Fix & Flip Loans in Charlotte, NC

Charlotte, NC is renowned for its real estate investments and with the growing number of opportunities available in the city, more and more investors are looking towards fix and flip loans to fund their projects.

If you’re looking for a fix and flip loan in Charlotte, NC, Insula Capital Group can provide the support you need. As a leading investment firm in the region, we offer a range of financing options to help investors fund their fix and flip projects.

You can also check out some of our just-funded projects for some inspiration on how we can help you turn your real estate investment dreams into a reality.

Get in Touch

Why Fix and Flip Loans in Charlotte, NC

Fix and flip loans are short-term loans that investors use to purchase, renovate, and sell properties for a profit.

Once you’ve found the right property, a fix and flip loan can provide the necessary funds for the purchase and any required renovations.

Our private money lenders understand that every real estate project is unique. That’s why we offer a range of fix and flip loan options designed to suit the diverse needs of investors in Charlotte, NC.

With years of industry expertise and a commitment to excellence, we have earned a reputation for delivering flexible financing solutions and unparalleled customer service.

Whether you’re a seasoned investor or just starting out, we have the expertise and resources to help you succeed.

The Insula Difference

– Fast and Efficient Approval Process

Time is of the essence in the competitive real estate market. That’s why we prioritize efficiency in our loan approval process, providing investors with quick decisions and expedited funding to seize profitable investment opportunities without delay.

Our approvals are no more than 24 hours and we can fund in as little as 3–4 business days. With our quick and hassle-free financing options, you can get started on your fix and flip project in no time.

– Competitive Rates and Terms

We offer competitive interest rates and flexible loan terms to ensure that our clients receive the most favorable financing options available.

Our team works closely with investors to structure loans that align with their financial objectives and project timelines.

– No Hidden Fees or Prepayment Penalties

Transparency is key to our approach at Insula Capital Group. We believe in upfront communication and honesty with our clients, which is why we never charge hidden fees or impose prepayment penalties on our fix and flip loans.

– Flexible Loan Amounts and Eligibility Criteria

Whether you’re looking to finance a small-scale renovation project or a large-scale property overhaul, we offer flexible loan amounts to accommodate projects of all sizes.

Additionally, our eligibility criteria are designed to be inclusive, allowing investors with varying credit profiles to access the financing they need.

Reach out to speak to our team of experienced private money lenders dedicated to guiding investors through every step of the loan process.

From initial consultation to loan closing and beyond, we provide personalized support and expert advice to ensure a seamless experience for our clients.

Quick Stats

- Population: 10.7 million

- Population Density: 211 people/square mile

- Median Home Sales Price: $309,000

- Median Price to Rent: $1,418/month

- New Real Estate Listings: 3,892

- *On average, home values have gone up about 5.2% over the past year.

- *Charlotte is ranked as 4 among top 10, indicating that the Charlotte metro area is one of the most affordable places to own a home in the U.S.

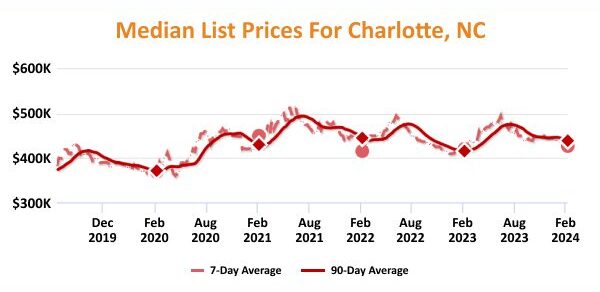

The Real Estate Landscape In Charlotte

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Starting A Fix And Flip Project In Charlotte's Real Estate Market: The Key Benefits

Growing Real Estate Market

Charlotte has experienced significant growth in its real estate market in recent years. With a strong economy, a growing population, and an influx of businesses, the demand for housing in Charlotte remains robust. This creates ample opportunities for investors to find properties suitable for fix and flip projects.

Moreover, Charlotte’s real estate market offers favorable conditions for fix and flip projects, including relatively affordable property prices compared to other major cities and a steady appreciation in home values. Low interest rates and a healthy rental market further contribute to the attractiveness of real estate investment in Charlotte.

Renovation Potential

Charlotte has a diverse housing stock that includes both historic homes and newer properties in need of renovation. Investors can capitalize on the opportunity to purchase distressed or outdated properties, renovate them to modern standards, and sell them at a profit.

Strong Demand for Renovated Homes

Homebuyers in Charlotte often seek move-in-ready properties that require minimal renovations. By renovating properties to meet modern design and functionality standards, investors can attract a larger pool of potential buyers and command higher sale prices. Additionally, renovated homes tend to spend less time on the market, allowing investors to realize profits more quickly.

Call The Experts!

While starting a fix and flip project in Charlotte’s real estate market can offer numerous opportunities for success, it’s essential to conduct thorough research, due diligence, and financial analysis before diving in.

Schedule a consultation to discuss market trends, property values, renovation costs, and potential risks for making informed investment decisions. Or explore our just-funded project section to find out more.

Ready to apply for a fix & flip loan?

Frequently Asked Questions

Contact Us Today!

If you’re interested in fix and flip loans for your project, contact Insula Capital Group today. Our hard money lenders are available to answer any questions you may have and help guide you through the process.

Fill out our application today and take the first step towards turning your real estate investment dreams into a reality.