Private Money Lenders | Hard Money Loans in Delaware

As the United States “first state,” Delaware offers a unique blend of culture, history, natural beauty, and small-town feels. But those aren’t the only reasons drawing people from across the country—it’s the business opportunities the state offers.

With incredible tax advantages and a thriving economy, Delaware is an excellent place to invest. As the most trusted private money lenders in Delaware, we encourage real estate investors to make the most of the state’s amazing investment opportunities.

Get in Touch

Make The Most of Your Real Estate Investments with Delaware’s Best Hard Money Lenders

When it comes to maximizing your real estate investments in Delaware, trust Insula Capital Group as your premier hard money lender. With our extensive experience and deep understanding of the Delaware market, we provide tailored loan solutions that align with your investment goals.

Our team at Insula Capital Group offers a wide range of hard money lending programs, including fix and flip loans, new construction loans, and bridge financing. We prioritize quick approvals, competitive rates, and personalized guidance throughout lending.

You can check out our just-funded projects for better insights about our loans, and then we can start discussing your next project!

The Significance Of Hard Money Loans In Delaware

Hard money loans offer quick approvals so you can capitalize on time-sensitive opportunities in the real estate market. With private lenders, you can forget about the lengthy processes since they don’t take much time to process your application and provide loan approval in no time.

Hard money financing is a perfect option for real estate investors and entrepreneurs with unique projects. Unlike traditional lenders, hard money lenders focus on the value of your assets, which can help you access loans with excellent terms.

Whether you’re a seasoned investor or a startup owner, the ability to secure quick, flexible, and collateral-based financing makes hard money loans an exceptional choice for turning your real estate dreams into reality.

Delaware’s Real Estate Landscape

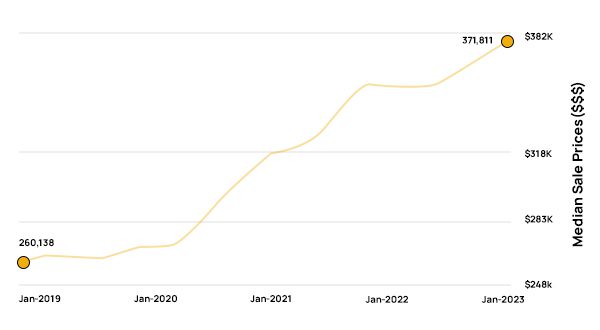

Understanding the real estate market before purchasing any property is crucial for every investor. Have a look at some statistics from the Delaware real estate market to make a smart decision:

- Median Home Value: $317,985

- 1-Year Appreciation Rate: +16.5%

- Median Sales Price: $326,500

- Median Rent Price: $1,634

- Price-To-Rent Ratio: 21

- Unemployment Rate: 4%

- Population: 973,764

- Median Household Income: $68,287

- Property Value Increase: 13% in the last 5 years

- Average Home Price: $339,000

The Real Estate Market In Delaware

16.21

Price-To-Rent Ratio

$339,000

Average Home Prices

$326,500

Median Sale Prices

973,764

Population

39.13%

Property Value Increase In The Last Five Years

+16.5%

1-Year Appreciation Rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Start Your Real Estate Projects In Delaware!

Delaware’s proximity to key economic hubs enhances Delaware’s appeal as a residential and commercial destination. The economic prospects increase real estate prices across the state and offer a lucrative investment opportunity.

One significant factor fueling Delaware’s real estate market is its excellent tax structure. The relatively low property taxes make the state an attractive option for those seeking financial benefits in their real estate transactions.

Delaware’s coastal charm and diverse geography also play a crucial role in boosting real estate demand. The state has an excellent market for holiday homes and luxurious properties.

Delaware has a business-friendly environment, which attracts entrepreneurs and skilled labor from across the US. The inflow of companies and high-skilled workers increases demand for residential and commercial real estate in the state.

Ready to apply for a hard money loan?

Frequently Asked Questions

As one of the most well-known private money lenders in Delaware, we offer a diverse range of loan programs that are tailored to each real estate investor’s unique needs. Our programs include fix and flip loans, bridge loans for mixed-use complexes, residential rentals, and new construction loans. You can explore all our loan programs and find one that aligns with your project’s requirements.

Securing hard money loans with Insula Capital Group is different from traditional lending institutions. We have unique eligibility criteria that prioritize property value and equity over credit score. While a high credit score isn’t mandatory, your loan approval relies on the property’s value and collateral.

Insula Capital Group aims to provide exceptional financial services in all major cities across the state. Some of the top cities we’re serving at the moment include:

Brandywine, DE Wilmington, DE Dover, DE Newark, DE Middletown, DE

If your city isn’t listed above, feel free to contact us and discuss things further with our team in Delaware—we’re happy to help!

Top Hard Money Lenders Loan Cities in Delaware

Finance Your Real Estate Projects By Joining Hands With Us

Looking to kickstart your real estate projects? Get adequate financing from Insula Capital Group. We provide unique financial solutions to help our clients in Delaware. From real estate investors to property developers, we cater to a wide range of clients.

Our quick and flexible lending process can help you complete your real estate ventures without any hassle. We’ve got a streamlined application process, and our team offers competitive rates. We can become your strategic financial partner that can help you navigate financial problems with ease. Our team can examine your financial situation and provide a hard money loan according to your requirements. With no pre-payment penalties and extra fees, our loans are an excellent option for individuals who are struggling to buy a property.

Reach out to our team for more details.