Private Money Lenders | Hard Money Loans in Alabama

With a thriving economy, affordable living costs, and captivating natural beauty, Alabama attracts both residents and visitors. The state is known for its incredible cultural heritage and charming small towns and the ample opportunities it offers to its residents.

However, as private money lenders, what really attracts us to Alabama is its incredibly promising real estate market. With consistent growth in both commercial and residential sectors, the market offers some very lucrative opportunities for investors looking for new real estate ventures.

Sounds interesting? Let Insula Capital Group help you out with the best private lending programs to get started!

Get in Touch

Get The Best Hard Money Lenders on Board In Alabama

With over 30 years of experience, Insula Capital Group offers some of the best private lending services in the US, including here in Alabama.

Our services aren’t one-size-fits-all, and we take time to understand your financial situation and your project’s exact requirements before designing a loan deal that’s perfect for you.

As Alabama’s most reliable private money lenders, we also offer excellent financial advice, quick processes, and competitive rates to make things easier for our clients! Check out our loan programs and just-funded projects for better insights!

With us on board, you can rest assured that your project will have the financing it needs, thereby propelling you toward quick and efficient project completion with maximum peace of mind!

Get The Best Hard Money Lenders on Board In Alabama

Hard money loans are one of your best bets when it comes to real estate investments. Finding homes at affordable rates can be a major challenge and this is precisely what makes hard money loans a great option when you’re finding entry points into the real estate industry.

Hard money loans come with lower restrictions. This essentially means that, as lenders, we have very few requirements that you need to fulfill before we approve your loan.

Additionally, hard money loans have quicker closing times, more flexibility, and collateral backing. Moreover, hard money loans are a great help when you’re investing in a rundown property because they offer great funding based on the property’s value post-renovation instead of its standing value at the time of purchase.

To sum it up, hard money loans are infinitely better than traditional loans, and a great choice for seasoned and rookie investors.

Alabama’s Real Estate Scene

Thinking about investing in Alabama’s real estate market? Here are some key stats to keep in mind in order to ensure the best results:

- Population: 5.11 million

- Migration Rate (Into Alabama): 13.4%

- Median Household Income: $59, 609

- Unemployment Rate: 2.40%

- Average Home Prices: $274,200

- Average Rent Prices: $1505

- Median Days Before Sale: 42

- Median Sale Price: $268,400

- Annual Increase: 1.7%

- Sold Volume: 1.2 billion

- Homes Sold Above List Price: 19.3%

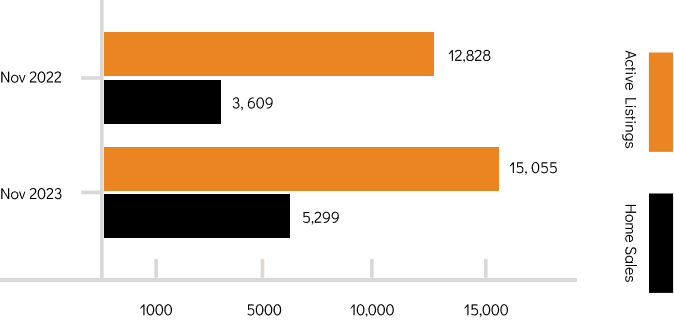

- Active Listings: 15,055

- Foreclosure Rate: 11.9% increase

- Median Real Property Tax Rate: 3.33 per $1000

Alabama’s Real Estate Market

5.11 million

State Population

$268,400

Median Sale Price

$274,200

Average Home Price

1.7%

1-Year Appreciation Rate

1/1663

Home Foreclosure Rate

15,055

Active Listings

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in Alabama’s Real Estate Market?

Ask any seasoned investors, and they’ll tell you that Alabama is one of the best places to invest in. With a relatively low cost of living, it always has families looking for affordable housing options. This inevitably drives up the demand for both owned and rental properties.

Moreover, Alabama has a diverse economy with thriving industries, be it finance, aerospace, or manufacturing. This makes it an attractive spot for job seekers who come to the state to build their careers; once here, they need a place to stay! This, of course, results in greater demand and better appreciation of property values.

Additionally, one cannot overlook Alabama’s favorable tax policies, all of which enhance the returns on real estate investments! Once you invest in a property in Alabama, you can rest assured it will yield significant returns in time.

It’s also worth considering that cities like Montgomery and Birmingham in Alabama offer incredible suburban lifestyles and amenities that constantly draw populations from across the US. These cities have emerging neighborhoods that are incomparably promising and worth investment in as the state continues to develop further.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

As the best private money lenders in Alabama, we offer quite a few hard money loan programs at Insula Capital Group. Depending on your project type and scope, you can choose to fix and flip loans, new construction loans, rental loans, or multifamily mixed-use bridge loans.

If you’re not sure about the perfect hard money loan for your project, consider getting in touch with our team. Our experts can discuss your project in detail with you to assess what loan type would work best!

Hard money loans don’t work the same way as conventional loans, and therefore, you don’t necessarily need a high credit score to secure a hard money loan. We can get your loan approved even with a low credit score as long as you have property that can serve as collateral.

