In April 2025, California remained one of the most expensive states for residential real estate, with the median home price reaching $855,300. While demand continues to surge, especially in urban centers and high-growth suburbs, breaking into the market is no small feat. First-time and seasoned developers alike face steep property prices, lengthy permitting processes, and fierce bidding competition for buildable lots.

Securing development financing in California from trusted development loan providers is essential for California’s market realities. However, standing out to development loan lenders takes more than just a promising idea. Let’s take a detailed look at it.

Why Development Financing in California Is So Competitive

California’s real estate market offers high potential returns—but it’s also one of the hardest places to build. Development loan providers in the state face significant risks, which makes them cautious and selective.

Here’s what drives that competitiveness:

1. Escalating Construction Costs

Construction expenses are through the roof. In California, labor shortages are chronic, especially in skilled trades. Add to that rising material costs and frequent supply chain delays, and your project budget can inflate rapidly. Strict building codes—like seismic safety and energy compliance—further raise costs. All this makes it harder to forecast a profitable return, so lenders become more conservative in their funding decisions.

2. Regulatory Delays

Zoning approvals, CEQA reviews, and permitting in California can take months—or even years. Every day a project is delayed increases the carrying cost and loan exposure. Development loan lenders in California will be wary of any application that doesn’t clearly outline entitlement status and timeline.

3. High Demand Means High Competition

Yes, homes and commercial properties in California sell fast—but that also means many developers are chasing the same funding sources. Real estate development financing here is a race. Lenders see dozens of applications for every high-potential market—especially in Los Angeles, San Diego, San Jose, and suburban hot spots.

4. Tight Lending Standards

Due to all these risks, development loan lenders in California apply stricter screening methods. They’re not just funding an idea—they’re betting on your ability to deliver, repay, and adapt to shifting regulations. If your application isn’t airtight, it won’t make it past the first review.

What Development Loan Lenders in California Look For

If you’re applying for real estate development loans in California, here’s exactly what lenders will scrutinize:

1. Detailed Project Financials

You must present a full financial model—clean, comprehensive, and backed by logic. Your pro forma should show:

- Hard and soft costs: Every dollar needed for construction, design, legal, and administrative tasks.

- Sales price or lease assumptions: These should align with current market data, not optimistic guesses.

- Draw schedule: Show when you need the funds and what milestones trigger each release.

- Contingency reserves: Budget for at least 10–15% to cover the unexpected.

Lenders assess if the deal is viable, where the risk lies, and how realistic your numbers are.

2. Experience of the Development Team

If this is your first major project, lenders will scrutinize your partners. Team up with well-known contractors, engineers, or consultants who’ve built in California before. Proven teams reduce perceived risk.

3. Market Demand Evidence

Back your assumptions with data. Use comps, absorption rates, and local demand trends. Projects near transit corridors, schools, or business hubs usually get more attention. If you’re building in an under-supplied market, make that crystal clear.

4. Permitting and Entitlement Status

Entitlements are everything in California. A shovel-ready site (with permits in hand) is gold to development loan providers. If you’re still early in the zoning process, expect less favorable terms—or delays in approval.

How to Stand Out in a Crowded Field

Thousands of developers are applying for real estate development loans in California. You need more than a good location to get funded.

Here’s how to give your proposal the edge:

- Submit a complete loan package: This includes financials, environmental reports, title documents, architectural plans, and a detailed project narrative.

- Demonstrate CEQA compliance: Environmental review is a major hurdle. Show how you’ll meet California’s requirements to avoid costly holdups.

- Prove your exit strategy: Presales, signed lease letters, or planned refinancing all give lenders confidence in your repayment plan.

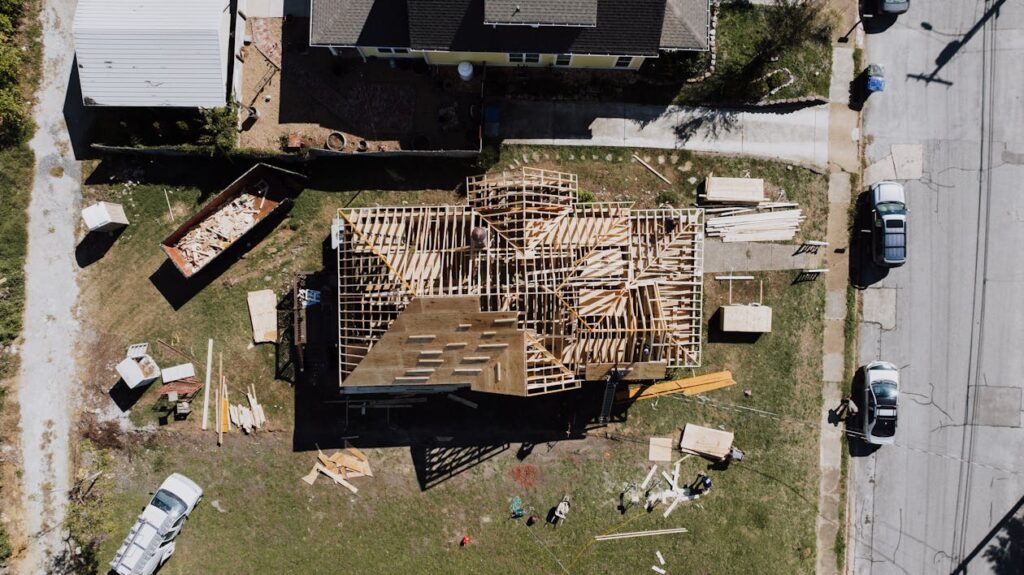

- Use visuals and data: Add site renderings, timelines, and market analytics. These elements make your presentation easier to trust and easier to approve.

Loan Options to Secure Development Financing in California

You can combine private financing with public programs to structure the right solution.

Private Development Loans

Development loan lenders in California offer short-term, high-leverage funding to qualified developers. These loans often have interest-only terms and are faster to fund than traditional bank loans.

Construction-to-Permanent Loans

These loans convert into long-term mortgages once construction is complete, which saves on refinancing costs. Lenders require thorough underwriting, but they’re ideal for residential or mixed-use projects with stable exit strategies.

Common Mistakes That Sabotage Development Financing Applications

Avoid these frequent errors that can derail even strong projects:

- Underestimating costs: In California, costs rise fast. Lenders will catch unrealistic budgets. Always add contingencies.

- Incomplete documentation: Missing plans, permits, or surveys signals disorganization.

- Weak market validation: You need solid data showing there’s demand—not just an assumption.

- Unclear repayment strategy: Lenders must see how they’ll be paid back—with timelines and triggers.

- Applying to the wrong development loan lender: Not all development loan providersspecialize in the same regions or asset types. Do your homework before submitting.

Secure Development Financing in California from Insula Capital Group

Need capital to move your California project forward? Insula Capital Group can help. As experienced development loan lenders in California, we offer fast, flexible real estate development financing tailored for today’s market.

Whether you’re building in LA, the Bay Area, or emerging suburbs, we work with you to structure the funding your project needs—on your timeline. Contact us today to secure development financing in California without the usual delays.