Private Money Lenders | Hard Money Loans in Indiana

Indiana is a remarkable state, and it’s definitely worth living and investing in. With its affordable cost of living, residents can enjoy a high quality of life without breaking the bank.

The state’s economy, driven by sectors such as manufacturing, healthcare, and agriculture, also presents lucrative investment opportunities. The state also offers diverse and vibrant communities, rich cultural heritage, and recreational amenities that contribute to a fulfilling lifestyle. So, whether you’re seeking a stable investment environment or a welcoming place to call home, Indiana has much to offer.

As the most reliable private money lender operating in Indiana, we urge you to explore its investment opportunities with us.

Check out our loan programs and just-funded projects for better insights.

Get in Touch

Let The Best Private Money Lenders in Indiana Set You Up For Success!

Insula Capital Group stands as a reliable hard money lender in Indiana, committed to assisting investors in achieving success in their real estate ventures.

With over 30 years of experience and our in-depth industry knowledge and expertise, we provide tailored financing solutions designed to meet the specific requirements of each investor. We prioritize prompt funding and efficient approval processes, recognizing the significance of seizing timely opportunities.

Our competitive loan terms and individualized approach distinguish us, empowering investors to optimize returns and navigate the intricacies of real estate investments with confidence. With us on board, you can unlock the true potential of your Indiana real estate investments!

Why Apply for A Hard Money Loan?

Hard money loans are an excellent option for most borrowers due to their speed, flexibility, and accessibility. These loans are ideal for real estate investors facing time-sensitive opportunities or those with less-than-perfect credit.

Hard money lenders prioritize the property’s value, allowing for quicker approval and funding processes compared to traditional loans. Their flexibility in terms and conditions accommodates unique investment scenarios, such as property flips or renovations.

While, at times, interest rates with hard money loans may be higher, the ability to secure financing swiftly in unconventional situations makes hard money loans an excellent choice for those looking to capitalize on immediate real estate opportunities.

Indiana’s Real Estate Market: Insights for Investors

- Population: 6.806 million

- Median Household Income: $67,173

- Unemployment rate: 3.70%

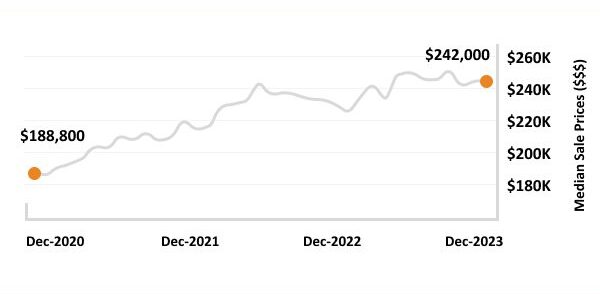

- Median sale price: $242,400

- Growth YoY: +2.2%

- Number of Homes for Sale: 20,790

- Homes Sold Above List Price: 20.4%

- Median Days On Market: 20

- Average Rent Prices: varies statewide

- Foreclosure rate: 0.32%

Georgia’s Real Estate Market

6.806 million

State Population

+2.2%

Growth YoY

$242,400

Median Sale Price

20.4%

Homes Sold Above List Price

20,790

Number of Homes for Sale

0.32%

Foreclosure rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest In Indiana’s Real Estate Market?

With a strong economy, population growth, and some very investment-friendly tax policies, Indiana is a great place to invest if you want to grow and diversify your portfolio.

Once you start exploring the real estate scene in Indiana, you’ll realize it has something for everyone. From luxury homes close to parks and great schools to rental properties closer to downtown, it’s always easy to find a great home in Indiana, and this is what makes Indiana worth investing in.

With a relatively low cost of living, Indiana sees an incredible influx of new residents almost every year. Needless to say, all of these new residents need properties to either own or rent. As a real estate investor, your new real estate projects funded by our hard money loans could become their new homes!

And, of course, one can’t overlook Indiana’s thriving job market, which has resulted in a lower unemployment rate in recent years and a higher standard of living that’s making it possible for people to invest in new projects!

Ready to apply for a money lenders loan?

Frequently Asked Questions

We understand the importance of timely funding, and our streamlined process enables us to provide quick approvals and funding. In many cases, we can get approvals within 24 hours and fund loans within a matter of days, allowing you to seize time-sensitive investment opportunities in Fort Wayne, IN and nearby regions.

Our loan approval process is designed to be quick and hassle-free to ensure minimum delays during your project. With us on board, you can rest assured that you’ll have access to the funds you need whenever you need them.

Yes, our hard money loans are asset-based, meaning we primarily consider the value of the property and the potential of the investment. We work with borrowers who may have low credit scores or limited credit history, offering them opportunities to secure financing based on the collateral they’re able to provide.

This is what makes our hard money loans a better option than traditional loans. Regardless of your financial history, you can get a hard money loan with ease!

We’ve worked with clients in several of Indiana’s top cities, including Fort Wayne, Indianapolis, Evansville, South Bend, and Fishers, IN.

In case you don’t see your city listed above, feel free to reach out to the best hard money lenders in Indiana, and we’ll guide you accordingly.

Top Hard Money Lenders Loan Cities in Indiana

Work With the Best Private Money Lenders In Indiana

At Insula Capital Group, we believe in tailored solutions for our clients. This is why we offer a wide selection of loan programs and experts who take the time to understand what you exactly need.

We also make sure that once a loan application is submitted, it’s expedited to ensure there are zero delays in your project and that you have access to the funds you need as quickly as possible. With us on board, you don’t have to worry about unnecessary delays or hidden fees! We’re the ultimate partners you need to fund your next real estate project in Indiana!