{“type”:”elementor”,”siteurl”:”https://insulacapitalgroup.com/wp-json/”,”elements”:[{“id”:”2850724″,”elType”:”widget”,”isInner”:false,”isLocked”:false,”settings”:{“tabs”:[{“tab_title”:”Why should I opt for a hard money loan in Orlando, FL?”,”tab_content”:”<p>A hard money loan is the perfect financing option because it offers multiple benefits like quick approvals, low interest rates, minimal requirements and much more. If you want to learn more about our hard money loan deals, we recommend <a href=\”https://insulacapitalgroup.com/just-funded-projects/\”><u>visiting our just-funded project section</u></a>. </p>”,”_id”:”9d37bc9″},{“tab_title”:” Where can I use a hard money loan in Orlando, FL?”,”tab_content”:”<p>You can use our hard money loans to finance a wide range of real estate projects. We offer specific loan programs like <a href=\”https://insulacapitalgroup.com/fix-flip-financing/\”><u>fix and flip loans</u></a>, <a href=\”https://insulacapitalgroup.com/residential-rental-program/\”><u>residential rental programs</u></a>, <a href=\”https://insulacapitalgroup.com/multifamily-mixed-use/\”><u>multifamily mixed-use loans</u></a>, and <a href=\”https://insulacapitalgroup.com/loans/new-construction/\”><u>new construction loans</u></a> to help you complete your real estate ventures without any financial hassle.</p>”,”_id”:”c55afd4″},{“tab_title”:”How to start the hard money loan application in Orlando, FL?”,”tab_content”:”<p>You can start the loan application by filling out our <a href=\”https://insulacapitalgroup.com/full-application/\”><u>online full application form</u></a> and submitting the required documents.</p>”,”_id”:”10776f4″}],”ha_advanced_tooltip_content”:”I am a tooltip”,”pa_condition_repeater”:[],”border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true,”size”:0},”box_shadow_box_shadow_type”:”yes”,”box_shadow_box_shadow”:{“horizontal”:0,”vertical”:4,”blur”:40,”spread”:0,”color”:”rgba(0, 0, 0, 0.07058823529411765)”},”icon_align”:”right”,”title_typography_typography”:”custom”,”title_typography_font_family”:”Roboto”,”title_typography_font_weight”:”600″,”title_typography_font_size”:{“unit”:”px”,”size”:20,”sizes”:[]},”title_typography_font_size_mobile”:{“unit”:”px”,”size”:18,”sizes”:[]},”title_padding”:{“unit”:”px”,”top”:”20″,”right”:”14″,”bottom”:”20″,”left”:”14″,”isLinked”:false},”content_typography_typography”:”custom”,”content_typography_font_family”:”Roboto”,”content_typography_font_size_mobile”:{“unit”:”px”,”size”:16,”sizes”:[]},”content_typography_font_weight”:”400″,”_css_classes”:”faq”,”premium_tooltip_text”:”Hi, I’m a global tooltip.”,”premium_tooltip_position”:”top,bottom”,”selected_icon”:{“value”:”fas fa-arrow-down”,”library”:”fa-solid”},”selected_active_icon”:{“value”:”fas fa-arrow-up”,”library”:”fa-solid”},”space_between”:{“unit”:”px”,”size”:20,”sizes”:[]},”title_background”:”#FFFFFF”,”title_color”:”#000000″,”tab_active_color”:”#000000″,”icon_color”:”#008FD5″,”icon_active_color”:”#008FD5″,”content_background_color”:”#FFFFFF”,”content_color”:”#515151″,”content_typography_font_size”:{“unit”:”px”,”size”:20,”sizes”:[]},”_element_custom_width”:{“unit”:”%”,”size”:85,”sizes”:[]},”ha_advanced_tooltip_typography_line_height”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_word_spacing”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_position_tablet”:”center center”,”ha_advanced_tooltip_title_section_bg_color_gradient_position_mobile”:”center center”,”premium_tooltip_text_typo_line_height”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_word_spacing”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_gradient_angle_tablet”:{“unit”:”deg”},”premium_tooltip_container_bg_gradient_angle_mobile”:{“unit”:”deg”},”premium_tooltip_container_bg_gradient_position_tablet”:”center center”,”premium_tooltip_container_bg_gradient_position_mobile”:”center center”,”_background_gradient_position_tablet”:”center center”,”_background_gradient_position_mobile”:”center center”,”_background_hover_gradient_position_tablet”:”center center”,”_background_hover_gradient_position_mobile”:”center center”,”_ha_background_overlay_gradient_position_tablet”:”center center”,”_ha_background_overlay_gradient_position_mobile”:”center center”,”_ha_background_overlay_hover_gradient_position_tablet”:”center center”,”_ha_background_overlay_hover_gradient_position_mobile”:”center center”,”content_width”:”full”,”title_html_tag”:”div”,”faq_schema”:””,”border_color”:””,”space_between_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”space_between_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”box_shadow_box_shadow_position”:” “,”title_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_text_transform”:””,”title_typography_font_style”:””,”title_typography_text_decoration”:””,”title_typography_line_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_word_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_shadow_text_shadow_type”:””,”title_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”title_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”title_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”icon_space”:{“unit”:”px”,”size”:””,”sizes”:[]},”icon_space_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”icon_space_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_text_transform”:””,”content_typography_font_style”:””,”content_typography_text_decoration”:””,”content_typography_line_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_word_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_shadow_text_shadow_type”:””,”content_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”content_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”content_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”content_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_title”:””,”_margin”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_margin_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_margin_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_element_width”:””,”_element_width_tablet”:””,”_element_width_mobile”:””,”_element_custom_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_element_custom_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_flex_align_self”:””,”_flex_align_self_tablet”:””,”_flex_align_self_mobile”:””,”_flex_order”:””,”_flex_order_tablet”:””,”_flex_order_mobile”:””,”_flex_order_custom”:””,”_flex_order_custom_tablet”:””,”_flex_order_custom_mobile”:””,”_flex_size”:””,”_flex_size_tablet”:””,”_flex_size_mobile”:””,”_flex_grow”:1,”_flex_grow_tablet”:””,”_flex_grow_mobile”:””,”_flex_shrink”:1,”_flex_shrink_tablet”:””,”_flex_shrink_mobile”:””,”_element_vertical_align”:””,”_element_vertical_align_tablet”:””,”_element_vertical_align_mobile”:””,”_position”:””,”_offset_orientation_h”:”start”,”_offset_x”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_end”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_x_end_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_end_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_orientation_v”:”start”,”_offset_y”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_end”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