Private Money Lenders | Hard Money Loans in Oklahoma

Leveraging Opportunities in Oklahoma’s Real Estate Landscape with Insula Capital Group

Welcome to Insula Capital Group, your committed hard money lender, empowering real estate visionaries across the diverse landscapes of Oklahoma. We tailor our financing solutions to fit your ambitions, paving the way for your real estate success.

Capturing the Essence of Real Estate Investment Across Oklahoma

As seasoned private money lenders, we understand the nuances of Oklahoma’s real estate markets, extending from the metropolitan allure of Oklahoma City and Tulsato the vibrant suburban expanses of Broken Arrow, Norman, and Edmond.

Every location holds a unique promise, and at Insula Capital Group, we enable you to leverage these opportunities with our comprehensive range of loan programs.

Our offerings are tailored to individual needs. We invest time in comprehending your financial position and project specifics to create a customized loan package that suits you perfectly.

Connect with us to discuss your financing options.

Utilizing Hard Money Loans for Real Estate Projects in Oklahoma

Speedy Approval and Funding

Traditional financing methods often involve lengthy approval periods, whereas our hard money lenders streamline the process, providing quicker access to funds.

In Oklahoma’s fast-paced real estate market, this agility can be a game-changer, allowing investors to seize time-sensitive opportunities.

Flexible Qualification Criteria

Traditional lenders typically have stringent qualification criteria, making it challenging for some investors to secure loans.

Hard money lenders at Insula Capital Group, however, are more concerned with the property’s value and potential rather than the borrower’s credit history or financial standing.

Asset-Centric Approach

Hard money loans are asset-based, primarily focusing on the property’s value and potential profitability. This approach is advantageous for real estate investors in Oklahoma, as it allows them to secure financing based on the property’s intrinsic value, even if their credit history is less than perfect.

Adaptability to Unique Projects

Real estate projects in Oklahoma can vary widely in terms of scope and complexity. Hard money lenders recognize the diverse nature of these projects and tailor loan terms accordingly. Whether it’s a fix-and-flip venture, new construction, or a commercial property investment, our hard money loans can be adapted to suit the specific needs of the project.

Local Market Expertise

Our hard money lenders possess a deep understanding of the local real estate market in Oklahoma. This familiarity allows for more informed lending decisions, and borrowers can benefit from the lender’s insights into market trends, property values, and potential challenges.

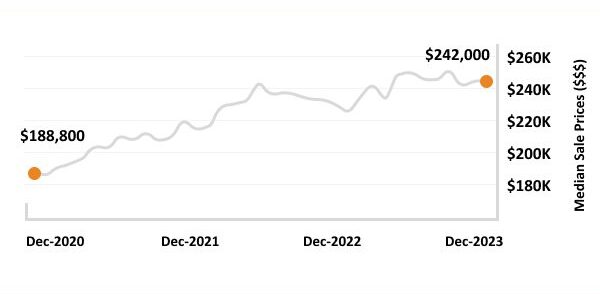

An Overview of Key Statistics of Oklahoma’s Real Estate Market

- Median Home Value: $139,614

- 1-Year Appreciation Rate: +6.2%

- Median Sale Price: $233,500

- Median Time To Sale: 46 Days

- Median Rent Price: $1,050

- Price-To-Rent Ratio: 108

- Foreclosure Rate: 0%

- Unemployment Rate: 3%

- Population: 3,943,079

- Median Household Income: $49,767

The Real Estate Market In Oklahoma

3,943,079

Population

$49,767

Median Household Income

$233,500

Median Sale Prices

46 days

Median Time To Sale

11.08

Price-To-Rent Ratio

+6.2%

1-Year Appreciation Rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Is Investing In The Oklahoma Real Estate Market A Lucrative Option

Investing in Oklahoma’s real estate market offers a range of opportunities due to factors such as steady population growth, affordability, a diversified economy, and an emerging technology hub.

The influence of the energy sector, coupled with urban development initiatives, contributes to the appeal of both residential and commercial properties. Higher education institutions, cultural attractions, and tourism further boost the demand for real estate.

Low-interest rates, maintained by the Fed to stimulate the housing market, have further enhanced the investment landscape. With rates at historic lows, investors can justify higher acquisition costs and potentially increase cash flow from monthly rental properties.

The demand for rental properties is strong in Oklahoma, driven by a favorable price-to-rent ratio of 11.08, making homeownership more affordable than renting. Limited inventory levels contribute to increased demand for rental properties, providing landlords with the opportunity to command premium rental rates.

Considering these factors, building a rental property portfolio emerges as a compelling exit strategy for investors, as important market indicators point toward a favorable environment for becoming a buy-and-hold investor in the aftermath of the pandemic.

Ready to apply for a Hard Money loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

At Insula Capital Group, we prioritize your ambitions, providing tailored financing solutions with swift approvals and flexible terms. We cater to various real estate markets across Oklahoma, including Oklahoma City, Tulsa, Broken Arrow, Norman, and Edmond, among others.

We offer residential rental loans, focusing on the property’s value and providing the financial backing to help you maximize your rental property investments in Oklahoma.

Yes, our new construction loans provide robust financial backing for your construction projects across Oklahoma.

Top Hard Money Lenders Loan Cities in Oklahoma

Let’s Partner Up!

At Insula Capital Group, we prioritize fast approvals, competitive rates, and exceptional customer service. Our team will analyze your financial needs and provide customized hard money loan deals. Our loans have various features, including quick approvals, no junk fees, minimal paperwork, no pre-payment penalties, and much more.

Check out our loan programs and just-funded projects for better insights and inspiration!