New Construction Loans in Cincinnati, OH

Cincinnati, OH, is a city with a thriving real estate market, offering ample opportunities for real estate investors, developers, and builders. As one of the fastest-growing cities in the Midwest, Cincinnati provides a diverse range of new construction projects, from single-family homes to multi-family developments and commercial properties.

As a real estate investor, developer, or builder in Cincinnati, OH, you can benefit from the city’s strong demand for new housing and commercial spaces. And with Insula Capital Group‘s new construction loans, you can access the capital you need to fund your projects and maximize your profits.

Get in Touch

Easy New Construction Loans in Cincinnati, OH

Are you a real estate investor, developer, or builder looking to bring your vision to life? Insula Capital Group is here to help with our new construction loans in Cincinnati, OH. We understand that seeing a plot of land and envisioning the building that deserves to be there is just the beginning. Our competitive rates and flexible terms make it easier for experienced investors to accomplish their goals, even without a massive portfolio of projects to back them up.

Benefits of Applying for New Construction Loans With Us!

Insula Capital Group specializes in providing new construction loans in Cincinnati, OH, to real estate investors, developers, and builders. Our short-term loan program is designed with your needs in mind, offering several benefits that can help you succeed in your new construction project:

- Minimal Experience Required: Unlike traditional lenders, we don’t require a lengthy track record of completed projects to qualify for our new construction loans. We only require around three successful projects completed from the ground up, making it easier for experienced investors to access the capital they need.

- Competitive Loan Terms: Our new construction loans in Cincinnati, OH, come with competitive rates and loan-to-cost ratios of up to 75%, including plans and permits. This means you can access the capital you need to cover the costs of land acquisition, construction materials, labor, and other project expenses.

- Flexible Property Types: Whether you’re building a single-family home or a small multi-family development, our new construction loans cover a wide range of property types, including 1–4 family homes. This flexibility allows you to pursue a variety of new construction projects in Cincinnati, OH.

- No Prepayment Penalty: We understand that you may want to pay off your loan early to maximize your profits. That’s why we don’t impose any prepayment penalties, giving you the flexibility to repay your loan when it’s most convenient.

Find Out More About Ohio’s Real Estate Market

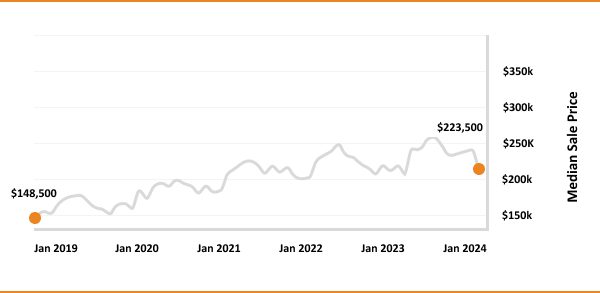

Investing in the real estate market and starting construction projects offers lucrative opportunities. But starting projects without any research isn’t a viable strategy, and you might lose your hard-earned money. Here are some statistics that might help you with your research:

- Median Home Value:$216,746

- 1-Year Appreciation Rate:+12.3%

- Average Sales Price:260,232

- Home Sales:13,785

- Median Rent Price (1 & 2 Bedroom Units):$1,065

- Price-To-Rent Ratio:05

- Unemployment Rate:0%

- Population:11,780,017)

- Median Household Income:$58,116

- Foreclosure Rate: 1 in every 1,027

The Real Estate Landscape In Cincinnati

$58,116

Population

$1065

Median Rent Price

$216,746

Median Home Value

+12.3%

1-Year Appreciation Rate

$260,232

Average Sales Price

1/1027

Foreclosure Rate

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Is Starting A Construction Project In Cincinnati, OH, An Excellent Option

Starting a construction project in Cincinnati, OH, offers various advantages, which makes it an excellent option for investors and property developers. Cincinnati’s strategic location makes it a hub for business.

With easy access to major highways and an international airport, the city offers excellent connectivity, facilitating the efficient movement of goods and people. This logistical advantage not only streamlines construction operations but also enhances market accessibility.

For construction projects, there’s a steady demand for commercial, residential, and infrastructure developments, which is perfect for investors. Cincinnati’s thriving real estate market undoubtedly presents excellent prospects for investors and developers. The city’s favorable zoning regulations and government incentives further attract investment in the region.

Cincinnati offers residents and businesses an exceptional quality of life. With its affordable cost of living and excellent educational institutions, the city attracts a talented workforce. This leads to an increased demand for residential properties and long-term value appreciation.

Ready to apply for a New Construction loan?

Frequently Asked Questions

New construction loans are specialized loans designed for real estate investors, developers, and builders looking to finance a new property’s construction from the ground up. These loans provide funding for land acquisition, construction materials, labor, and other project expenses.

Insula Capital Group offers new construction loans to experienced real estate investors, developers, and builders in Cincinnati, OH. To qualify, you typically need to have a minimum of three successful ground-up projects in your portfolio.

Insula Capital Group offers new construction loans for a wide range of property types, including 1–4-family homes, multi-family developments, and commercial properties.

Don't Miss Out On Amazing Opportunities – Contact Us Today!

Don’t miss out on the opportunities that Cincinnati, OH, offers. Contact Insula Capital Group today to see how we can help you succeed in the booming Cincinnati real estate market.

Ready to invest in Cincinnati, OH, with Insula Capital Group? Learn more about our new construction loans in Cincinnati, OH, and how we can help you achieve your real estate investment goals in this thriving city. Let’s work together to turn your vision into reality! Fill out our application to get started!