_y_end_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_end_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_z_index”:””,”_z_index_tablet”:””,”_z_index_mobile”:””,”_element_id”:””,”e_display_conditions”:””,”ha_floating_fx”:””,”ha_floating_fx_translate_toggle”:””,”ha_floating_fx_translate_x”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”ha_floating_fx_translate_y”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”ha_floating_fx_translate_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”ha_floating_fx_translate_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_floating_fx_rotate_toggle”:””,”ha_floating_fx_rotate_x”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:45}},”ha_floating_fx_rotate_y”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:45}},”ha_floating_fx_rotate_z”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:45}},”ha_floating_fx_rotate_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”ha_floating_fx_rotate_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_floating_fx_scale_toggle”:””,”ha_floating_fx_scale_x”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”ha_floating_fx_scale_y”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”ha_floating_fx_scale_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”ha_floating_fx_scale_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_element_link”:{“url”:””,”is_external”:””,”nofollow”:””,”custom_attributes”:””},”ha_transform_fx”:””,”ha_transform_fx_translate_toggle”:””,”ha_transform_fx_translate_x”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_toggle”:””,”ha_transform_fx_rotate_mode”:”loose”,”ha_transform_fx_rotate_x”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_toggle”:””,”ha_transform_fx_scale_mode”:”loose”,”ha_transform_fx_scale_x”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_toggle”:””,”ha_transform_fx_skew_x”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_toggle_hover”:””,”ha_transform_fx_translate_x_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_toggle_hover”:””,”ha_transform_fx_rotate_mode_hover”:”loose”,”ha_transform_fx_rotate_x_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_toggle_hover”:””,”ha_transform_fx_scale_mode_hover”:”loose”,”ha_transform_fx_scale_x_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_toggle_hover”:””,”ha_transform_fx_skew_x_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_transition_duration”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_enable”:””,”ha_advanced_tooltip_position”:”top”,”ha_advanced_tooltip_position_tablet”:””,”ha_advanced_tooltip_position_mobile”:””,”ha_advanced_tooltip_animation”:””,”ha_advanced_tooltip_duration”:1000,”ha_advanced_tooltip_arrow”:”true”,”ha_advanced_tooltip_trigger”:”hover”,”ha_advanced_tooltip_distance”:{“unit”:”px”,”size”:”0″,”sizes”:[]},”ha_advanced_tooltip_distance_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_distance_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_align”:”center”,”ha_advanced_tooltip_align_tablet”:””,”ha_advanced_tooltip_align_mobile”:””,”ha_advanced_tooltip_width”:{“unit”:”px”,”size”:”120″,”sizes”:[]},”ha_advanced_tooltip_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_arrow_size”:{“unit”:”px”,”size”:”5″,”sizes”:[]},”ha_advanced_tooltip_arrow_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_arrow_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_typography”:”yes”,”ha_advanced_tooltip_typography_font_family”:”Nunito”,”ha_advanced_tooltip_typography_font_size”:{“unit”:”px”,”size”:”14″,”sizes”:[]},”ha_advanced_tooltip_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_font_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_font_weight”:”500″,”ha_advanced_tooltip_typography_text_transform”:””,”ha_advanced_tooltip_typography_font_style”:””,”ha_advanced_tooltip_typography_text_decoration”:””,”ha_advanced_tooltip_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_background”:””,”ha_advanced_tooltip_title_section_bg_color_color”:””,”ha_advanced_tooltip_title_section_bg_color_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_b”:”#f2295b”,”ha_advanced_tooltip_title_section_bg_color_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_type”:”linear”,”ha_advanced_tooltip_title_section_bg_color_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_position”:”center center”,”ha_advanced_tooltip_title_section_bg_color_image”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_image_tablet”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_image_mobile”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_position”:””,”ha_advanced_tooltip_title_section_bg_color_position_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_position_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_attachment”:””,”ha_advanced_tooltip_title_section_bg_color_repeat”:””,”ha_advanced_tooltip_title_section_bg_color_repeat_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_repeat_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_size”:””,”ha_advanced_tooltip_title_section_bg_color_size_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_size_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_video_link”:””,”ha_advanced_tooltip_title_section_bg_color_video_start”:””,”ha_advanced_tooltip_title_section_bg_color_video_end”:””,”ha_advanced_tooltip_title_section_bg_color_play_once”:””,”ha_advanced_tooltip_title_section_bg_color_play_on_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_privacy_mode”:””,”ha_advanced_tooltip_title_section_bg_color_video_fallback”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_slideshow_gallery”:[],”ha_advanced_tooltip_title_section_bg_color_slideshow_loop”:”yes”,”ha_advanced_tooltip_title_section_bg_color_slideshow_slide_duration”:5000,”ha_advanced_tooltip_title_section_bg_color_slideshow_slide_transition”:”fade”,”ha_advanced_tooltip_title_section_bg_color_slideshow_transition_duration”:500,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_size”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_size_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_size_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_position”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_position_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_position_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_lazyload”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_ken_burns”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_ken_burns_zoom_direction”:”in”,”ha_advanced_tooltip_background_color”:”#000000″,”ha_advanced_tooltip_color”:”#ffffff”,”ha_advanced_tooltip_border_border”:””,”ha_advanced_tooltip_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_color”:””,”ha_advanced_tooltip_border_radius”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_radius_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_radius_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_box_shadow_box_shadow_type”:””,”ha_advanced_tooltip_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”ha_advanced_tooltip_box_shadow_box_shadow_position”:” “,”eael_wrapper_link_switch”:””,”eael_wrapper_link”:{“url”:””,”is_external”:””