Securing financing through hard money loans can be a game-changer for real estate investors looking to capitalize on lucrative opportunities. However, navigating the qualification process requires a strategic approach and a thorough understanding of the requirements set forth by private lenders.

In this step-by-step guide, we’ll walk you through the key components of qualifying for a hard money loan, offering valuable insights and practical advice to empower you to secure financing for your investment projects.

Step 1: Assess Property Potential

Before applying for a hard money loan, conduct a comprehensive assessment of the investment property’s potential. Evaluate factors such as market demand, location dynamics, and potential for value appreciation. Highlighting the property’s profit potential and investment viability will strengthen your loan application and increase your chances of approval.

Step 2: Gather Financial Documentation

Compile all necessary financial documentation to support your loan application. This includes proof of income, assets, and liabilities, as well as a detailed project budget outlining construction costs, materials, and contingency reserves. Providing thorough and accurate financial documentation demonstrates your ability to manage the investment responsibly and repay the loan.

Step 3: Showcase Experience and Expertise

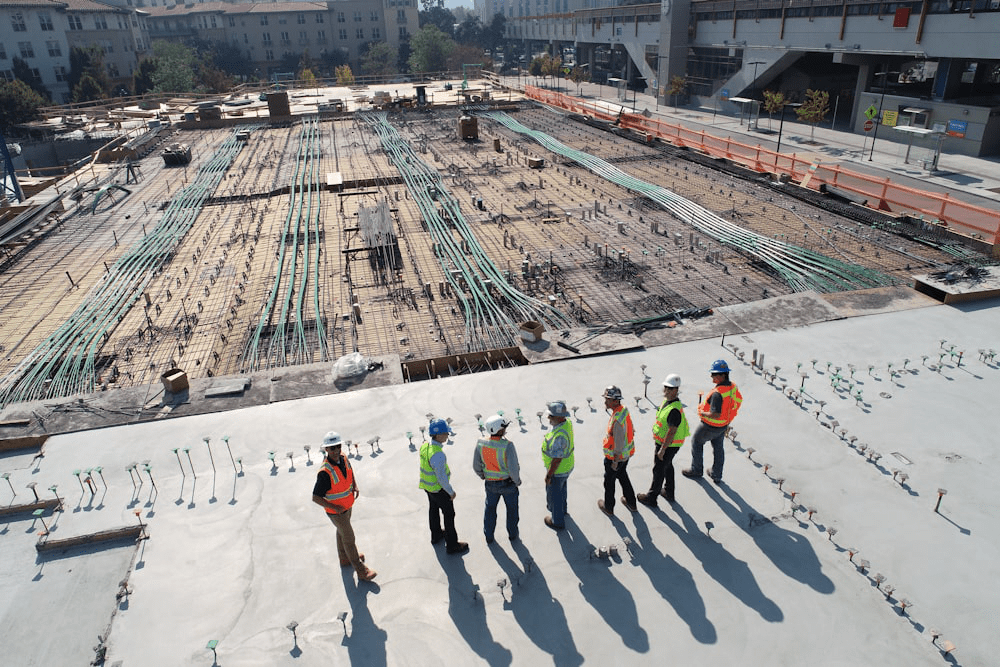

Highlight your experience and expertise in real estate investing to reassure lenders of your ability to successfully manage the investment project. Share details of your past investment projects, industry credentials, and any relevant certifications or qualifications. Demonstrating a proven track record of success will instill confidence in lenders and strengthen your loan application.

Step 4: Assess Collateral and Asset Value

Evaluate the collateral being offered to secure the hard money loan, typically the investment property itself. Conduct a thorough appraisal of the property to determine its current market value and potential for appreciation. Providing accurate and up-to-date information on the collateral’s value will help mitigate lending risks and increase your chances of loan approval.

Step 5: Ensure Regulatory Compliance

Ensure compliance with all local regulations, zoning laws, and environmental standards when acquiring the investment property. Obtaining necessary permits and adhering to legal requirements demonstrates your commitment to regulatory compliance and minimizes the risk of legal obstacles or delays that could impact the investment’s profitability.

Step 6: Maintain Transparent Communication

Maintain open and transparent communication with the private lender throughout the loan qualification process. Keep the lender informed of project progress, financial milestones, and any unforeseen challenges that may arise. Building a strong rapport and fostering collaborative engagement will enhance trust and strengthen your partnership with the lender.

Step 7: Develop a Comprehensive Project Plan

Create a detailed project plan outlining the scope, timeline, and budget of the investment project. Include architectural designs, construction schedules, and cost estimates to provide a clear roadmap for the project’s execution. A well-developed project plan demonstrates your thorough planning and preparedness, enhancing your credibility as a borrower.

Step 8: Establish Clear Exit Strategies

Outline clear exit strategies for repaying the hard money loan within the agreed-upon term. Explore options such as refinancing with a conventional mortgage, selling the property for a profit, or securing long-term financing through alternative means. Presenting viable exit strategies reassures lenders of your ability to fulfill repayment obligations and mitigate risks.

Step 9: Demonstrate Market Knowledge and Analysis

Conduct comprehensive market research to assess the target location’s demand, competition, and pricing trends. Analyze market dynamics to identify opportunities for value appreciation and rental income potential. Providing a thorough market analysis demonstrates your understanding of investment fundamentals and enhances the attractiveness of your loan application.

Step 10: Seek Professional Guidance and Support

Consult with experienced real estate professionals and private lenders like Insula Capital Group to navigate the complexities of the investment process. Seek their expertise and guidance to ensure compliance with legal requirements, maximize investment returns, and mitigate risks. Leveraging professional support strengthens your investment strategy and instills confidence in lenders.

Why Choose a Private Lender for Hard Money Loans

- Flexible Approval Criteria: Private money lenders offer more flexible approval criteria compared to conventional banks, focusing primarily on the value and potential of the investment property rather than the borrower’s credit history.Unlike impersonal transactions with traditional banks, private lenders emphasize open communication, collaborative problem-solving, and responsive decision-making. By fostering strong relationships based on trust and mutual respect, private money lenders become valued partners in their clients’ investment journeys, providing guidance and support beyond the initial loan transaction.

- Expedited Approval Process: Private money lendersprovide expedited approval processes, making lending decisions within days rather than weeks or months. Streamlined underwriting procedures enable borrowers to access capital quickly, facilitating timely investment opportunities.Private money lenders excel in providing rapid access to capital, offering quick turnaround times on loan approvals and fund disbursements. With streamlined underwriting processes and simplified documentation requirements, private lenders can expedite the financing process, enabling investors to capitalize on time-sensitive investment opportunities.

- Customized Loan Structures: Private money lenders offer tailored loan structures customized to meet individual investors’ unique needs and objectives. Flexible terms enable investors to optimize financing solutions and adapt to changing market conditions. Whether it’s structuring interest-only payments, offering equity participation, or providing bridge financing, private money lenders can offer innovative solutions to meet the specific needs of investors.

- Asset-Based Lending: Private money lenders primarily focus on the value of the investment property as collateral, reducing the emphasis on personal credit scores and financial history. Asset-based lending principles allow investors to leverage the intrinsic value of the property to secure financing.

Ready to unlock the potential of your real estate investments with hard money loans in the US? Insula Capital Group is your trusted partner in securing the financing you need to maximize your investment opportunities. Whether you’re acquiring properties in Arkansas, Illinois, California, Maryland, or beyond, our team of experts is dedicated to providing tailored construction, multi-family, fix and flip, and other private financing solutions and personalized services to help you achieve your investment goals.

Contact us today to explore our flexible hard money loan options and embark on your real estate investment journey with confidence.