Private Money Lenders | Hard Money Loans in Colorado

Colorado offers an unparalleled quality of life thanks to its natural beauty, strong economy, and amazing employment opportunities. Its vibrant community and its innovative streak make the state both exciting and promising.

But what really attracts private money lenders like us to Colorado is its real estate market which is known for its consistent appreciation, making it a very attractive option for investors that are looking for long-term returns.

If that’s something that interests you as an investor, check out our loan programs and just-funded projects to get inspired!

Get in Touch

Diversify Your Investment Portfolio with The Best Hard Money Lenders in Colorado

As one of the best private money lenders in Colorado, Insula Capital Group is committed to excellence in helping real estate investors and their success. We offer unmatched financing plans to help you reach your investment goals with minimal hassle.

We use our 30 years of experience and incomparable expertise to come up with tailored loan options that meet your unique requirements as an investor. With our streamlined application processes and easy-to-meet requirements, our hard money loans will be your best investment decision.

Complete Your Real Estate Projects With Hard Money Loans In Colorado

Struggling to get adequate financing for your real estate projects? Using hard money loans can be an excellent idea. This financing method is gaining popularity because of its speed of approval, as hard money lenders prioritize the collateral’s value rather than an extensive review of the borrower’s credit history. It makes them ideal for real estate investors looking to close deals without any delay.

Hard money loans provide greater flexibility in terms of repayment structures, enabling borrowers to customize agreements to their specific needs. Conventional lenders have strict criteria and lengthy approval processes, but hard money lenders focus on the property’s potential to offer viable lending terms.

Find Out More About Colorado’s Real Estate Market

Looking to purchase real estate properties in Colorado? Here are some exciting statistics that’ll help you make an informed decision:

- Population: 5.849 million

- GDP: $371.3 billion

- Average employment growth:1.4%

- Unemployment rate: 3.5%

- Median income: $44,818

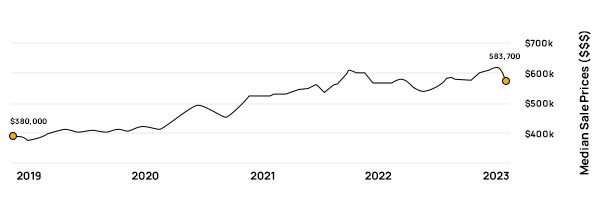

- Median sale price: $583,700

- Number of homes for sale: 25,360

- Average home prices: $611,000

- Average rent prices: $2000 in Denver and $1576 in Colorado Springs

- House foreclosure rate: 1/1073

- 1-year appreciation rate: +19.1%

The Real Estate Market In Colorado.

25,360

Number Of Homes For Sale

$611,000

Average Home Prices

$583,700

Median Sale Prices

1/1073

House Foreclosure Rate

5.849 million

Population

+19.1%

1-Year Appreciation Rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Should You Invest In Colorado’s Real Estate Market

Thinking about investing in Colorado’s real estate market? You’re making the right decision! Colorado’s real estate market is thriving, which makes it a dynamic and attractive investment option. With a booming tech sector, numerous outdoor recreational opportunities, and a high quality of life, Colorado consistently attracts new residents. The influx of people increases demand for housing across the state, from trendy urban apartments to small houses. As demand for property rises, it can drive up prices, providing a golden opportunity for you to invest in the market and earn hefty profits.

The accessibility to world-class skiing, hiking, and other recreational activities makes Colorado the perfect destination for those looking to enjoy an active lifestyle. It has increased demand for vacation homes and investment properties in towns across the state.

The business-friendly policies in Colorado contribute to a favorable economic climate, which attracts businesses and investors from across the US. The state’s economic prosperity enhances real estate development and offers investment opportunities.

Ready to apply for a hard money loan?

Frequently Asked Questions

As the best hard money lenders in Colorado, we offer a wide range of loan programs for real estate investors. These include new construction loans, fix and flip loans, bridge loans for multifamily mixed-use properties, and residential rental loans. You can explore the loan programs and pick the one that works best for your project’s scope.

Hard money lenders operate very differently from traditional banks and other lending institutions; therefore, they don’t have the same eligibility criteria either. When you apply for a hard money loan at Insula Capital Group, you don’t necessarily need a very high credit score as long as your equity and property value is enough to secure the loan.

As one of the nation’s top private money lenders, we strive to offer our services in as many major cities as possible. In Colorado, our financial services are available in the following cities:

Colorado Springs, CO Denver, CO Fort Collins, CO Aurora, CO Lakewood, CO

If you’re looking for a reliable hard money lender in a Colorado city not listed above, feel free to reach out to us for more information.

Top Hard Money Lenders Loan Cities in Colorado

Join Hands With A Reputable Hard Money Lender In Colorado

If you need excellent financial support in Colorado, consider connecting with Insula Capital Group. We redefine hard money financing with tailor-made solutions that cater to your unique needs.

Whether you’re a real estate investor or business owner, our expert team is committed to providing flexible funding to enhance your projects. Our streamlined application process ensures quick approvals, and our competitive rates set us apart in the industry. We can be your strategic partner for seizing opportunities in the real estate market and turning your visions into reality.

Get in touch with us for more details.