Investment Property Loans in New York

Florida’s real estate market and the ever-changing positive trends have presented countless opportunities for individuals and groups to make investments and get faster returns on their investments. Whether you’re trying to acquire a property to rent out or just looking for a property that you can buy, renovate, and then float in the real estate market, Insula Capital Group’s investment property loans in Florida can help you fulfill all your needs!

Our team is equipped with the knowledge and expertise to understand the unique needs and requirements of each client’s investment and provide services and suggestions based on these needs. Our brokers understand local regulations and market trends, which allows them to provide you with apt suggestions, maximum-value investment opportunities, and customized investment property financing options!

Whether you need help understanding market trends, property values, investment property mortgages, or more, there’s nothing that our experts at Insula Capital Group can’t help you out with! Our team members have become the leading investment property loan lenders in Florida, marking the industry with their excellent work ethics, complete knowledge, and years of experience!

Get in Touch

Maximize Your Investment Potential with New York’s Leading Property Loan Lenders!

Navigating the difficulties of investment property loans in New York requires a trustworthy and experienced partner. Working with skilled investment property loan lenders ensures that you get the best market rates, tailored financing options, and timely guidance throughout the process.

At Insula Capital Group, we provide the knowledge, expertise, and support to make your investment journey hassle-free. Our seasoned New York investment property loan brokers have an in-depth understanding of the local market dynamics, allowing them to secure the best opportunities, negotiate favorable terms, and help you achieve your financial goals.

We work closely with each client to identify the most promising real estate opportunities, taking into account your unique needs and goals for investment property financing.

When you choose Insula Capital Group, you’re choosing a partner who will guide you every step of the way—from securing the best investment property loan rates to making informed, confident decisions about your investments.

Connect with us today and let Insula Capital Group help! We’re here to simplify the process so you can focus on maximizing your returns.

What Makes Investment Property Loans Right for You?

Investment property loans offer the versatility that you need to capitalize on this ever-evolving market. Here’s why these loans could be the perfect fit for your investment goals:

Diverse Opportunities in a Competitive Market

New York offers a wide range of real estate investment opportunities, from residential rental properties to commercial spaces. With a well-structured loan, you can access funding to acquire properties in high-demand areas, putting you ahead in the competitive New York real estate market.

Expert Guidance in a Complex Market

The New York real estate market is known for its complexity, with varying regulations, zoning laws, and market fluctuations. By partnering with investment property loan lenders in New Yorkwho understand these intricacies, you’ll gain valuable insights and strategies for success. Our team’s local expertise ensures that you not only secure the best loan terms but also make well-informed decisions about your investments.

Building Long-Term Wealth

Investment property loans provide a pathway to building sustainable, long-term wealth. By leveraging investment property mortgages, you can expand your real estate holdings and generate consistent rental income while also benefiting from property appreciation.

Understanding the New York Real Estate Dynamics

Don’t take a leap before you spend your time assessing the market. Here are some important statistics that you need to look at before committing to a loan plan:

- The Price to Rent Ratio is 38.26

- The Median Rent Price is $3863.

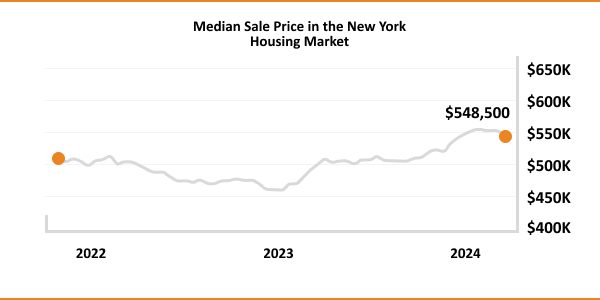

- The appreciation on properties in the last year was 2.7%.

- The home foreclosure rate for New York is 1/5196.

Property Investment Statistics for New York

19.68 million

State Population

$3,863

Median Rent Price

$549,000

Median Property Price

2.7%

1-year Property Appreciation

1/5196

Home Foreclosure Rate

38.26

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Discover Top-Tier Investment Property Loans in New York

The first step to getting the right funding is finding a trusted and experienced investment property loan lenderto guide you through the process. If you’re trying to figure out theinvestment property mortgages, you need someone who understands the local market and can offer customized solutions according to your financial standing and goals.

At Insula Capital Group, our mission is to simplify the financing process for you. Our investment property loan lenders are bent on offering personalized solutions and insightful advice that ensure you have the right financing to meet your investment goals.

What sets us apart? Here’s how we can redefine your experience with investment property financing in New York:

- In-Depth Knowledge of the New York Market

- Tailored Financial Strategies

- Competitive Loan Rates

Contact us today and let our experts help you navigate the world of investment property mortgages with confidence.

Ready to apply for a investment property loan?

Frequently Asked Questions

Investment property loans in New Yorkcan be used to finance various types of properties, including single-family homes, multi-family units, vacation rentals, and commercial properties. Whether you’re looking to purchase a property to rent out, flip, or hold for long-term appreciation, Insula Capital Group offers flexible financing options tailored to your specific investment goals.

Typically, investment property loans have higher rates compared to primary home loans, but Insula Capital Group is committed to securing the most competitive rates for our clients, ensuring you get the best possible financing to maximize your returns.

Why Choose Insula Capital Group for Investment Property Financing in New York?

Insula Capital Group is the trusted partner you need to navigate Florida’s vibrant real estate market. Our team offers a deep understanding of the local market dynamics, from major cities to emerging areas, allowing us to provide tailored guidance for your investments.

We specialize in offering customized financing solutions that align with your specific goals, ensuring that every client receives a financial plan suited to their unique needs. Whether you’re new to real estate or an experienced investor, our competitive investment property loan rateshelp maximize your returns.

We streamline the entire process, ensuring fast approvals and minimal hassle so you can secure investment property financing quickly and efficiently.

At Insula Capital Group, we’re not just here to provide financing—we’re here to be your dedicated partner every step of the way, offering valuable insights and support as you grow your investment portfolio.