New Construction Loans in Albany

Ground Up Construction Loans in Albany – Secure Funding for Your Next Construction Project

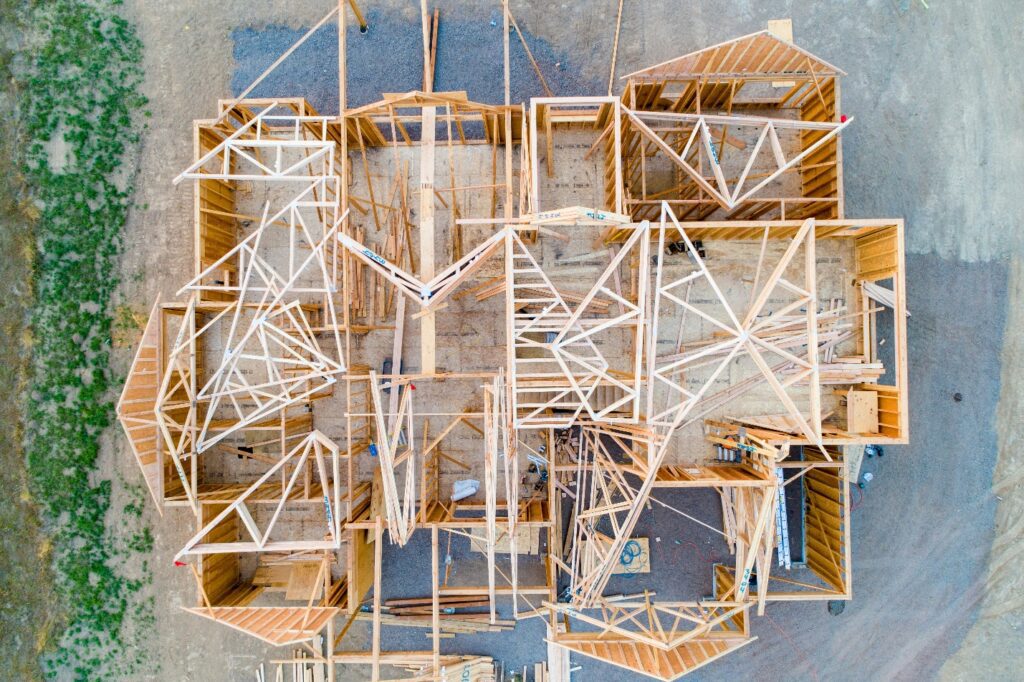

Albany’s development scene has entered a strong growth phase. From residential infill projects to mixed-use redevelopment projects, the city continues to attract investors who recognize its potential. Yet the biggest obstacle for builders and developers often isn’t the project itself, but the wait for funding.

At Insula Capital Group, we make sure financing never holds your plans back. Our Ground Up Construction Loans in Albany are built for speed, flexibility, and reliability. Whether you’re purchasing land, beginning vertical construction, or refinancing mid-project, we offer funding options that provide liquidity and flexibility across all phases.

Unlike traditional banks that focus on credit histories and rigid timelines, our loans are asset-based and centered on the value and potential of your project. That means fewer restrictions, faster approvals, and direct access to the capital you need!

Why Choose Ground Up Construction Loans in Albany

- Provide timely capital so you can secure land and permits without losing momentum.

- Finance construction from foundation to completion, and you can close in as little as a week.

- Maximize leverage with funding sized to the project’s after-completion value.

- Offer payment structures that match the realities of a construction calendar.

Why Albany Is a Hotspot for Ground‑Up Development

Expanding Housing Demand

Albany’s population growth, coupled with a shortage of new housing, has created strong demand for new residential projects. Young professionals, students, and families are driving rental absorption at record rates.

Urban Redevelopment Momentum

Neighborhoods are seeing new mixed-use and multifamily construction. These projects are revitalizing older structures and strengthening the city’s long-term growth outlook.

Affordability Compared to Major Metro Areas

Compared to cities like New York and Boston, Albany offers affordable land and construction costs, making it attractive for developers seeking solid returns on investment.

Institutional and Private Investment

The presence of universities, hospitals, and expanding corporate campuses has kept demand steady. This steady influx supports both residential and commercial projects.

Reliable Market Stability

As the state capital, Albany maintains a consistent employment base. This stability helps mitigate risks for developers and lenders alike, making it a strong location for ground-up construction.

