DSCR Mortgage in Florida: Lending Made Easy

California’s property market offers tremendous potential for rental income, but securing the right financing can be challenging—especially for investors who want to scale quickly. At Insula Capital Group, we specialize in DSCR loans Californian investors can count on—tailored for those who prefer simplicity, speed, and performance-based approvals.

Our DSCR rental loans for California are designed specifically for rental property owners, including those investing in single-family homes, short-term rentals, or small multifamily properties.

Our DSCR mortgage programs for California are ideal for both new and experienced investors who want a streamlined, flexible loan structure based on the property’s debt service coverage ratio—not your employment history, W2s, or tax returns.

These loans evaluate the property’s rental income instead of your personal income—making it easier to qualify and scale your real estate portfolio in California’s competitive environment.

Whether you’re buying, refinancing, or cashing out, Insula Capital Group offers trusted solutions and competitive DSCR loan rates in California to help you succeed in markets from Los Angeles and San Diego to Sacramento and beyond.

Partner with Florida’s Leading DSCR Loan Lenders at Insula Capital Group

With decades of experience in real estate financing, Insula Capital Group brings a deep understanding of Florida’s diverse property landscape.

Our Florida DSCR mortgage solutions are crafted to meet the unique needs of investors, emphasizing speed, flexibility, and personalized service.

Why choose Insula Capital Group for your DSCR loans in Florida?

- Income-Based Qualification:We assess the property’s income potential, eliminating the need for personal income verification.

- Flexible Loan Options:Choose from fixed-rate, interest-only, or adjustable-rate mortgages to suit your investment strategy.

- Entity-Friendly Lending:Finance properties under LLCs, trusts, or individual names, providing versatility in ownership structures.

- Expert Guidance:Our team navigates you through the DSCR loan requirements Florida mandates, ensuring a smooth process.

- Statewide Coverage:From the Panhandle to the Keys, we support investments across all Florida markets.

As your trusted DSCR loan lenders in Florida, Insula Capital Group is committed to facilitating your success in the dynamic Florida real estate market.

The Strategic Advantages of DSCR Loans in Florida

Florida DSCR mortgage loans offer a pragmatic alternative to traditional financing, especially for investors focused on rental income. By evaluating the Debt Service Coverage Ratio (DSCR), these loans prioritize the property’s ability to generate income over the borrower’s personal financials.

Key benefits of DSCR loans in Florida include:

- Simplified Qualification:No need for tax returns, W-2s, or pay stubs; approval is based on property cash flow.

- Portfolio Expansion:Easily finance multiple properties without the constraints of traditional loan limits.

- Diverse Property Types:Applicable to single-family homes, condos, multifamily units, and vacation rentals.

- Rapid Processing:Accelerated approval and funding timelines to capitalize on market opportunities.

- Refinancing Options:Access cash-out or rate-and-term refinancing to optimize your investment returns.

With Insula Capital Group, leverage the advantages of DSCR loans to build and diversify your Florida real estate portfolio.

Why Invest in Florida with DSCR Loans?

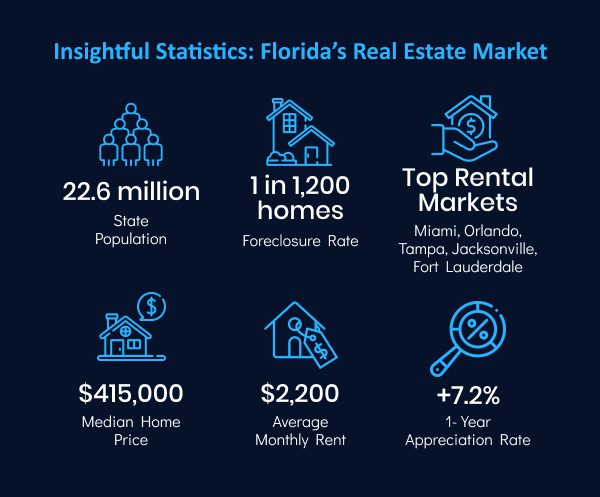

Florida’s diverse economy, growing population, and attractive lifestyle make it a prime location for real estate investment. From bustling urban centers to serene coastal towns, opportunities abound for both long-term and short-term rental strategies.

Florida’s real estate market remains robust, driven by population growth, economic expansion, and a favorable climate. Here’s a snapshot of the current landscape:

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

Why DSCR Loans Are the Smart Choice for Today’s Investors

Today’s real estate investors face a fast-moving market, rising interest rates, and tighter lending criteria from traditional banks.

That’s where DSCR loans stand out as a strategic financing option—built to match the unique needs of income-focused investors.

Here’s why savvy investors are turning to DSCR loans

- No Income Verification Required:Skip the hassle of tax returns, pay stubs, and complex income calculations. DSCR loans base approval on the property’s income potential, not your personal finances.

- Ideal for Self-Employed or LLC Investors:Whether you invest under an LLC, trust, or personally, Florida DSCR mortgage solutions offer flexible structures to support your business model.

- Quicker Approvals:With fewer documentation hurdles, DSCR loans move faster—letting you act on hot deals before the competition does.

- Scalable Financing:Want to build a portfolio? DSCR loans allow you to finance multiple properties without traditional loan caps, so you can grow faster.

- Focus on Cash Flow:These loans are designed for what matters most—your property’s ability to cover its expenses and generate consistent returns.

With rising demand for rental housing across the state, now is the perfect time to finance smarter. DSCR loans offer the speed, simplicity, and scalability modern investors need to succeed in Florida’s competitive real estate market.

Ready to Apply for a DSCR Loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions for

DSCR Loans in Florida

DSCR loan requirements are based on the income the property generates. We typically look for a DSCR of at least 1.0 (meaning the rental income covers the loan payment). You’ll also need a minimum credit score (generally 620+), a down payment (as low as 20%), and a rental lease or projected rental income analysis.

DSCR loan rates in Florida depend on the loan-to-value ratio, property type, borrower credit, and the property’s rental income. At Insula Capital Group, we offer competitive rates customized to your investment scenario.

DSCR is calculated by dividing the property’s gross rental income by its total debt service (including mortgage, taxes, and insurance). A DSCR of 1.25 means the property generates 25% more income than needed to cover its expenses.

Yes! DSCR loans can be used for both purchases and refinances, including cash-out refinance options. It’s a popular way for investors to pull equity out of existing rental properties to fund future acquisitions.

We finance single-family homes, duplexes, triplexes, fourplexes, townhomes, condos, and even short-term vacation rentals.

Start Your DSCR Loan in Florida Today

Whether you’re starting your rental journey or expanding a thriving portfolio, Insula Capital Group makes it easy to access the capital you need. As Florida’s trusted DSCR loan lenders, we simplify the process and offer funding options that align with your goals.

Whether you’re growing your rental portfolio or seeking better loan terms for an existing asset, our experts are ready to guide you through every step. Don’t let traditional income verification slow you down—choose a lending partner that moves at the speed of your success.

Get started with Florida’s top DSCR loan lenders today. Apply online or speak with a lending advisor to explore your options.

Easy Steps to Get Funded

Receive a proof of funds

Get verification of your funding capacity.

Source a property

Find the right property to invest in.

Provide requested documentation

Submit essential documents for approval.

Close your Loan

Finalize the deal and secure your funding.