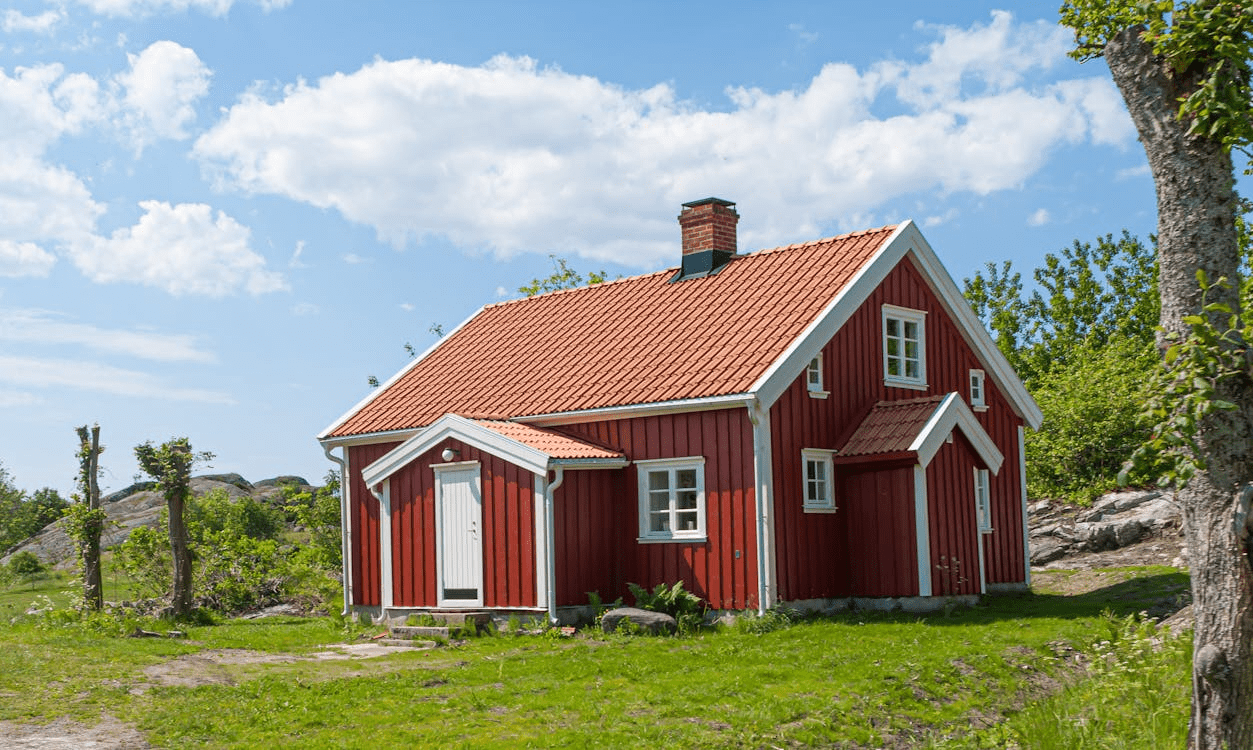

For farmers and investors, acquiring agricultural land is a paramount step towards ensuring long-term profitability and sustainability. However, the financing process can often seem daunting, filled with complex terms and considerations. Understanding the nuances of agricultural land financing tips can empower you to make informed decisions and secure the right funding for your needs. In this blog, we’ll discuss essential strategies for obtaining financing for agricultural land, covering everything from loan options to eligibility requirements.

Understanding the Different Loan Options

Before diving into the specifics of obtaining financing, it’s crucial to familiarize yourself with the various land loan options available. Multiple paths can lead you to secure the funds necessary for purchasing agricultural land. These include:

· Commercial Land Loans: Suitable for larger agricultural operations, these loans often provide substantial amounts of capital but come with specific requirements and longer terms.

· Land Purchase Loans: Specifically designed for acquiring land, these loans can cater to both residential and commercial purposes, making them flexible options for farmers and investors alike.

· Investment Land Loans: If you’re looking to invest in agricultural land for financial returns rather than for personal use, this type of financing could be beneficial.