,”nofollow”:””,”custom_attributes”:””},”eael_wrapper_link_disable_traditional”:””,”eael_hover_effect_switch”:””,”eael_hover_effect_enable_live_changes”:””,”eael_hover_effect_opacity_popover”:””,”eael_hover_effect_opacity”:{“unit”:”px”,”size”:0.8,”sizes”:[]},”eael_hover_effect_filter_popover”:””,”eael_hover_effect_blur_is_on”:””,”eael_hover_effect_blur”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_contrast_is_on”:””,”eael_hover_effect_contrast”:{“unit”:”px”,”size”:80,”sizes”:[]},”eael_hover_effect_grayscale_is_on”:””,”eael_hover_effect_grayscal”:{“unit”:”px”,”size”:40,”sizes”:[]},”eael_hover_effect_invert_is_on”:””,”eael_hover_effect_invert”:{“unit”:”px”,”size”:70,”sizes”:[]},”eael_hover_effect_saturate_is_on”:””,”eael_hover_effect_saturate”:{“unit”:”px”,”size”:50,”sizes”:[]},”eael_hover_effect_sepia_is_on”:””,”eael_hover_effect_sepia”:{“unit”:”px”,”size”:50,”sizes”:[]},”eael_hover_effect_offset_popover”:””,”eael_hover_effect_offset_left”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_offset_left_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_left_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_top”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_offset_top_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_top_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_popover”:””,”eael_hover_effect_rotate_is_on”:””,”eael_hover_effect_transform_rotatex”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_rotatex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatey”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_rotatey_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatey_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatez”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_transform_rotatez_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatez_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_scale_is_on”:””,”eael_hover_effect_transform_scalex”:{“unit”:”px”,”size”:0.9,”sizes”:[]},”eael_hover_effect_transform_scalex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_scalex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_scaley”:{“unit”:”px”,”size”:0.9,”sizes”:[]},”eael_hover_effect_transform_scaley_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_scaley_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_skew_is_on”:””,”eael_hover_effect_transform_skewx”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_transform_skewx_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_skewx_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_skewy”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_transform_skewy_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_skewy_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”eael_hover_effect_general_settings_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_easing”:”ease”,”eael_hover_effect_opacity_popover_hover”:””,”eael_hover_effect_opacity_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_filter_hover_popover”:””,”eael_hover_effect_blur_hover_is_on”:””,”eael_hover_effect_blur_hover”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_contrast_hover_is_on”:””,”eael_hover_effect_contrast_hover”:{“unit”:”%”,”size”:100,”sizes”:[]},”eael_hover_effect_grayscale_hover_is_on”:””,”eael_hover_effect_grayscal_hover”:{“unit”:”%”,”size”:0,”sizes”:[]},”eael_hover_effect_invert_hover_is_on”:””,”eael_hover_effect_invert_hover”:{“unit”:”%”,”size”:0,”sizes”:[]},”eael_hover_effect_saturate_hover_is_on”:””,”eael_hover_effect_saturate_hover”:{“unit”:”%”,”size”:100,”sizes”:[]},”eael_hover_effect_sepia_hover_is_on”:””,”eael_hover_effect_sepia_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_offset_hover_popover”:””,”eael_hover_effect_offset_hover_left”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_offset_hover_left_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_hover_left_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_hover_top”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_offset_hover_top_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_hover_top_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_popover”:””,”eael_hover_effect_rotate_hover_is_on”:””,”eael_hover_effect_transform_hover_rotatex”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_rotatex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatey”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_rotatey_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatey_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatez”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_rotatez_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatez_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_scale_hover_is_on”:””,”eael_hover_effect_transform_hover_scalex”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_transform_hover_scalex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_scalex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_scaley”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_scaley_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_scaley_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_skew_hover_is_on”:””,”eael_hover_effect_transform_hover_skewx”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_skewx_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_skewx_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_skewy”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_skewy_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_skewy_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_hover_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”eael_hover_effect_general_settings_hover_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_hover_easing”:”ease”,”eael_hover_effect_hover_tilt”:””,”pa_display_conditions_switcher”:””,”pa_display_action”:”show”,”pa_display_when”:”any”,”premium_fe_switcher”:””,”premium_fe_target”:””,”premium_fe_translate_switcher”:””,”premium_fe_Xtranslate”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”premium_fe_Xtranslate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xtranslate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Ytranslate”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”premium_fe_Ytranslate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Ytranslate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_trans_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_trans_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_rotate_switcher”:””,”premium_fe_Xrotate”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:45}},”premium_fe_Xrotate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xrotate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yrotate”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:45}},”premium_fe_Yrotate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yrotate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Zrotate”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:45}},”premium_fe_Zrotate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Zrotate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_rotate_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_