New Construction Loans in Atlanta, GA

Are you planning on building a new property in Atlanta, GA, soon? That’s a great investment!

As the largest city in Georgia, Atlanta has garnered a reputation among real estate investors like no other. Building a property here can result in high returns on investment. The problem is the large costs you will likely incur during construction. Most investors do not have the resources to bear these costs all by themselves. This is where new construction loans come in.

You can get a new construction loan in Atlanta, GA, to kick off your property building project today. Learn how!

Get in Touch

Start Building your Property Today by Getting a New Construction Loan in Atlanta, GA

As a private money lending company that has been serving the Georgia market for many years, Insula Capital Group understands your construction concerns. Every property development project involves multiple stages, all needing to be financed separately. That’s why we offer specialized construction loans for various types of properties across Atlanta.

Our construction loans carry a term of one year. We also don’t release the complete loan amount at once, like you would expect from a regular lump sum payment loan. Instead, we wait for you to draw the funds as each stage of your construction project progresses. This way, we can help minimize your financial burden.

Contact our team to learn more about our new construction loan deals.

Is Opting For A Hard Money New Construction Loan A Good Option In Atlanta?

Don’t know if you should use a hard money new construction loan for your upcoming project in Atlanta? We can help you! If you’re struggling to acquire a construction loan from traditional banks, using hard money construction financing options can be an excellent option.

Unlike traditional lenders, hard money lending companies focus less on credit history and more on property value. It leads to a quicker and more flexible loan approval process, which can help you take advantage of opportunities in the competitive real estate market. Rather than waiting weeks or months, you can get loan approval within a few days by connecting with a reliable private hard money lender.

Hard money lenders understand the financial complexities of construction projects and can customize the loan terms to help you fulfill your project’s objectives. From short-term financing to an extended repayment schedule, you can get a wide range of financing options for your construction venture.

With numerous advantages, a hard money new construction loan can be an excellent option for property developers and investors in Atlanta. So, what are you waiting for? Get in touch with us for more details.

Examine Atlanta’s Real Estate Market To Make Informed Decisions!

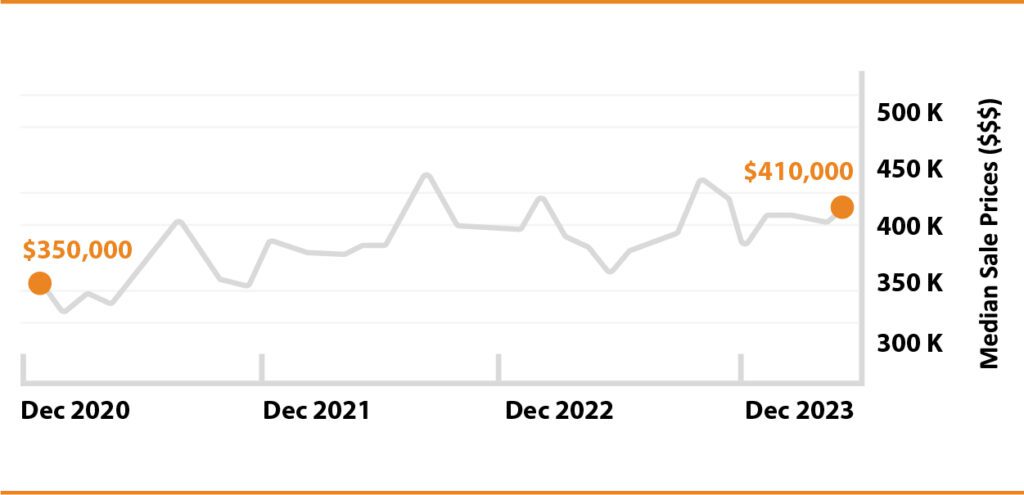

If you want to purchase properties or construct them in Atlanta, you must conduct research before starting any venture. A real estate project is a big investmentand this is why you must always make a well-informed decision. If you’re looking to create a strategy for real estate projects from scratch, the following statistics might be helpful for you:

- Median Home Value:$313,818

- 1-Year Appreciation Rate:+6.9%

- Median Rent Price:$1,795

- Price-To-Rent Ratio:56

- Atlanta-Sandy Springs-Marietta Unemployment Rate:5%

- Atlanta City Population:506,811

- Atlanta City Median Household Income:$59,948

- Percentage Of Vacant Homes:66%

- Foreclosure Rate: 1 in every 8,146

The Real Estate Landscape In Atlanta

506,811

Population

$1,795

Median Rent Price

$313,818

Median Home Value

+6.9%

1-Year Appreciation Rate

$59,948

Median Household Income

14.56

Average Days On Market

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Should You Start A Construction Venture In Atlanta?

With its strong economic condition and a booming real estate market, Atlanta offers abundant opportunities for investors and property developers to start construction projects.

You can construct various properties like new residential buildings, commercial complexes, or mixed-use buildings. The demand for new construction projects is rising in the city and you can easily capitalize on it by starting a new project.

If you need the capital to jumpstart any construction venture, our team is here for you at every step.

Ready to apply for a New Construction loan?

Frequently Asked Questions

Our new construction loans offer a loan-to-cost ratio of 75%, including plans and permits.

In this case, you can formally request an extension of the due date for your interest-only payments. If we approve it, we might still charge you a fee.

None. We don’t apply prepayment penalties to our new construction loans.

Looking for a Trustable Lending Company? Insula Capital Group is Here for You!

If you are unsure which type of construction loan you need, you can reach out to our expert underwriters.

Our team has a collective business experience of 30+ years. As we deal with more clients, we gain more insight into the particular requirements of each individual project. We understand that your project will be different from others in various ways, which is why we prefer to have an initial interview with you before providing you with a contract. You can discuss all of your concerns with us before filling out our application form. We also require minimal documentation to simplify the process for you.

If you want an idea of what working with us could be like, go through our just-funded projects page.

Reach out to Our Team to Get Started

You can contact us on any business day between 9 am to 5 pm. We look forward to hearing from you!

Get Quick Loan Approvals from Insula Capital Group

Whether you’re a seasoned investor or a first-time buyer, a hard money loan can provide the financial boost needed to capitalize on these opportunities. With the ability to close deals quickly, you’ll gain a competitive edge and seize profitable investments that may not be available with conventional financing.

Start applying by completing our online application form at your convenience! You can go through our FAQs and just-funded projects to learn more about our tailored lending services.