New Construction Loans in Charleston, SC

Charleston, SC, is a city that offers excellent opportunities for real estate investment. The real estate market in Charleston has been on the rise in recent years, making it a hot spot for developers, builders, and investors. The city’s growing population, diverse economy, and rich history attract many people to live and invest here. And if you want to take advantage of that, you need our new construction loans in Charleston, SC.

Get in Touch

Why Do You Need to Invest in New Construction Loans?

For those looking to start a new construction project in Charleston, the importance of finding the right financing solution cannot be overstated. New construction loans are crucial to turning your vision into a reality. They provide the funding you need to build a property that meets the market’s demands and stands out in the competitive real estate market.

Investing in new construction loans can be a great opportunity for developers, builders, and investors. New construction projects offer the potential for higher returns compared to other types of real estate investments.

How Can Insula Capital Group Help?

At Insula Capital Group, we understand the importance of finding the right financing solution for your new construction project in Charleston, SC. Our new construction loans are designed for experienced investors, developers, and builders. Our program provides a great source of capital at competitive rates to help you achieve your real estate investment goals.

Our new construction loans in Charleston, SC, require a minimum of three successful ground-up projects to qualify, making it accessible to a wide range of investors. We offer loan amounts up to $10 million, and our loan-to-cost ratio can reach 75%. We can fund up to 90% of the total project cost, including hard and soft costs.

How Hard Money Loans Work Best for New Construction Projects

Hard money loans are preferred for new construction projects in real estate. For new construction projects, timelines are often less than ideal, which makes it necessary to have quick access to capital. You can expect conventional loans to take weeks or even months to process, but hard money loans can often be secured within days, making them ideal for time-sensitive projects.

Private hard money lenders are often more willing to work with borrowers who have less-than-perfect credit or unconventional income sources, which can be common for new developers. You can also receive higher loan-to-value ratios compared to traditional financing options when working with hard money loans. Borrowers use this as a strategy to put their own money into other aspects of a project while using the loan to fund the majority.

Hard money loans are typically short-term, usually ranging from six months to three years, which can be beneficial for new construction projects as they allow developers to quickly complete the project and sell or refinance the property. Hard money loans can offer crucial financial support for new construction projects, particularly for those who may face challenges securing financing through traditional channels.

Numbers and Stats from The Charleston, SC Real Estate Market to Know

Investing in new constructions requires a lot of research, planning, and focus. Despite some of the promising numbers and progress in the region, investors need to be very particular about their projects to ensure they make informed decisions. Here are some of the most essential numbers that any real estate investor would want to know firsthand:

- Median Home Price:$215,500

- 1-Year Appreciation Rate:-4%

- Median Home Value (1-Year Forecast): +4.3%

- Average Monthly Rent: $1,990

- Unemployment Rate:4%

- Population:127,999

- Median Household Income: $51,771

The Real Estate Landscape In Charleston

127,999

Population

$215,500

Median Home Price

$1,990

Average Monthly Rent

-4%

1-Year Appreciation Rate

$51,771

Median Household Income

+4.3%

Median Home Value (1-Year Forecast)

Just Funded Projects

June 2022

Fix & Flip

- Weiser, ID

Purchase Price

170,000

Renovation Budget

59,000

Loan Amount

207,000

After Repair Value

309,000

July 2022

Fix & Flip

- Washington, DC

Purchase Price

255,000

Renovation Budget

80,000

Loan Amount

296,750

After Repair Value

450,000

December 2021

Fix & Flip

- Centerreach, NY

Purchase Price

340,000

Renovation Budget

46,050

Loan Amount

321,300

After Repair Value

459,000

November 2021

Fix & Flip

- Hartford, CT

Purchase Price

149,000

Renovation Budget

70,000

Loan Amount

196,650

After Repair Value

290,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

130,000

Renovation Budget

105,300

Loan Amount

209,300

After Repair Value

335,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

62,000

Renovation Budget

60,000

Loan Amount

106,500

After Repair Value

176,000

November 2021

Fix & Flip

- North Babylon, NY

Purchase Price

310,000

Renovation Budget

32,750

Loan Amount

311,750

After Repair Value

495,000

November 2021

Fix & Flip

- East Hampton, NY

Purchase Price

1,250,000

Renovation Budget

577,465

Loan Amount

1,577,465

After Repair Value

2,487,500

November 2021

Fix & Flip

- Jersey City, NJ

Purchase Price

525,000

Renovation Budget

240,650

Loan Amount

848,800

After Repair Value

831,000

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

How the Charleston, SC Real Estate Market Makes It Viable for New Construction Investments

Before investing in a new construction project, it’s necessary to consider that the area you’ll be building in has a thriving economy or shows great potential. In the case of Charleston, SC, there are various economic and social indicators that show great promise. Charleston boasts a strong educational foundation, with notable institutions such as the College of Charleston and The Citadel that bring in students from out of state as well. The city’s business environment has also made strides in recent years, thanks to a range of industries, including aerospace, automotive, and technology. Some major corporations like Boeing and Volvo have also set up shop in the area.

The healthcare infrastructure is also commendable, with renowned facilities such as the Medical University of South Carolina (MUSC) offering top-tier medical services and driving medical innovation. Charleston’s population growth reflects its appeal, with an estimated 5% increase from 2020 to 2021, according to the U.S. Census Bureau, ensuring sustained demand for housing.

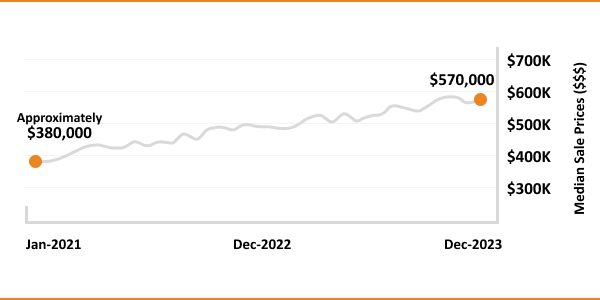

Charleston’s charm and quality of life attract both domestic and international migrants. The city’s historic sights, booming culinary scene, and many recreational activities are often listed as major factors for people considering the area as their new home. With a median home value growth rate of 7.7% over the past year, according to Zillow, Charleston offers promising investment potential for new construction real estate investors seeking a dynamic market with strong fundamentals.

Ready to apply for a New Construction loan?

Frequently Asked Questions

Our new construction loan program requires a minimum of three successful ground-up projects to qualify.

Insula Capital Group offers loan amounts in millions for new construction loans.

The loan-to-cost ratio for our new construction loan program can reach up to 75%. We can fund up to 90% of the total project cost, including hard and soft costs.

Insula Capital Group’s new construction loan program provides a simple and streamlined process to help you secure the funding you need. We offer fast and efficient loan approvals with flexible terms and competitive rates. Our team of experienced professionals is dedicated to providing the funding and support you need to succeed.

Let Us Help You!

Let us help you turn your vision into a reality with our new construction loans in Charleston, SC. Contact Insula Capital Group today to get started on your new construction project.Fill out our online application or check out just-funded projects now!