rotate_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_scale_switcher”:””,”premium_fe_Xscale”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”premium_fe_Xscale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xscale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yscale”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”premium_fe_Yscale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yscale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_scale_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_scale_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_skew_switcher”:””,”premium_fe_Xskew”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:20}},”premium_fe_Xskew_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xskew_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yskew”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:20}},”premium_fe_Yskew_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yskew_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_skew_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_skew_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_opacity_switcher”:””,”premium_fe_bg_color_switcher”:””,”premium_fe_blur_switcher”:””,”premium_fe_contrast_switcher”:””,”premium_fe_gScale_switcher”:””,”premium_fe_hue_switcher”:””,”premium_fe_brightness_switcher”:””,”premium_fe_saturate_switcher”:””,”premium_fe_direction”:”alternate”,”premium_fe_loop”:”default”,”premium_fe_loop_number”:3,”premium_fe_easing”:”easeInOutSine”,”premium_fe_ease_step”:5,”premium_fe_disable_safari”:””,”premium_tooltip_switcher”:””,”pa_tooltip_target”:””,”premium_tooltip_type”:”text”,”premium_tooltip_icon_switcher”:””,”premium_tooltip_icon”:{“value”:”fas fa-star”,”library”:”fa-solid”},”premium_tooltip_lottie_url”:””,”premium_tooltip_lottie_loop”:”true”,”premium_tooltip_lottie_reverse”:””,”hide_tooltip_on”:[],”premium_tooltip_text_color”:””,”premium_tooltip_text_typo_typography”:””,”premium_tooltip_text_typo_font_family”:””,”premium_tooltip_text_typo_font_size”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_font_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_font_weight”:””,”premium_tooltip_text_typo_text_transform”:””,”premium_tooltip_text_typo_font_style”:””,”premium_tooltip_text_typo_text_decoration”:””,”premium_tooltip_text_typo_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_shadow_text_shadow_type”:””,”premium_tooltip_text_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”premium_tooltip_icon_color”:””,”premium_tooltip_icon_size”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_icon_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_icon_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_icon_shadow_text_shadow_type”:””,”premium_tooltip_icon_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”premium_tooltip_img_size”:{“unit”:”px”,”size”:100,”sizes”:[]},”premium_tooltip_img_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_img_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_img_fit”:”cover”,”premium_tooltip_img_fit_tablet”:””,”premium_tooltip_img_fit_mobile”:””,”premium_tooltip_container_bg_background”:””,”premium_tooltip_container_bg_color”:””,”premium_tooltip_container_bg_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_color_b”:”#f2295b”,”premium_tooltip_container_bg_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”premium_tooltip_container_bg_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_gradient_type”:”linear”,”premium_tooltip_container_bg_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”premium_tooltip_container_bg_gradient_position”:”center center”,”premium_tooltip_container_bg_image”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_image_tablet”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_image_mobile”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_position”:””,”premium_tooltip_container_bg_position_tablet”:””,”premium_tooltip_container_bg_position_mobile”:””,”premium_tooltip_container_bg_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_attachment”:””,”premium_tooltip_container_bg_repeat”:””,”premium_tooltip_container_bg_repeat_tablet”:””,”premium_tooltip_container_bg_repeat_mobile”:””,”premium_tooltip_container_bg_size”:””,”premium_tooltip_container_bg_size_tablet”:””,”premium_tooltip_container_bg_size_mobile”:””,”premium_tooltip_container_bg_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”premium_tooltip_container_bg_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_video_link”:””,”premium_tooltip_container_bg_video_start”:””,”premium_tooltip_container_bg_video_end”:””,”premium_tooltip_container_bg_play_once”:””,”premium_tooltip_container_bg_play_on_mobile”:””,”premium_tooltip_container_bg_privacy_mode”:””,”premium_tooltip_container_bg_video_fallback”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_slideshow_gallery”:[],”premium_tooltip_container_bg_slideshow_loop”:”yes”,”premium_tooltip_container_bg_slideshow_slide_duration”:5000,”premium_tooltip_container_bg_slideshow_slide_transition”:”fade”,”premium_tooltip_container_bg_slideshow_transition_duration”:500,”premium_tooltip_container_bg_slideshow_background_size”:””,”premium_tooltip_container_bg_slideshow_background_size_tablet”:””,”premium_tooltip_container_bg_slideshow_background_size_mobile”:””,”premium_tooltip_container_bg_slideshow_background_position”:””,”premium_tooltip_container_bg_slideshow_background_position_tablet”:””,”premium_tooltip_container_bg_slideshow_background_position_mobile”:””,”premium_tooltip_container_bg_slideshow_lazyload”:””,”premium_tooltip_container_bg_slideshow_ken_burns”:””,”premium_tooltip_container_bg_slideshow_ken_burns_zoom_direction”:”in”,”premium_tooltip_container_border_border”:””,”premium_tooltip_container_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_border_color”:””,”premium_tooltip_container_border_radius”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_container_box_shadow_box_shadow_type”:””,”premium_tooltip_container_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”premium_tooltip_container_box_shadow_box_shadow_position”:” “,”premium_tooltip_container_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_arrow_color”:””,”premium_tooltip_mouse_follow”:””,”premium_tooltip_interactive”:”yes”,”premium_tooltip_arrow”:””,”premium_tooltip_trigger”:”hover”,”premium_tooltip_distance_position”:6,”premium_tooltip_min_width”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_min_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_min_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_max_width”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_max_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_max_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_height_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_height_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_anime”:”fade”,”premium_tooltip_anime_dur”:350,”premium_tooltip_delay”:10,”pa_tooltip_zindex”:””,”premium_wrapper_link_switcher”:””,”premium_wrapper_link_selection”:”url”,”premium_wrapper_link”:{“url”:””,”is_external”:””,”nofollow”:””,”custom_attributes”:””},”premium_wrapper_existing_link”:””,”motion_fx_motion_fx_scrolling”:””,”motion_fx_translateY_effect”:””,”motion_fx_translateY_direction”:””,”motion_fx_translateY_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_translateY_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_translateX_effect”:””,”motion_fx_translateX_direction”:””,”motion_fx_translateX_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_translateX_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_opacity_effect”:””,”motion_fx_opacity_direction”:”out-in”,”motion_fx_opacity_level”:{“unit”:”px”,”size”:10,”sizes”:[]},”motion_fx_opacity_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_blur_effect”:””,”motion_fx_blur_direction”:”out-in”,”motion_fx_blur_level”:{“unit”:”px”,”size”:7,”sizes”:[]},”motion_fx_blur_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_rotateZ_effect”:””,”motion_fx_rotateZ_direction”:””,”motion_fx_rotateZ_speed”:{“unit”:”px”,”size”:1,”sizes”:[]},”motion_fx_rotateZ_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_scale_effect”:””,”motion_fx_scale_direction”:”out-in”,”motion_fx_scale_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_scale_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_transform_origin_x”:”center”,”motion_fx_transform_origin_y”:”center”,”motion_fx_devices”:[“desktop”,”tablet”,”mobile”],”motion_fx_range”:””,”motion_fx_motion_fx_mouse”:””,”motion_fx_mouseTrack_effect”:””,”motion_fx_mouseTrack_direction”:””,”motion_fx_mouseTrack_speed”:{“unit”:”px”,”size”:1,”sizes”:[]},”motion_fx_tilt_effect”:””,”motion_fx_tilt_direction”:””,”motion_fx_tilt_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”sticky”:””,”sticky_on”:[“desktop”,”tablet”,”mobile”],”sticky_offset”:0,”sticky_offset_tablet”:””,”sticky_offset_mobile”:””,”sticky_effects_offset”:0,”sticky_effects_offset_tablet”:””,”sticky_effects_offset_mobile”:””,”sticky_parent”:””,”_animation”:””,”_animation_tablet”:””,”_animation_mobile”:””,”animation_duration”:””,”_animation_delay”:””,”_transform_rotate_popover”:””,”_transform_rotateZ_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotate_3d”:””,”_transform_rotateX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_perspective_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translate_popover”:””,”_transform_translateX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_popover”:””,”_transform_keep_proportions”:”yes”,”_transform_scale_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skew_popover”:””,”_transform_skewX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewX_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewX_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewY_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_flipX_effect”:””,”_transform_flipY_effect”:””,”_transform_rotate_popover_hover”:””,”_transform_rotateZ_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotate_3d_hover”:””,”_transform_rotateX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translate_popover_hover”:””,”_transform_translateX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_popover_hover”:””,”_transform_keep_proportions_hover”:”yes”,”_transform_scale_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skew_popover_hover”:””,”_transform_skewX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewX_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewX_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_flipX_effect_hover”:””,”_transform_flipY_effect_hover”:””,”_transform_transition_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”motion_fx_transform_x_anchor_point”:””,”motion_fx_transform_x_anchor_point_tablet”:””,”motion_fx_transform_x_anchor_point_mobile”:””,”motion_fx_transform_y_anchor_point”:””,”motion_fx_transform_y_anchor_point_tablet”:””,”motion_fx_transform_y_anchor_point_mobile”:””,”_background_background”:””,”_background_color”:””,”_background_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_background_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_color_b”:”#f2295b”,”_background_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_gradient_type”:”linear”,”_background_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_background_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_gradient_position”:”center center”,”_background_image”:{“url”:””,”id”:””,”size”:””},”_background_image_tablet”:{“url”:””,”id”:””,”size”:””},”_background_image_mobile”:{“url”:””,”id”:””,”size”:””},”_background_position”:””,”_background_position_tablet”:””,”_background_position_mobile”:””,”_background_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_attachment”:””,”_background_repeat”:””,”_background_repeat_tablet”:””,”_background_repeat_mobile”:””,”_background_size”:””,”_background_size_tablet”:””,”_background_size_mobile”:””,”_background_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_video_link”:””,”_background_video_start”:””,”_background_video_end”:””,”_background_play_once”:””,”_background_play_on_mobile”:””,”_background_privacy_mode”:””,”_background_video_fallback”:{“url”:””,”id”:””,”size”:””},”_background_slideshow_gallery”:[],”_background_slideshow_loop”:”yes”,”_background_slideshow_slide_duration”:5000,”_background_slideshow_slide_transition”:”fade”,”_background_slideshow_transition_duration”:500,”_background_slideshow_background_size”:””,”_background_slideshow_background_size_tablet”:””,”_background_slideshow_background_size_mobile”:””,”_background_slideshow_background_position”:””,”_background_slideshow_background_position_tablet”:””,”_background_slideshow_background_position_mobile”:””,”_background_slideshow_lazyload”:””,”_background_slideshow_ken_burns”:””,”_background_slideshow_ken_burns_zoom_direction”:”in”,”_background_hover_background”:””,”_background_hover_color”:””,”_background_hover_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_background_hover_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_color_b”:”#f2295b”,”_background_hover_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_hover_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_gradient_type”:”linear”,”_background_hover_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_background_hover_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_hover_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_hover_gradient_position”:”center