Private Money Lenders | Hard Money Loans in San Diego, CA

With gorgeous beaches, a pleasant climate, and a thriving economy, San Diego is the place to be! It draws residents and visitors from across the US, and with good reason!

If you’re an investor, we urge you to consider investing in San Diego’s real estate market! As private money lenders with a lot of experience in this city, we can guarantee success!

Get in Touch

Unlock Your Real Estate Potential with Hard Money Lenders in San Diego, CA

If you’re looking to unlock your real estate potential in the vibrant market of San Diego, CA, look no further than Insula Capital Group, the best private money lenders in town. Our team understands the unique dynamics of San Diego’s real estate market and offers tailored solutions to help you seize opportunities and maximize your returns.

With our hard money loans, you can access quick funding, flexible terms, and personalized guidance. Whether you’re a seasoned investor or a first-time buyer, our experienced team is here to assist you every step of the way. We prioritize fast approvals and efficient processes, allowing you to act swiftly in a competitive market.

Don’t let financing constraints hold you back from realizing your real estate dreams—partner with our hard money lenders in San Diego to unlock your real estate potential and embark on a successful investment journey.

Check out our just-funded projects and loan programs to get started!

The Strategic Benefits of Hard Money Loans

Hard money loans offer a strategic financial solution for real estate investors, particularly in fast-paced market scenarios. These loans are notable for their quick funding timelines, bypassing the lengthy procedures typical of conventional bank loans.

Tailored to cater to the real estate asset’s value, hard money loans from Insula Capital Group are designed with flexible terms, accommodating a broader spectrum of investors, including those with less-than-perfect credit profiles. This approach enables investors to rapidly progress from property acquisition to renovation and onto the selling phase, maximizing profitability in competitive real estate markets.

Our streamlined application and approval processes underscore its commitment to enhancing the efficiency and success of diverse real estate projects, further establishing it as a pivotal financial partner in real estate investment.

San Diego’s Housing Market: Key Insights for Hard Money Lending

San Diego’s real estate market is characterized by its robustness and resilience, offering a favorable environment for both buyers and sellers.

The city’s dynamic culture and solid economic base are significant drivers of its real estate market.

Vital Statistics and Projections for San Diego’s Real Estate:

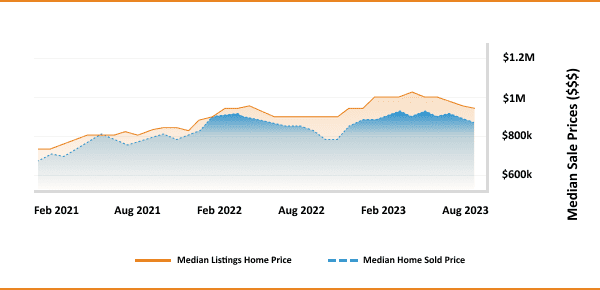

- Median Home Value:Currently stands at $891,746.

- Median List Price:Has seen an increase to $849,667, which is up by 4.4% year-over-year.

- 1-Year Appreciation Rate:Notably high at 23.2%.

- Forecasted Median Home Value:Expected to rise by 16.4% next year.

- Supply Trends:The weeks of supply are 3.9, down by 1.8 compared to the previous year.

- New Listings:There has been a decrease to 500.6, marking an 18.6% year-over-year reduction.

- Active Listings:Currently, there are 1,992 active listings, which is a significant decrease of 42.5% year-over-year.

- Sales Figures:Homes sold amount to 553.7, down by 10.7% compared to the previous year.

- Market Liquidity:Median days on the market are around 12, shorter by 2.5 days year-over-year.

- Rental Market:The median rent is $2,745, showing a 14.8% increase year-over-year.

- Price-to-Rent Ratio:Stands at 25.32.

- Unemployment Rate:As per the latest estimates by the Bureau Of Labor Statistics, it’s at 4.2%.

