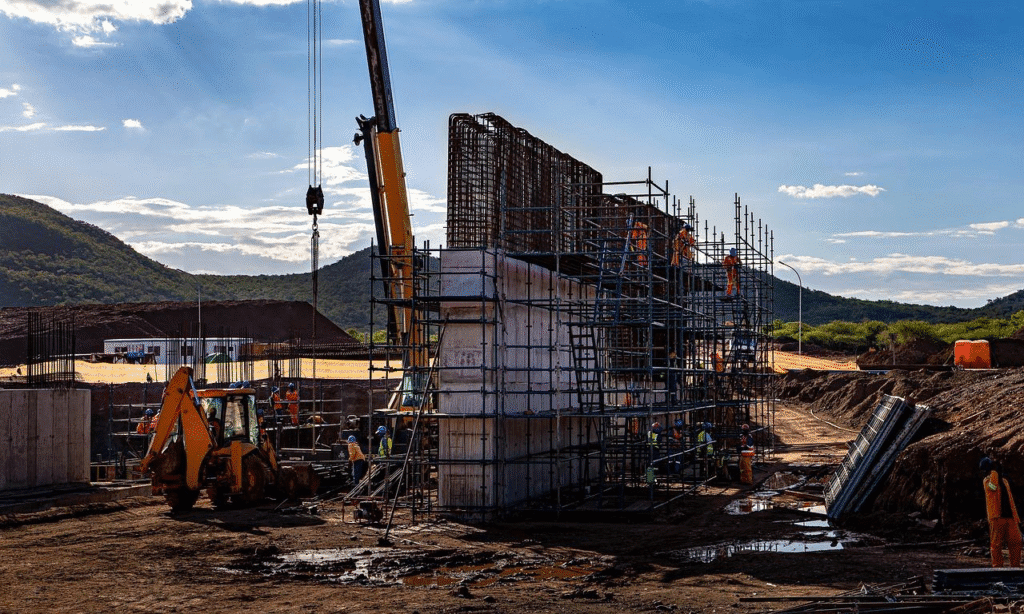

Bridge Loans for Construction: Keeping Projects Moving

Rising interest rates have made traditional construction financing more challenging, particularly for developers without a long track record or those working on unique projects. This is where a bridge loan for construction can step in.

Bridge loan lenders often focus more on the property’s projected value after completion than on the borrower’s credit history. This asset-based approach means bridge loan eligibility depends largely on the project’s feasibility, not just financial statements.

For developers, private bridge loans can prevent costly delays by providing loan funding during critical phases of construction. Whether it’s acquiring land, covering upfront material costs, or ensuring payroll continuity, this financing can keep momentum going until permanent funding becomes available.

Protecting Profitability with Smart Bridge Loan Strategies

Higher borrowing costs mean there’s less room for error. To protect profitability when using bridge loan financing, investors should focus on a few key strategies:

- Reducing the time between acquisition and sale or refinancing minimizes interest costs.

- Factor in potential interest rate increases, especially with adjustable-rate bridge loan terms.

- Whether it’s refinancing into a long-term loan or selling the property, know your exit strategybefore committing.

- Some bridge loan providers offer extensions or repayment adjustments if market conditions shift unexpectedly.

Private vs. Traditional Bridge Loan Lenders

In a high-interest rate climate, private bridge loans often have the edge over traditional bank financing. While rates may still be higher, private bridge loan companies can offer faster approvals, fewer documentation requirements, and more creative loan structures.

For example, bridge loan lenders in New York or Texas may approve funding within days something nearly impossible with traditional lenders. For investors facing tight timelines, that speed can mean the difference between securing a deal and losing it.

Additionally, private lenders can tailor loan amounts and repayment schedules to the specific needs of a project, whether it’s a bridge loan for commercial property or a bridge loan for residential properties.

The Future of Bridge Loans in a High-Interest Rate Market

While rising rates add pressure, demand for bridge loans for investors isn’t disappearing. Instead, it’s evolving. We’re seeing more short-term bridge loans, more creative financing solutions, and a greater emphasis on exit planning.

The reality is that certain situations like securing a property before selling another, funding urgent renovations, or taking advantage of a time-sensitive opportunity will always require fast, flexible financing. Bridge loans fill that gap, even when interest rates are less favourable.

The key is understanding the risks, structuring deals strategically, and working with experienced bridge loan providers who can navigate the challenges of today’s lending environment.

Conclusion: Are Bridge Loans Still Worth It?

The short answer is yes, but only if used strategically. In a high-interest rate era, every financing decision matters more. Bridge loan financing can still unlock opportunities, but investors must weigh the costs carefully, structure deals efficiently, and work with lenders who understand their market and goals.

Fast-Track Your Real Estate Goals

If you’re ready to explore flexible, fast bridge loan financing in in New York, California, or Texas, tailored to your needs even in today’s high-interest rate environment partner with experts who can make it happen. Insula Capital Group offers nationwide private lending solutions designed to help investors move quickly and confidently. Get in touch today to discuss how we can structure the right bridge loan for your next project.