center”,”_background_hover_image”:{“url”:””,”id”:””,”size”:””},”_background_hover_image_tablet”:{“url”:””,”id”:””,”size”:””},”_background_hover_image_mobile”:{“url”:””,”id”:””,”size”:””},”_background_hover_position”:””,”_background_hover_position_tablet”:””,”_background_hover_position_mobile”:””,”_background_hover_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_attachment”:””,”_background_hover_repeat”:””,”_background_hover_repeat_tablet”:””,”_background_hover_repeat_mobile”:””,”_background_hover_size”:””,”_background_hover_size_tablet”:””,”_background_hover_size_mobile”:””,”_background_hover_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_hover_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_hover_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_hover_video_link”:””,”_background_hover_video_start”:””,”_background_hover_video_end”:””,”_background_hover_play_once”:””,”_background_hover_play_on_mobile”:””,”_background_hover_privacy_mode”:””,”_background_hover_video_fallback”:{“url”:””,”id”:””,”size”:””},”_background_hover_slideshow_gallery”:[],”_background_hover_slideshow_loop”:”yes”,”_background_hover_slideshow_slide_duration”:5000,”_background_hover_slideshow_slide_transition”:”fade”,”_background_hover_slideshow_transition_duration”:500,”_background_hover_slideshow_background_size”:””,”_background_hover_slideshow_background_size_tablet”:””,”_background_hover_slideshow_background_size_mobile”:””,”_background_hover_slideshow_background_position”:””,”_background_hover_slideshow_background_position_tablet”:””,”_background_hover_slideshow_background_position_mobile”:””,”_background_hover_slideshow_lazyload”:””,”_background_hover_slideshow_ken_burns”:””,”_background_hover_slideshow_ken_burns_zoom_direction”:”in”,”_background_hover_transition”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_cls_added”:”overlay”,”_ha_background_overlay_background”:””,”_ha_background_overlay_color”:””,”_ha_background_overlay_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_ha_background_overlay_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_color_b”:”#f2295b”,”_ha_background_overlay_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_gradient_type”:”linear”,”_ha_background_overlay_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_ha_background_overlay_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_gradient_position”:”center center”,”_ha_background_overlay_image”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_image_tablet”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_image_mobile”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_position”:””,”_ha_background_overlay_position_tablet”:””,”_ha_background_overlay_position_mobile”:””,”_ha_background_overlay_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_attachment”:””,”_ha_background_overlay_repeat”:””,”_ha_background_overlay_repeat_tablet”:””,”_ha_background_overlay_repeat_mobile”:””,”_ha_background_overlay_size”:””,”_ha_background_overlay_size_tablet”:””,”_ha_background_overlay_size_mobile”:””,”_ha_background_overlay_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_video_link”:””,”_ha_background_overlay_video_start”:””,”_ha_background_overlay_video_end”:””,”_ha_background_overlay_play_once”:””,”_ha_background_overlay_play_on_mobile”:””,”_ha_background_overlay_privacy_mode”:””,”_ha_background_overlay_video_fallback”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_slideshow_gallery”:[],”_ha_background_overlay_slideshow_loop”:”yes”,”_ha_background_overlay_slideshow_slide_duration”:5000,”_ha_background_overlay_slideshow_slide_transition”:”fade”,”_ha_background_overlay_slideshow_transition_duration”:500,”_ha_background_overlay_slideshow_background_size”:””,”_ha_background_overlay_slideshow_background_size_tablet”:””,”_ha_background_overlay_slideshow_background_size_mobile”:””,”_ha_background_overlay_slideshow_background_position”:””,”_ha_background_overlay_slideshow_background_position_tablet”:””,”_ha_background_overlay_slideshow_background_position_mobile”:””,”_ha_background_overlay_slideshow_lazyload”:””,”_ha_background_overlay_slideshow_ken_burns”:””,”_ha_background_overlay_slideshow_ken_burns_zoom_direction”:”in”,”_ha_background_overlay_opacity”:{“unit”:”px”,”size”:0.5,”sizes”:[]},”_ha_css_filters_css_filter”:””,”_ha_css_filters_blur”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_css_filters_brightness”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_contrast”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_saturate”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hue”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_overlay_blend_mode”:””,”_ha_background_overlay_hover_background”:””,”_ha_background_overlay_hover_color”:””,”_ha_background_overlay_hover_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_color_b”:”#f2295b”,”_ha_background_overlay_hover_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_hover_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_gradient_type”:”linear”,”_ha_background_overlay_hover_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_ha_background_overlay_hover_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_gradient_position”:”center center”,”_ha_background_overlay_hover_image”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_image_tablet”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_image_mobile”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_position”:””,”_ha_background_overlay_hover_position_tablet”:””,”_ha_background_overlay_hover_position_mobile”:””,”_ha_background_overlay_hover_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_attachment”:””,”_ha_background_overlay_hover_repeat”:””,”_ha_background_overlay_hover_repeat_tablet”:””,”_ha_background_overlay_hover_repeat_mobile”:””,”_ha_background_overlay_hover_size”:””,”_ha_background_overlay_hover_size_tablet”:””,”_ha_background_overlay_hover_size_mobile”:””,”_ha_background_overlay_hover_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_hover_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_video_link”:””,”_ha_background_overlay_hover_video_start”:””,”_ha_background_overlay_hover_video_end”:””,”_ha_background_overlay_hover_play_once”:””,”_ha_background_overlay_hover_play_on_mobile”:””,”_ha_background_overlay_hover_privacy_mode”:””,”_ha_background_overlay_hover_video_fallback”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_slideshow_gallery”:[],”_ha_background_overlay_hover_slideshow_loop”:”yes”,”_ha_background_overlay_hover_slideshow_slide_duration”:5000,”_ha_background_overlay_hover_slideshow_slide_transition”:”fade”,”_ha_background_overlay_hover_slideshow_transition_duration”:500,”_ha_background_overlay_hover_slideshow_background_size”:””,”_ha_background_overlay_hover_slideshow_background_size_tablet”:””,”_ha_background_overlay_hover_slideshow_background_size_mobile”:””,”_ha_background_overlay_hover_slideshow_background_position”:””,”_ha_background_overlay_hover_slideshow_background_position_tablet”:””,”_ha_background_overlay_hover_slideshow_background_position_mobile”:””,”_ha_background_overlay_hover_slideshow_lazyload”:””,”_ha_background_overlay_hover_slideshow_ken_burns”:””,”_ha_background_overlay_hover_slideshow_ken_burns_zoom_direction”:”in”,”_ha_background_overlay_hover_opacity”:{“unit”:”px”,”size”:0.5,”sizes”:[]},”_ha_css_filters_hover_css_filter”:””,”_ha_css_filters_hover_blur”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_css_filters_hover_brightness”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hover_contrast”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hover_saturate”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hover_hue”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_transition”:{“unit”:”px”,”size”:0.3,”sizes”:[]},”_border_border”:””,”_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_color”:””,”_border_radius”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_box_shadow_box_shadow_type”:””,”_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”_box_shadow_box_shadow_position”:” “,”_border_hover_border”:””,”_border_hover_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_color”:””,”_border_radius_hover”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_hover_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_hover_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_box_shadow_hover_box_shadow_type”:””,”_box_shadow_hover_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”_box_shadow_hover_box_shadow_position”:” “,”_border_hover_transition”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_switch”:””,”_mask_shape”:”circle”,”_mask_image”:{“url”:””,”id”:””,”size”:””},”_mask_notice”:””,”_mask_size”:”contain”,”_mask_size_tablet”:””,”_mask_size_mobile”:””,”_mask_size_scale”:{“unit”:”%”,”size”:100,”sizes”:[]},”_mask_size_scale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_size_scale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position”:”center