Investment Property Loans

At Insula Capital Group, we specialize in offering tailored investment property loansfor investors looking to maximize their returns in the competitive New York real estate market. Whether you’re an experienced investor or exploring investment property loans for first-time buyers, we provide a wide range of investment property financing optionsto suit your needs.

Our private money lending servicesstreamline the process, ensuring fast approval and flexible terms that help you secure properties quickly. With investment property loan ratesinfluenced by market dynamics, Insula Capital Group remains committed to offering competitive rates that align with your investment goals. We also provide specialized products like investment property bridge loans and refinance loans, allowing you to leverage your assets effectively.

Navigating the complexities of real estate investment loansin New York requires expertise, which is why our team of experienced investment property mortgage brokersis dedicated to simplifying the loan application process. From discussing loan requirements to identifying the best investment property loan lenders, we are here to guide you through every step of the process, offering personalized solutions that meet loan eligibility criteria and empower your investments.

Start your journey today with a trusted partner in investment property loan companies—Insula Capital Group.

Hire Seasoned Investment Property Mortgage Brokers, Today!

At Insula Capital Group, our team of seasoned investment property mortgage brokers is dedicated to helping you navigate the complexities of investment property financing with ease. Whether you are seeking investment property loans online or prefer a more hands-on approach, our experts are here to provide guidance every step of the way. With extensive knowledge of investment property loan rates and investment property loan options, we ensure you secure the best deals available.

Our brokers understand the unique challenges of the New York real estate market and can tailor real estate investment loans to match your goals. We handle everything from assessing loan eligibility to streamlining the loan application process, offering a comprehensive approach that saves you time and hassle. Our team is also skilled in arranging investment property loans for first-time buyers, making it easier for new investors to enter the market.

When you work with Insula Capital Group, you gain access to reliable, trusted professionals who prioritize your success. Reach out today to discover how our investment property loan brokers can fast-track your real estate investments!

Reach out to our team for more information.

Explore the Benefits of Acquiring Investment Property Loans!

Financial commitments can be overwhelming, and therefore people have their doubts. However, with Insula Capital Group, you’ll experience working with the industry’s best brokers, ensuring you have greater returns. Here’s how you can maximize the benefits of your investments:

We Offer Flexible Financing Options

Insula Capital Group offers a variety of investment property financing options, including bridge loans and refinance loans, tailored to meet your unique investment needs.

Fast Approval Process

With our streamlined process, you can expect fast approval on your investment property loan application, enabling you to secure real estate opportunities quickly.

Competitive Loan Rates

We provide some of the most competitive investment property loan rates, ensuring that your investment remains financially viable and profitable.

Expert Guidance

Our experienced investment property loan brokers guide you through the entire process, offering insights and advice to make the most of your investment.

Simplify your financial requirements by working with some of the most versatile and talented brokers in town. Give us a call or fill out our application form to schedule your appointment today!

Ready to apply for a investment property loan?

Get in touch with our experienced team for more details about our financing services.

Should You Be Making a Real Estate Investment?

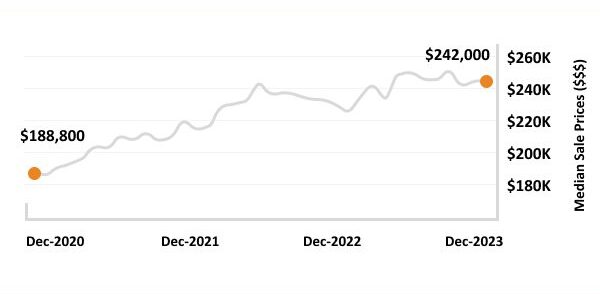

Real estate industries have always seen ups and downs, and therefore an individual needs to have complete information and insights to make an informed decision. Check out these stats to make a decision:

- The medial investment property price is $412,300.

- The price to rent ratio in the USA is 134.66.

- The 1-year rent appreciation for investment properties in USA is 4%.

Investment Property Statistics in USA

$2073

Median Rent Price

$412,300

Median Property Price

4%

1-Year Appreciation Rate

134.66

Price-To-Rent Ratio USA

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Private Lenders are Better than Traditional Banks?

When it comes to investment property financing, private lenders offer significant advantages over traditional banks. At Insula Capital Group, we understand the urgency and flexibility investors’ need, which is why our private lending solutions are designed to offer more efficient and investor-friendly benefits. Here’s why working with private lenders is the smarter choice:

- Faster Approval Times

Unlike traditional banks, private lenders provide investment property loans with fast approval, often finalizing your loan within days, allowing you to seize investment opportunities quickly. - Flexible Loan Terms

Private lenders offer more adaptable terms, including investment property bridge loans, tailored to your specific project needs and repayment timeline. - Less Stringent Requirements

With more relaxed investment property loan requirements, private lenders are more likely to approve loans based on property potential rather than rigid credit criteria. - Greater Loan Accessibility

Private lenders often provide investment property loans for first-time buyersand investors who may not meet traditional bank standards, making real estate investing more accessible.

Choosing a private lender like Insula Capital Group means quicker, more flexible, and investor-focused solutions, ensuring your next investment succeeds with fewer hurdles.

Ready to apply for a investment property loan?

Frequently Asked Questions

Top Fix and Flip Loan Cities in Arkansas

Contact Our Private Money Lenders for a Streamlined Financing Experience!

At Insula Capital Group, we specialize in simplifying the process of securing investment property loans. Our experienced team is ready to guide you through every step, offering personalized investment property financing options tailored to your needs. Whether you’re looking for fast approval or flexible loan terms, we’re here to help.

Contact us today to experience a hassle-free and efficient approach to real estate financing!