Fix & Flip Loans in Arkansas

If you are looking to make a quick buck in Arkansas, flipping properties might be a great venture for you!

Hundreds of real estate investors in Arkansas find house flips to be lucrative. However, the costs involved in buying, rehabbing, and reselling a property are never easy for one person to bear. This issue is what makes fix and flip financing so important.

The private money lenders at Insula Capital Group offer fix & flip loans to innovative property investors across the US. Find out how you can benefit from our loan programs below.

Get in Touch

Cover the Full Costs of Your House Rehabwith a Fix & Flip Loan in Arkansas

Property investors who undertake house rehab projects don’t require long-term mortgage loans. Instead, they find fix & flip loans to be much more effective. The fix & flip loans offered by our loan experts are designed to help you finance up to 100% of your rehab costs. This loan program can greatly take the stress of flipping properties off of your shoulders. We work with all types of investors, so don’t let your lack of experience stop you from applying. Our expert underwriters will evaluate your application in as little time as possible.

We have been in the business of curating financial solutions for investors for over 30 years now. Our years of experience have made us capable of addressing every client’s unique concerns most effectively.

We also offer other loan programs like new construction loans and multifamily property loans. All of our loans can be approved within a day and funded within a week. Learn more about our fix & flip loans through our recently funded projects.

Why Are Hard Money Fix & Flip Loans A Viable Option For Investors In Arkansas?

Do you want to start a fix & flip project in Arkansas? If yes, we recommend opting for an efficient financing option to prevent any financial hassle.

As an investor, you might have faced various challenges in securing conventional financing. Fortunately, hard money fix & flip loans provide a viable alternative that can help you achieve your investment goals quickly and efficiently.

Arkansas has a booming real estate market with numerous opportunities for investors to purchase damaged properties, renovate them, and sell them for a profit. However, traditional lenders don’t offer financing for fix & flip projects because of their short-term nature and higher risks. This is why you must opt for a hard money fix & flip financing options from private lenders in Arkansas.

While it can take weeks or even months to get approval for fix & flip loans from conventional lenders, private hard money lenders provide loan approval within days and help you capitalize on real estate opportunities. You can also get easy repayment terms and low interest rates from private lenders for your fix & flip projects.

If you need the capital for an upcoming venture in Arkansas, our team is here to provide the financing you need.

Learn More About The Real Estate Market In Arkansas To Efficiently Start Fix & Flip Projects

Want to understand the real estate market in Arkansas to make informed decisions? Our team can help you! We’ve collected various statistics to help you make viable investment strategies and efficiently complete fix & flip projects.

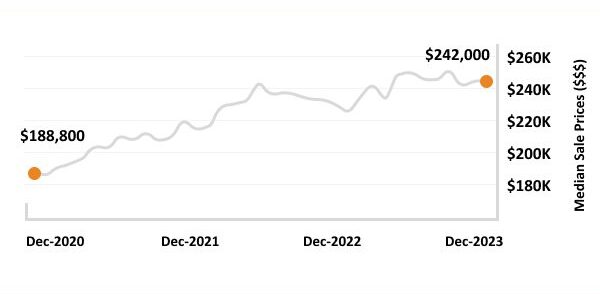

- Median Home Value: $242,000

- 1-Year Appreciation Rate: +10.4%

- Average Days On Market: 102

- Median Rent Price: $851

- Price-To-Rent Ratio: 60

- Unemployment Rate: 4%

- Unemployment Rate: 3%

- Population: 3,017,804

- Median Household Income: $47,597

The Real Estate Landscape In Arkansas

3,017,804

Population

$851

Median Rent Price

$242,000

Median Home Value

+10.4%

1-Year Appreciation Rate

$47,597

Median Household Income

14.60

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Is Investing In The Real Estate Market In Arkansas Worth It?

Are you considering Arkansas for your upcoming fix & flip project? It’s an excellent decision. Arkansas has a stable economy, which makes it an excellent option for investors who want to grow their portfolios in the long run. The state also has exceptional job and business opportunities, which attract skilled workers and entrepreneurs from across the US. This migration leads to an increase in the demand for housing and commercial properties. The rising demand can increase property prices and help investors earn hefty profits on their fix & flip projects.

If you need the capital to start your fix & flip venture in Arkansas, consider joining hands with our team.

Ready to apply for a fix & flip loan?

Frequently Asked Questions

Our loan-to-value is 85%, so we can finance up to 85% of your property’s purchase value.

We will determine the upper limit of the loan amount you can borrow after evaluating your application. However, there is a minimum borrowing limit of $50,000.

We typically release funds as per your project phases. You can request draws to get reimbursements.

Top Fix and Flip Loan Cities in Arkansas

Get Your Loan Approved in 24 Hours!

We offer lightning-fast loan approval services for clients across Arkansas. All you have to do to get started is submit a full application and provide the required documentation via our website. Then, you can sit back and wait for our team to reach out to you within 24 hours.

If you would like to discuss anything before applying, feel free to call us!