center”,”_mask_position_tablet”:””,”_mask_position_mobile”:””,”_mask_position_x”:{“unit”:”%”,”size”:0,”sizes”:[]},”_mask_position_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_y”:{“unit”:”%”,”size”:0,”sizes”:[]},”_mask_position_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_repeat”:”no-repeat”,”_mask_repeat_tablet”:””,”_mask_repeat_mobile”:””,”hide_desktop”:””,”hide_tablet”:””,”hide_mobile”:””,”_attributes”:””,”custom_css”:””},”defaultEditSettings”:{“defaultEditRoute”:”content”},”elements”:[],”widgetType”:”toggle”,”htmlCache”:”\t\t<div class=\”elementor-widget-container\”>\n\t\t\t\t\t<div class=\”elementor-toggle\”>\n\t\t\t\t\t\t\t<div class=\”elementor-toggle-item\”>\n\t\t\t\t\t<div id=\”elementor-tab-title-4221\” class=\”elementor-tab-title\” data-tab=\”1\” role=\”button\” aria-controls=\”elementor-tab-content-4221\” aria-expanded=\”false\”>\n\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon elementor-toggle-icon-right\” aria-hidden=\”true\”>\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-closed\”><i class=\”fas fa-arrow-down\”></i></span>\n\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-opened\”><i class=\”elementor-toggle-icon-opened fas fa-arrow-up\”></i></span>\n\t\t\t\t\t\t\t\t\t\t\t\t\t</span>\n\t\t\t\t\t\t\t\t\t\t\t\t<a class=\”elementor-toggle-title\” tabindex=\”0\”>Why should I opt for a hard money loan in Orlando, FL?</a>\n\t\t\t\t\t</div>\n\n\t\t\t\t\t<div id=\”elementor-tab-content-4221\” class=\”elementor-tab-content elementor-clearfix elementor-inline-editing\” data-tab=\”1\” role=\”region\” aria-labelledby=\”elementor-tab-title-4221\” data-elementor-setting-key=\”tabs.0.tab_content\” data-elementor-inline-editing-toolbar=\”advanced\”><p>A hard money loan is the perfect financing option because it offers multiple benefits like quick approvals, low interest rates, minimal requirements and much more. If you want to learn more about our hard money loan deals, we recommend <a href=\”https://insulacapitalgroup.com/just-funded-projects/\”><u>visiting our just-funded project section</u></a>. </p></div>\n\t\t\t\t</div>\n\t\t\t\t\t\t\t<div class=\”elementor-toggle-item\”>\n\t\t\t\t\t<div id=\”elementor-tab-title-4222\” class=\”elementor-tab-title\” data-tab=\”2\” role=\”button\” aria-controls=\”elementor-tab-content-4222\” aria-expanded=\”false\”>\n\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon elementor-toggle-icon-right\” aria-hidden=\”true\”>\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-closed\”><i class=\”fas fa-arrow-down\”></i></span>\n\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-opened\”><i class=\”elementor-toggle-icon-opened fas fa-arrow-up\”></i></span>\n\t\t\t\t\t\t\t\t\t\t\t\t\t</span>\n\t\t\t\t\t\t\t\t\t\t\t\t<a class=\”elementor-toggle-title\” tabindex=\”0\”> Where can I use a hard money loan in Orlando, FL?</a>\n\t\t\t\t\t</div>\n\n\t\t\t\t\t<div id=\”elementor-tab-content-4222\” class=\”elementor-tab-content elementor-clearfix elementor-inline-editing\” data-tab=\”2\” role=\”region\” aria-labelledby=\”elementor-tab-title-4222\” data-elementor-setting-key=\”tabs.1.tab_content\” data-elementor-inline-editing-toolbar=\”advanced\”><p>You can use our hard money loans to finance a wide range of real estate projects. We offer specific loan programs like <a href=\”https://insulacapitalgroup.com/fix-flip-financing/\”><u>fix and flip loans</u></a>, <a href=\”https://insulacapitalgroup.com/residential-rental-program/\”><u>residential rental programs</u></a>, <a href=\”https://insulacapitalgroup.com/multifamily-mixed-use/\”><u>multifamily mixed-use loans</u></a>, and <a href=\”https://insulacapitalgroup.com/loans/new-construction/\”><u>new construction loans</u></a> to help you complete your real estate ventures without any financial hassle.</p></div>\n\t\t\t\t</div>\n\t\t\t\t\t\t\t<div class=\”elementor-toggle-item\”>\n\t\t\t\t\t<div id=\”elementor-tab-title-4223\” class=\”elementor-tab-title\” data-tab=\”3\” role=\”button\” aria-controls=\”elementor-tab-content-4223\” aria-expanded=\”false\”>\n\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon elementor-toggle-icon-right\” aria-hidden=\”true\”>\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-closed\”><i class=\”fas fa-arrow-down\”></i></span>\n\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-opened\”><i class=\”elementor-toggle-icon-opened fas fa-arrow-up\”></i></span>\n\t\t\t\t\t\t\t\t\t\t\t\t\t</span>\n\t\t\t\t\t\t\t\t\t\t\t\t<a class=\”elementor-toggle-title\” tabindex=\”0\”>How to start the hard money loan application in Orlando, FL?</a>\n\t\t\t\t\t</div>\n\n\t\t\t\t\t<div id=\”elementor-tab-content-4223\” class=\”elementor-tab-content elementor-clearfix elementor-inline-editing\” data-tab=\”3\” role=\”region\” aria-labelledby=\”elementor-tab-title-4223\” data-elementor-setting-key=\”tabs.2.tab_content\” data-elementor-inline-editing-toolbar=\”advanced\”><p>You can start the loan application by filling out our <a href=\”https://insulacapitalgroup.com/full-application/\”><u>online full application form</u></a> and submitting the required documents.</p></div>\n\t\t\t\t</div>\n\t\t\t\t\t\t\t\t</div>\n\t\t\t\t</div>\n\t\t”,”editSettings”:{“defaultEditRoute”:”content”,”panel”:{“activeTab”:”content”,”activeSection”:”section_toggle”},”activeItemIndex”:1}}]}If you’re applying for a hard money loan with us at Insula Capital Group, you’ll find the process quite simple. All you really need to do is fill out the online applications.

You’ll find multiple forms on our website; these include quick applications, full applications, and prequalification forms. Fill out one that fits your requirements and submit the required documents. Once we’ve reviewed your application, we’ll get back to you with other details.

Top Hard Money Lenders Loan Cities in Alabama

Let’s Partner Up!

At Insula Capital Group, we strive to make investments easier for our clients. As the leading hard money lending company in the region, we want to give seasoned and rookie investors their best shot when it comes to investments in Alabama.

Whether it’s guidance you need or encouragement to take that first step, feel free to contact the best private money lenders in Alabama today!