Investors planning to grow their rental portfolios benefit from understanding the standards lenders use to approve funding. Recognizing how rental property loan requirements work helps both new and experienced applicants prepare documentation, assess financial readiness, and select lending structures that support long-term goals. These expectations shape approval decisions and influence what type of loan program suits each investment strategy.

Why Lenders Evaluate Financial Stability

Lenders rely on financial details to determine repayment ability. Credit history remains one of the strongest indicators of an investor’s reliability. A higher score often leads to more favorable terms, while lower scores may result in higher interest charges or limited loan choices. Lenders also review existing debt, payment history, and past credit use. These elements help predict whether an applicant can manage new monthly payments without financial strain.

Income documentation also plays a significant role. Lenders frequently examine pay stubs, tax returns, or business financials to confirm that income remains consistent. For investors with multiple properties, lenders often analyze rental income from existing units to strengthen applications. Stable income reduces lending risk and supports long-term financial commitments.

Importance of Property Condition

The condition of the rental property strongly influences lending decisions. Lenders review structural details, safety concerns, and long-term maintenance expectations. These assessments protect both the investor and the lender by ensuring the property remains profitable and market-ready.

An appraisal also verifies the value of the home, allowing lenders to determine loan amounts, equity levels, and risk factors. Homes requiring extensive repairs may qualify only for short-term funding or hard money for rental properties, while updated units often receive stronger long-term financing opportunities. Investors benefit from preparing the property beforehand by addressing cosmetic or structural concerns that could affect approval or reduce loan terms.

Reviewing Rental Income Potential

Projected rental income helps lenders determine whether the property will support monthly payments. This evaluation includes reviewing local rental prices, occupancy trends, and neighborhood demand. Strong rental potential can support programs involving rental loans for investors, providing confidence that the property generates reliable cash flow.

Some lenders request market rent studies, comparing similar homes within the same area to confirm realistic rental projections. Investors with multiple units may also submit documentation of current leases to demonstrate consistent performance across their portfolio.

Understanding Rates and Terms

Loan terms vary widely based on the applicant’s financial background and investment strategy. Monitoring rental property loan rates helps investors time their applications effectively. Many lenders offer fixed-rate and adjustable-rate options, each with benefits depending on the expected holding period.

Fixed-rate loans offer consistency, helping investors maintain predictable monthly expenses. Adjustable-rate loans may offer lower initial rates but may change over time based on market conditions. Lenders provide detailed term structures, allowing investors to compare repayment schedules and long-term financial commitments.

Programs involving rental property loan options can include long-term, interest-only, or hybrid structures designed to support property performance. Experienced investors often use loans with extended repayment periods, while newer landlords may prefer shorter terms that reduce initial expenses.

Down Payment Expectations

Down payment requirements differ depending on the type of loan and the investor’s financial history. Traditional lenders may require larger down payments to reduce risk. Many institutions expect investors to contribute a percentage of the purchase price, creating equity that supports future refinancing or expansion.

For income-producing properties, lenders often view higher down payments as a sign of financial security. Strong equity reduces risk and may improve loan terms. Programs designed for newer investors, such as rental property loan eligibility pathways, may evaluate personal savings, investment history, and credit standing before finalizing down payment amounts.