- Population:The latest estimate by the U.S. Census Bureau puts it at 3,338,330.

- Median Household Income:According to the latest data, it’s $78,980.

San Diego’s Real Estate Market

3,338,330

Population

$891,167

Median Sale Price

$960,202

Average Home Price

23.2%

1-Year Appreciation Rate

$78,980

Median Household Income

1,992 (-42.5% year over year)

Active Listings

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Opt for Hard Money Loans in San Diego’s Real Estate Market?

San Diego’s real estate market presents unique opportunities, making it an appealing choice for investors and developers. The market’s resilience and growth are powered by several key factors that make hard money loans an attractive financing option.

Economic Growth and Sector Diversity

San Diego’s economy is robust and diverse, with strong sectors like biotechnology, military, and tourism. This economic health fosters a steady demand for real estate, both residential and commercial, making the city a fertile ground for investment.

Rising Property Values

The real estate market in San Diego is known for its appreciating property values. As of late 2023, the median home price was $939.1K, reflecting a year-over-year increase. This trend of rising home values is expected to continue, offering a lucrative environment for real estate investors.

Cultural and Urban Appeal

San Diego is renowned for its rich cultural diversity and urban appeal. Each neighborhood offers unique investment prospects, from the bustling Gaslamp Quarter to the serene beaches of La Jolla. This variety attracts a diverse population and offers varied opportunities for real estate investments.

Strategic Market Position

San Diego’s strategic location as a coastal city adds to its appeal as a real estate investment destination. The city’s port and proximity to the Pacific Rim bolster both commercial and residential real estate markets.

Hard Money Loans as a Strategic Solution

In such a dynamic market, hard money loans from Insula Capital Group provide a swift and flexible financing solution. These loans are ideal for investors looking to capitalize on quick market moves, offering faster closings than traditional loans, which is crucial in a competitive market like San Diego.

Tailored Financing for Diverse Projects

Whether it’s for new constructions, renovations, or commercial projects, hard money loans provide tailored solutions that align with diverse investment strategies. Their reliance on property value rather than solely on credit scores makes them accessible to a broader range of investors.

With its dynamic growth, economic stability, and diverse opportunities, San Diego’s real estate market presents a compelling case for using hard money loans as a strategic financing tool. For investors looking to make the most of San Diego’s real estate opportunities, hard money loans offer the flexibility, speed, and adaptability needed in today’s market.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

We prioritize quick approvals at Insula Capital Group. Once you’ve filled out the application forms and submitted all required documents, we strive to get your loan approved within 24 hours. The exact duration may vary depending on additional documentation requirements and project complexity.

Typically, interest rates for hard money loans are higher than those of traditional money loans due to the increased risks associated with these financing programs. With that said, at Insula Capital Group, we’re known for our competitive interest rates and offer tailored plans based on your project and financial situation.

Hard money lenders usually focus more on your project’s potential and your property’s value rather than solely on your credit scores. So, even if you have bad credit, feel free to discuss the situation with our team to see what financing solutions we can whip up for you.

Connect with San Diego’s Premier Hard Money Lenders!

Choosing to partner with Insula Capital Group in San Diego is a decision to align with more than just a financial institution. It means joining hands with a committed partner dedicated to guiding you through the exciting real estate investment process in San Diego. Experience firsthand how our dedication to your success is put into action—visit our website to explore our portfolio of recently funded projects, a testament to our commitment to driving investor success.

Eager to craft your own success narrative in the San Diego real estate market? There’s no need to delay. Kickstart the process by filling out our easy-to-navigate prequalification form. For a more thorough exploration of your investment possibilities, proceed with our detailed full loan application. Should you have questions or desire an engaging conversation about your real estate goals, our team of experienced professionals is readily available for consultations.

Your journey in San Diego’s real estate market begins now, and Insula Capital Group is poised to guide you toward new achievements. Let’s bring your investment dreams to fruition, one property at a time!