Location and Livability

Albany offers easy access to New York City and Boston. Residents enjoy access to revitalized neighborhoods. This accessibility and quality of life draw people who want affordable options without sacrificing convenience.

Ground Up Construction Loan Options in Albany

At Insula Capital Group, construction financing is structured around your project’s timeline and strategy. Whether you are purchasing land to start a new build or refinancing mid-construction to maintain liquidity, our loans are designed to keep your schedule intact.

New Construction Purchase Loans

Designed for developers and builders acquiring land or teardown properties, our purchase loans provide the capital needed to secure lots and begin building immediately.

Common Use Cases:

- Buying raw land or infill sites for residential or mixed-use projects

- Acquiring properties to demolish and rebuild

- Purchasing entitled land ready for vertical construction

Loan Highlights:

- Up to 85% Loan-to-Cost (LTC)financing

- Funds available for both land acquisition and vertical construction

- Interest-only paymentsduring the build period

- No tax returns or income verificationrequired

- Closings in as little as 7–10 days

- Available

New Construction Refinance Loans

If your project is already underway but facing delays or shifting financial needs, our refinance loans can help stabilize funding and protect your returns.

Common Use Cases:

- Budget overruns or extended build timelines due to construction delays

- Unfavorable terms from your current lender

- Need to cash out the value from completed phases

- Consolidating multiple short-term notes, accrued interest, or fees into one structured solution

Loan Highlights:

- Refinance up to 70–75% of the current project value

- Funds for remaining construction and holding costs

- No prepayment penalties. Exit whenever it suits your strategy

- Fast underwritingwith mid-construction approval options

- Transition flexibilityto rental or long-term financing upon completion

- Option to roll interest or fees into the loan to preserve working capital

Choosing the right lending partner can determine your project’s success. Developers across New York trust Insula Capital Group because of our specialized expertise and commitment to client success.

Ready to apply for a fix & flip loan?

Get in touch with our experienced team for more details about our financing services.

How to Apply for a Ground Up Construction Loan in Albany

We’ve simplified the process to eliminate the frustration of traditional lending. You can apply and get approved in days, not months.

Step 1: Apply Online

Submit a short application outlining your project details and funding goals.

Step 2: Review and Loan Offer

Our team reviews your construction plans and investment strategy, then provides a customized loan offer suited to your needs.

Step 3: Property Evaluation

We assess the property’s projected value upon completion (After-Repair or After-Construction Value) and finalize loan terms that reflect your project’s true potential.

Step 4: Fast Funding and Draw Access

Once approved, funds are released quickly, typically within 7-10 days. Draws are structured around your project schedule, giving you steady access to capital as construction advances.

Throughout the process, our experts remain available to answer questions and ensure your loan keeps pace with your project. With Insula Capital Group, you get quick financing that allows you to acquire land and fund construction.

Why Partner with Insula Capital Group

- Construction Lending Expertise:With 30+ years of experience, our team has financed a wide range of projects.

- Quick Approvals:Approvals in as little as 24 hours and funding within 7-10 days keep you competitive when a site hits the market.

- Transparent Terms:There are no junk fees, no hidden costs, and no prepayment penalties.

- Flexible Loan Structures:Every build is different. We size to the project’s after-completion value, with interest-only payments during construction.

- Responsive Support:Our team works directly with you to keep your financing aligned with your project schedule.

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

Ready to Get Started? Apply Today

Albany offers strong opportunities for builders who can bring new housing to market. Don’t let slow financing cause you to miss out on the next great project. With Insula Capital Group’s Ground Up Construction Loans in Albany, you get the speed, flexibility, and support needed to acquire land, fund construction, and deliver projects on time.

Reach out to our construction lending specialists or apply online today. We’re here to help you capitalize on your vision and optimize project returns.

Frequently Asked Questions

Yes. Our construction loans are asset-based. We focus on the project, the budget, and the property’s value at completion. A less-than-perfect score does not automatically disqualify you.

Once terms are accepted and diligence is complete, closings can occur in as little as 7–10 days. This timeline allows you to secure permits and start building without waiting months for a bank’s approval.

Use the refinance option. We can size a new facility to the current project value, add funds for remaining work and holding costs, remove prepayment friction, and offer a path to rental or long-term financing after completion.