· Residential Land Loans: For those looking to buy land to establish a residence, these loans typically have more accessible qualifications.

Identifying the right type of loan is fundamental to your success. Each option has unique land loan rates, land loan requirements, and repayment structures, so understanding them can ensure you select the best fit for your goals.

Researching Land Loan Providers

Once you have determined the type of loan you need, your next step involves researching reputable land loan providers. This is a critical step in the process, as different lenders may offer varying terms, interest rates, and service levels. To effectively navigate this landscape:

· Compare land loan rates from multiple lenders. Look for competitive interest rates that fit your budget and financial projections.

· Investigate each lender’s credibility by examining customer reviews and testimonials.

· Consult with land loan brokers who can provide valuable advice and suggestions tailored to your specific situation.

Lenders specializing in land loans for investment or agricultural land financing may offer better terms tailored to your needs. Taking the time to find the right lender can pay off significantly in the long run.

Navigating the Loan Application Process

The land loan application process can feel overwhelming for many first-time borrowers. However, understanding what to expect can significantly ease the strain. Here are some general steps to follow during the application process:

· Gather Necessary Documentation: Lenders will require several documents, such as proof of income, tax returns, a business plan (for investment land loans), and details about the property you intend to purchase.

· Complete the Application: Fill out the application with accurate and truthful information to avoid delays in land loan approval.

· Stay in Communication: After submitting your application, maintain open lines of communication with your lender. This can help clear up any questions they may have and expedite the approval process.

Each lender may have different land loan requirements, so it’s crucial to carefully follow each institution’s guidelines during your application.

Understanding Loan Eligibility

Before beginning the application process, familiarize yourself with the land loan eligibility criteria typically used by lenders. General eligibility factors include:

· Your credit score and credit history

· Income stability and debt-to-income ratio

· The intended use of the land (agricultural, residential, investment)

· Property specifics, such as location and zoning

Understanding these factors will not only help you assess your readiness to apply for land mortgage loans but also reveal areas where you might need to improve your finances before seeking approval.

Timing and Planning

Financing for agricultural land doesn’t just hinge on securing the loan; timing plays a significant role, too. Being aware of the agricultural cycles can impact your decision on when to make your purchase. For example, purchasing land before planting season could provide immediate opportunities for growth.

Moreover, take into account the market conditions for land purchase loans in your area. Assessing land purchase loan rates and economic indicators can help you secure financing at a more favorable time, increasing your overall returns.

Planning ahead also includes considering long-term financial strategies. Can you sustain monthly payments during lean seasons, or do you need a loan structure that offers flexibility? Addressing these questions early on can prevent financial strain later.

Exploring Alternative Financing Options

In addition to traditional loans, consider alternative funding sources when pursuing agricultural land financing tips. Some possibilities include:

· Crowdfunding: This increasingly popular avenue can allow you to raise capital from multiple investors willing to back your agricultural project. Websites dedicated to agricultural crowdfunding can connect you with potential investment sources.

· Partnerships: Forming partnerships can also aid in financing. By teaming up with an individual or organization that shares similar agricultural goals, you can pool resources and share the associated financial burdens.

· Private Lenders: If traditional banks don’t offer you a loan, consider private lending options. Private lenders may provide more flexible terms and faster approvals, albeit often at higher interest rates.

By diversifying your approach to funding, you increase your chances of securing the financing you need.

Building Relationships with Lenders

Establishing strong connections with land loan lenders can make a significant difference in your financing pursuits. Building rapport with lenders may lead to favorable terms and ongoing support for your agricultural ventures.

Stay in touch with your lender even after securing financing. Regular updates about your farming operations and financial health can help foster goodwill. When it’s time for your next loan, lenders are more likely to consider you favorably if they feel they know and trust you.

Take the Next Step in Your Investment Journey!

Are you ready to secure the financing necessary for your agricultural endeavors? At Insula Capital Group, we specialize in providing tailored financing solutions that meet your agricultural land needs. Whether you’re interested in land mortgage loans or land purchase loans, our team will assist you throughout the land loan application process to ensure you find the best fit for your goals. Don’t let financing keep you from realizing your dreams—contact Insula Capital Group today, and let’s explore the right land financing options for you!