New Construction Loans in Yonkers

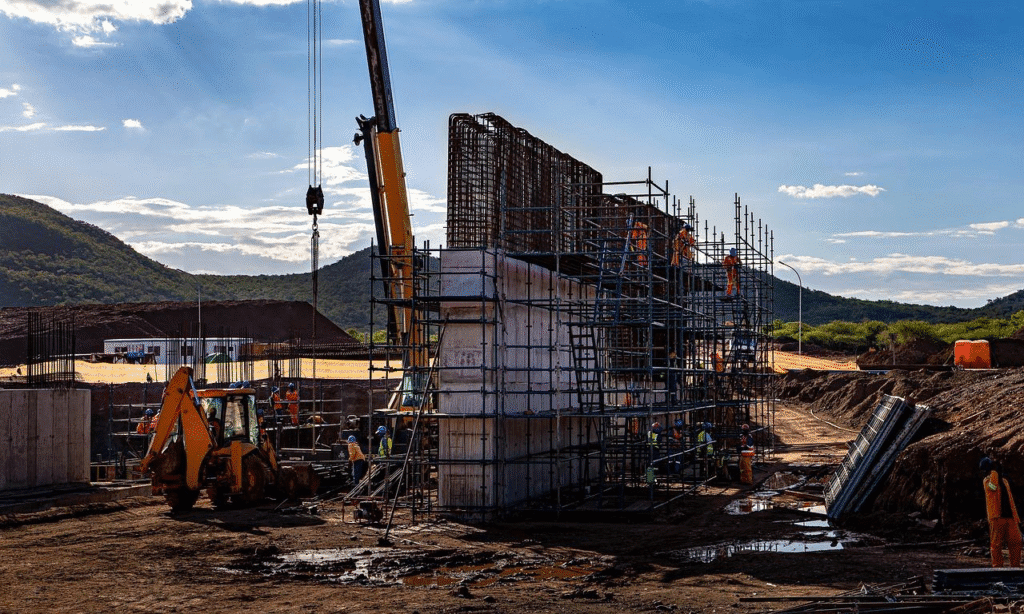

Ground Up Construction Loans in Yonkers – Reliable Capital for Developers

Albany’s development scene has entered a strong growth phase. From residential infill projects to mixed-use redevelopment projects, the city continues to attract investors who recognize its potential. Yet the biggest obstacle for builders and developers often isn’t the project itself, but the wait for funding.

At Insula Capital Group, we make sure financing never holds your plans back. Our Ground Up Construction Loans in Albany are built for speed, flexibility, and reliability. Whether you’re purchasing land, beginning vertical construction, or refinancing mid-project, we offer funding options that provide liquidity and flexibility across all phases.

Unlike traditional banks that focus on credit histories and rigid timelines, our loans are asset-based and centered on the value and potential of your project. That means fewer restrictions, faster approvals, and direct access to the capital you need!

Why Choose Ground Up Construction Loans in Yonkers

- Secure land and permits without delay.Quick access to funds means you can close fast and start development before opportunities disappear.

- Finance your full build.Cover expenses from foundation work to final finishes with structured draws aligned to each construction stage.

- Maximize leverage.Borrow based on projected completed property value, not just current land cost.

- Keep flexibility.Pay interest only on drawn funds and refinance easily once construction is complete.

Why Yonkers Is a Hotspot for Ground‑Up Development

Strong Residential Demand

Rental demand in Yonkers continues to outpace supply, driven by young professionals, families, and commuters seeking more space and affordability. The city’s growing appeal supports rental projects, with consistent appreciation in property values.

Ongoing Redevelopment and Zoning Support

The Yonkers city government has supported multiple rezoning efforts, transit-oriented development projects, and revitalization initiatives. For developers, this means a city actively encouraging new construction with fewer bureaucratic hurdles.

Expanding Infrastructure and Lifestyle Appeal

Yonkers benefits from its proximity to major highways, stations, and the waterfront. These advantages make it attractive to both investors and end-users. The opportunities to build and scale are strong.

Steady Renter and Buyer Interest

There’s steady demand from both renters and buyers. Well-located residential and mixed-use projects continue to lease quickly, especially those with good layouts and quality finishes.