Required Documentation for Loan Applications

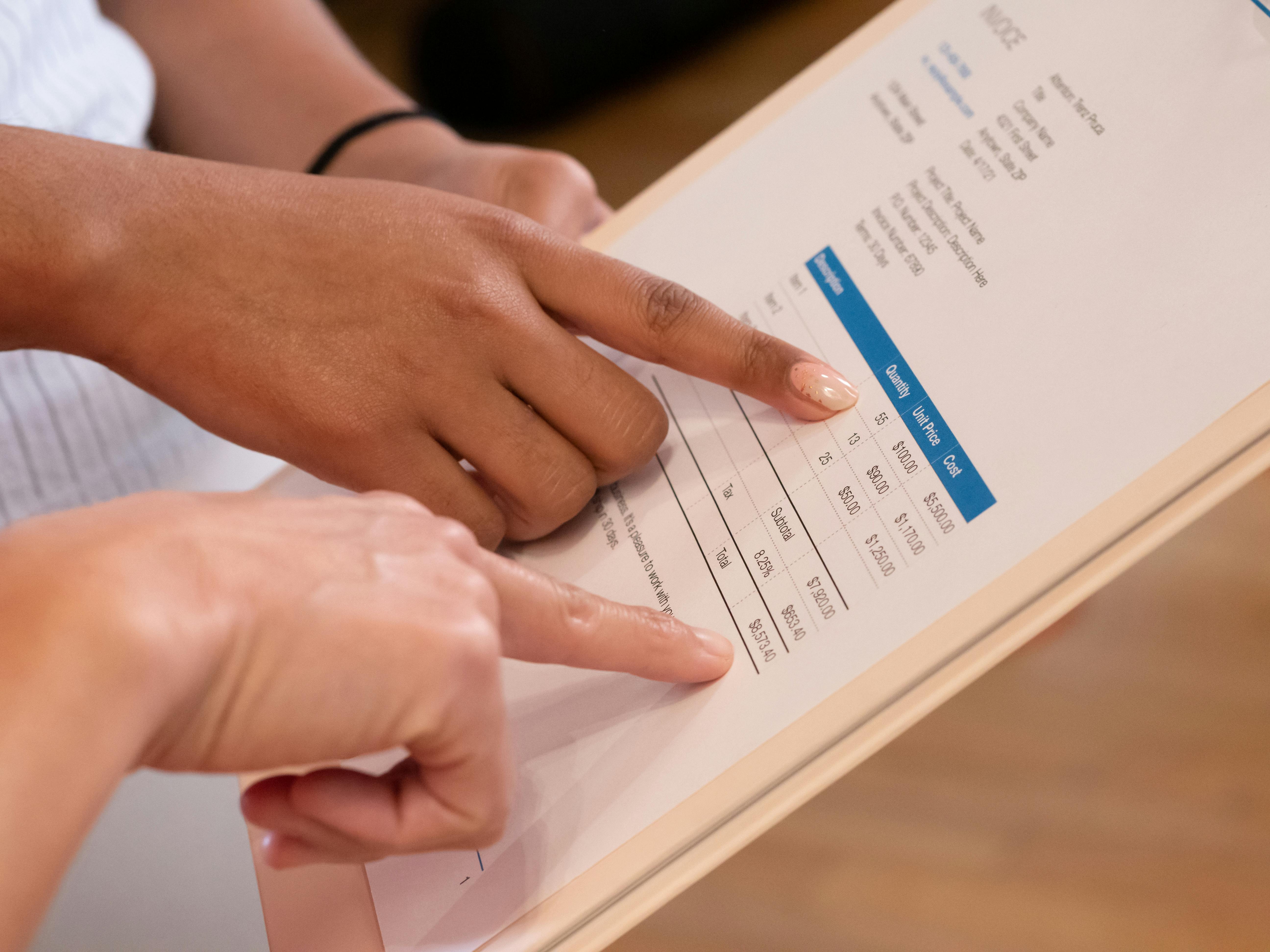

The rental property loan application process involves several documents, including identification, bank statements, tax returns, leases, and property information. Lenders rely on these records to evaluate financial readiness and investment stability. Missing documents can slow approval timelines or cause delays in funding.

Investors benefit from organizing paperwork early to prevent complications. Experienced landlords often maintain detailed records for each property, simplifying new applications and supporting faster decisions from lending institutions.

Importance of Experience in Rental Property Investing

Lenders assess investment experience to determine how well applicants manage rental properties. First-time applicants may face stricter standards or require additional documentation. Programs that support a rental property loan for first-time investors may request detailed financial projections, property inspection reports, or additional reserves.

Experienced investors often receive more flexible terms because their track record demonstrates reliability and understanding of rental management. Portfolio experience, solid tenant history, and strong cash-flow performance offer lenders greater confidence.

Refinancing Options and Requirements

Refinancing provides opportunities to reduce monthly payments, lower interest rates, or pull equity from a property. Programs involving rental property refinancing allow investors to restructure existing loans once rental performance improves. Lenders evaluate property condition, rental income, and financial history before approving updated terms.

Move Forward With Smarter Rental Loan Preparation

Understanding what lenders expect supports smarter applications and stronger long-term returns. Whether preparing loans for rental property, evaluating rental property financing, or reviewing requirements for rental property loans, clear preparation strengthens approval chances and supports sustainable growth. For investors ready to move forward with confidence, Insula Capital Group offers lending support designed to help applicants secure the right funding path. Check out our loan application process.

Contact us today.