Fast & Flexible DSCR Rental Loans in Texas

The Empire State offers incredible opportunities for real estate investors—whether you’re purchasing a multifamily building in Brooklyn, a rental condo in Manhattan, or a short-term vacation home in the Catskills.

At Insula Capital Group, we simplify the process with DSCR loans in New York, designed specifically for borrowers looking to qualify based on rental income rather than personal income.

Our New York DSCR mortgage solutions are ideal for investors, business owners, and self-employed individuals who want to grow their rental portfolios without the delays of traditional underwriting. Whether you’re scaling your holdings or refinancing an existing asset, our DSCR rental loans are built for speed, simplicity, and long-term success.

Get in Touch

Your Trusted DSCR Loan Lenders in Texas

We’re more than just lenders—we’re partners in your investment journey. Our experienced team understands the Texas real estate market and offers dependable lending solutions across all major metro areas and high-yield regions.

As seasoned DSCR loan lenders in Texas, we help everyone from first-time investors to LLCs and professional landlords access capital without tax return headaches or strict income criteria.

We provide custom financing solutions that empower you to grow your rental portfolio, tap into equity, or expand into short-term rentals.

Why choose us?

- No Employment or Income Verification

- Close in as Little as 2–3 Weeks

- 30-Year Fixed and Interest-Only Options

- Loans for Long-Term & Short-Term Rentals

- LLCs, Trusts & Corporations Welcome

- Investor-Friendly DSCR Loan Rates in Texas

DSCR Loans Texas: Target Hot Markets Like Austin, Dallas & Houston

Texas isn’t just one real estate market—it’s a collection of powerful, high-growth cities, each with its own rental income opportunities.

Our DSCR loans in Texas are designed to support investors targeting the state’s most profitable metro areas, including:

- Austin – With strong demand for short-term rentals near downtown and tech hubs, Austin is perfect for investors looking to maximize nightly rental income. DSCR loans make it easy to finance Airbnb and VRBO properties here.

- Dallas-Fort Worth – This sprawling metro is packed with suburbs ideal for long-term tenants and build-to-rent portfolios. Our DSCR rental loans in Texas offer a fast-track to financing SFRs, duplexes, and small multifamily homes in DFW.

- Houston – Known for steady population growth and affordable housing stock, Houston is one of the best places to use a Texas DSCR mortgage to expand your real estate holdings—especially in emerging neighbourhoods near downtown.

- San Antonio – A top pick for military rental properties and long-term stability, San Antonio offers strong DSCR opportunities for investors looking to secure 1.0+ ratios with minimal vacancy risk.

No matter where you’re investing in Texas, we tailor every DSCR loan to match the local market’s rental expectations—so you can close faster, earn more, and scale smart.

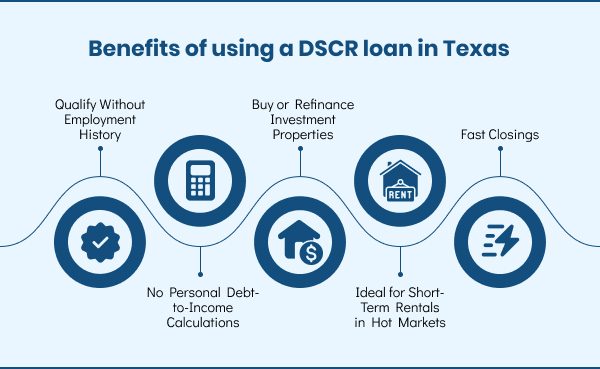

Why Choose DSCR Rental Loans in Texas?

Texas is one of the top real estate markets in the country, thanks to its low taxes, affordable properties, and rapid population growth.

That makes DSCR rental loans Texas investors’ best option for growing or refinancing real estate portfolios—without the limitations of conventional loans.

Texas offers strong cash flow potential across urban, suburban, and rural areas. With demand outpacing housing supply in most metro regions, DSCR loans Texas can help you act fast—without the burden of full-document underwriting.

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,729,700

After Repair Value$3,500,000

Purchase Price$1,020,000

Renovation Budget$964,700

Loan TypeFix & Flip

- After Repair Value$3,500,000

- Purchase Price$1,020,000

- Renovation Budget$964,700

- Loan TypeFix & Flip

Arlington, VA

July 2025

Fix & Flip

Loan Amount

$224,250

After Repair Value$345,000

Renovation Budget$174,111

Loan TypeFix & Flip

- After Repair Value$345,000

- Renovation Budget$174,111

- Loan TypeFix & Flip

Lehigh Acres, FL

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

Why Invest in Texas Real Estate?

From business-friendly tax laws to booming job markets, Texas is ideal for long-term rental income and appreciation. Whether you’re investing in short-term rentals near lakes or buy-and-hold properties in emerging suburbs, the Lone Star State is a proven performer.

Top reasons to invest:

- Strong Rental Demand in Growing Cities

- Affordable Housing vs. National Average

- Investor-Friendly Laws

- Booming Job Growth Across Industries

Use DSCR rental loans in Texas to purchase turnkey homes, refinance rentals, or unlock equity in income-generating properties—all without traditional income hurdles.

Ready to Apply for a DSCR Loan?

Frequently Asked Questions for

DSCR Loans in Texas

Yes. We finance both short-term and long-term rentals across Texas, including tourist destinations like Austin, Galveston, Fredericksburg, and Lake Travis.

No. DSCR loans are based on rental income—not personal income or employment history.

Absolutely. We work with investors who borrow through LLCs, corporations, and revocable trusts.

Most DSCR loans Texas close in as little as 2–3 weeks, provided documents are submitted promptly.

Yes. We offer cash-out and rate-and-term refinance options for qualified investment properties.

Get Approved by Top DSCR Loan Lenders Texas Investors Trust

Insula Capital Group is proud to be one of the most experienced DSCR loan lenders Texas investors rely on. We know the state’s markets inside and out, from booming cities like Houston and Austin to high-yield opportunities in Lubbock, Waco, and Corpus Christi.

Our mission is to empower investors with smart, fast capital. With competitive DSCR loan rates in Texas, streamlined approvals, and unmatched service, we help you move quickly on every opportunity—without income verification slowing you down.

If you’re ready to grow your rental portfolio in the Lone Star State, now is the time to secure a DSCR rental loan in Texas. Whether you’re buying, refinancing, or expanding, Insula Capital Group offers investor-focused financing solutions that work with your business model—not against it.

Apply now and discover how easy it is to get funded with a Texas DSCR mortgage from Insula Capital Group.

Easy Steps to Get Funded

Receive a proof of funds

Get verification of your funding capacity.

Source a property

Find the right property to invest in.

Provide requested documentation

Submit essential documents for approval.

Close your Loan

Finalize the deal and secure your funding.