Strategic Proximity to New York City

Yonkers sits directly north of Manhattan, offering the convenience of urban access. This makes it a target location for new housing, mixed-use developments, and infill construction.

Strong Financing Partner

Having a strong financing partner helps developers act quickly, handle upfront costs, and stay competitive in Yonkers’ fast-moving market. With steady funding, projects can become more profitable.

Ground Up Construction Loan Options in Yonkers

At Insula Capital Group, we structure every construction loan around the specific stage and scale of your project. Whether you’re purchasing land or refinancing mid-build, our programs are designed to maintain steady construction progress.

New Construction Purchase Loans

Ideal for developers and builders acquiring land or teardown properties to start a new project.

Use Cases:

- Buying raw land or infill sites for residential or mixed-use development

- Acquiring a structure to demolish and rebuild from the ground up

- Purchasing entitled land ready for vertical construction

Loan Highlights:

- Up to 85% Loan-to-Cost (LTC) financing

- Funds for both land acquisition and construction costs

- Interest-only paymentsduring the build period

- No income verification or tax returns required

- Close in as little as 7–10 days

- Nationwide availability, including New York

New Construction Refinance Loans

Already building and need more capital or more suitable terms? Refinance mid-project to keep momentum and protect your cash position.

Use Cases:

- Construction delays pushed you past the original budget or timeline

- The original lender’s terms became too restrictive

- You want to cash out a portion of the value created during the early phases

Loan Highlights:

- Refinance up to70–75% of the current project value

- Funds available for remaining construction and holding costs

- No prepayment penalties, so you can exit or refinance when it’s right

- Fast underwritingwith options for mid-construction approval

- Pathways to long-term financingif you plan to hold on to completion

- Option to roll interest into the loan to preserve working capital

With these loan options at your disposal, you can align capital with each phase of construction. Carefully structured terms and flexible schedules mean you can manage cash flow and keep your project on track.

Ready to apply for a fix & flip loan?

Get in touch with our experienced team for more details about our financing services.

How Ground Up Construction Loans Work in Yonkers

At Insula Capital Group, we provide straightforward funding for new construction. Expect quick decisions and fast funding to support your project from acquisition through completion.

Step 1: Apply with your project details. Provide property information, plans or scope, and funding needs. The intake is straightforward and focused on the deal.

Step 2: Receive a customized loan offer. We review your strategy and expected value at completion and present terms that match the plan.

Step 3: Project underwriting. We evaluate your property’s projected After-Completion Value (ACV) and assess your construction budget to structure the loan around your goals.

Step 4: Approval and quick funding. Once approved, funds can be released in days. This quick access allows you to start construction immediately.

With Insula Capital Group, you’re gaining a financial partner that is focused on your success. We can approve loans in as little as 24 hours and fund within days.

Why Partner with Insula Capital Group

- Construction Lending Expertise – With more than 30+ years of experience, our team understands the full cycle of development lending and structures loans that fit your build schedule.

- Speed and Flexibility – We provide quick approvals, fast closings, and flexible draw schedules so you can maintain progress.

- Transparent Terms – No hidden fees, no penalties, and clear repayment structures that support your financial goals.

- Personalized Support – Our experts remain available throughout your loan term, helping you stay aligned with your budget and timeline.

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

Ready to Get Started? Apply for Your Ground Up Construction Loan in Yonkers Today

The window of opportunity is open, but it won’t last forever. Fast, flexible financing can make the difference between winning a prime development site and losing it to someone else. At Insula Capital Group, we provide the capital you need to acquire land, build from the ground up and refinance mid‑project all without the delays of conventional lenders.

Don’t let funding slow you down. Apply today or contact our team to discuss your project. We’re ready to help you secure the financing you need to develop your vision in Yonkers.

Frequently Asked Questions

Yes. Our loans are asset-based, meaning approval depends primarily on the project’s value and feasibility, not your credit score. Developers and investors with solid plans and viable projects can still qualify for funding.

Once your application and documentation are complete, most projects can receive approval within 24 hours and funding within 7–10 days. Our focus is to help you begin construction without unnecessary hold-ups.

Yes. Many clients transition into permanent or rental financing once the property is stabilized or sold. Our team can guide you through refinancing options.