Build And Scale Your Real Estate Portfolio With DSCR Rental Loans in New York

The Empire State offers incredible opportunities for real estate investors—whether you’re purchasing a multifamily building in Brooklyn, a rental condo in Manhattan, or a short-term vacation home in the Catskills.

At Insula Capital Group, we simplify the process with DSCR loans in New York, designed specifically for borrowers looking to qualify based on rental income rather than personal income.

Our New York DSCR mortgage solutions are ideal for investors, business owners, and self-employed individuals who want to grow their rental portfolios without the delays of traditional underwriting. Whether you’re scaling your holdings or refinancing an existing asset, our DSCR rental loans are built for speed, simplicity, and long-term success.

Get in Touch

Your Trusted New York DSCR Loan Lenders

At Insula Capital Group, we offer experience-driven lending solutions tailored for New York’s unique real estate landscape.

As dedicated DSCR loan lenders in New York, we’ve helped hundreds of clients secure funding for everything from walk-up buildings in Brooklyn to duplexes in upstate cities like Albany and Syracuse.

Our focus is simple: deliver fast, reliable, and flexible financing based on the income potential of your investment property.

With competitive DSCR loan rates in New York and expert-level market insight, we’re here to help you seize profitable opportunities statewide—from the boroughs to the burbs.

With Insula Capital Group, you’ll benefit from:

- Asset-Based Qualification– No W-2s, no tax returns—just property performance.

- Funding for All Property Types– Single-family homes, multifamily units, vacation rentals, and more.

- Fast Closings– Close in as little as 2–3 weeks.

- Flexible Terms– Interest-only options and 30-year fixed-rate terms available.

- Custom Loan Structures– Designed around your strategy and long-term goals.

- Investor-Focused – Our team knows what matters to landlords and developers.

Why DSCR Loans Make Sense for New York Investors

DSCR (Debt Service Coverage Ratio) loans allow real estate investors to qualify for a mortgage based on rental income—not personal earnings.

Instead of relying on tax documentation or pay stubs, we evaluate whether your investment property can cover the loan payment (typically requiring a DSCR of 1.0 or higher).

This is especially useful in a high-demand, high-reward market like New York, where many investors operate through LLCs or have complex income streams.

Use DSCR loans in New York if you:

- Own multiple income properties

- Are self-employed or own a business

- Invest through a legal entity (LLC, trust, etc.)

- Want to refinance without personal income documentation

- Need fast closings with less paperwork

Our New York DSCR mortgage programs simplify the financing process so you can focus on acquiring high-performing assets.

Wondering If You Qualify?

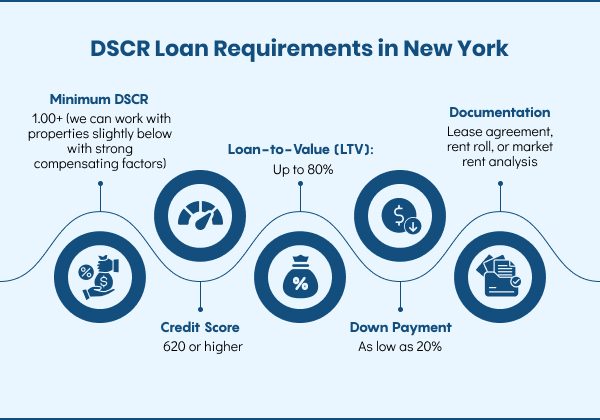

Our DSCR loan requirements in New York are designed to support real estate investors, not penalize them. Here’s what you need:

New York Real Estate Market Snapshot

New York is one of the most dynamic and resilient housing markets in the country. From urban hubs to upstate suburbs, the Empire State continues to attract investors with stable rental demand, strong appreciation potential, and high occupancy rates.

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,729,700

After Repair Value$3,500,000

Purchase Price$1,020,000

Renovation Budget$964,700

Loan TypeFix & Flip

- After Repair Value$3,500,000

- Purchase Price$1,020,000

- Renovation Budget$964,700

- Loan TypeFix & Flip

Arlington, VA

July 2025

Fix & Flip

Loan Amount

$224,250

After Repair Value$345,000

Renovation Budget$174,111

Loan TypeFix & Flip

- After Repair Value$345,000

- Renovation Budget$174,111

- Loan TypeFix & Flip

Lehigh Acres, FL

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

Why Invest in New York Real Estate?

New York isn’t just a cultural and financial capital—it’s one of the most profitable rental markets in the U.S. Investors from around the world target the state for its:

- High Rental Demand:NYC’s population density and limited housing supply create year-round rental stability.

- Diverse Property Types:Invest in urban rentals, student housing, vacation homes, or suburban single-family units.

- Global Appeal:International investors continue to drive value in markets like Manhattan and Brooklyn.

- Tourism + Business:A steady flow of tourists and business travelers fuels the short-term rental market.

- Resilient Economy:With Wall Street, media, education, healthcare, and tech, NY has one of the broadest economic bases in the country.

DSCR loans in New York offer a streamlined way to invest in these income-producing opportunities—without being restricted by traditional income limits or red tape.

Ready to Apply for a DSCR Loan?

Frequently Asked Questions for

DSCR Loans in New York

Your New York DSCR mortgage rate depends on credit score, loan-to-value ratio, property cash flow, and rental income stability. At Insula Capital Group, we offer competitive fixed and adjustable rates with fast funding.

Absolutely. Whether you’re doing a cash-out refinance or lowering your monthly payments, DSCR refinancing is a great way to leverage existing equity.

Yes, short-term rentals are eligible, including Airbnb and Vrbo properties—especially in high-demand areas like NYC, the Hudson Valley, and the Finger Lakes.

Yes. We finance short-term rentals and Airbnb properties, especially in vacation destinations like the Catskills, Hudson Valley, and Hamptons.

We lend on 1–4 unit properties, condos, townhomes, and multi-unit rentals. Mixed-use properties may also qualify with strong rental income.

Your Trusted DSCR Loan Lenders in New York

At Insula Capital Group, we’re not just lenders—we’re your investment partners. Our DSCR rental loans in New York are designed to help you seize profitable opportunities in today’s competitive housing market.

From Manhattan apartments to upstate multifamily units, we provide the flexible funding you need to grow your rental income with confidence. Don’t let income documentation, red tape, or delays slow you down.

Whether you’re entering the New York market or expanding your holdings, our New York DSCR mortgage specialists are here to help you close with confidence.

Apply today for DSCR rental loans in New York and take the next step toward growing your investment portfolio.

Easy Steps to Get Funded

Receive a proof of funds

Get verification of your funding capacity.

Source a property

Find the right property to invest in.

Provide requested documentation

Submit essential documents for approval.

Close your Loan

Finalize the deal and secure your funding.