Rental Property Loans in California

Unlock the potential of your real estate investments with rental property loans in California from Insula Capital Group. We are a trusted private money lender specializing in providing fast, flexible financing tailored to meet the needs of property investors. Whether you’re expanding your portfolio, purchasing a new rental property, or refinancing an existing asset, we deliver solutions designed to help you grow.

Our rental property financing offers competitive terms and streamlined approvals, ensuring you can capitalize on opportunities without the lengthy delays of traditional lending. With years of experience in private money lending, our team understands the complexities of the real estate market and works closely with you to structure financing that aligns with your goals.

Contact us today to learn more about our rental property loans in California and get the financial support you need for your next investment.

Get in Touch

Work with the Finest Private Money Lenders in California!

At Insula Capital Group, we stand out as one of the premier private money lenders in California, offering unmatched expertise and flexible solutions for real estate investors. We understand that time is crucial when securing a property, which is why our lending process is designed to be fast, transparent, and hassle-free.

Our team works diligently to customize rental property financing that aligns with your investment strategy, whether you’re acquiring a new property or refinancing an existing asset. Unlike traditional lenders, we focus on your property’s potential rather than complicated financial histories, giving you the freedom to move quickly and confidently in the competitive market.

With a reputation for reliability and a deep understanding of the California real estate landscape, we provide financing that supports your long-term success. Trust Insula Capital Group to deliver the capital you need when you need it, backed by a team of seasoned professionals dedicated to your investment goals.

Partner with us and experience the difference of working with the finest private money lenders in California. Let us help you unlock the full potential of your rental property ventures today!

How Rental Property Financing Can Benefit Investors in California

Investing in rental properties can be a game-changer for your financial portfolio, and securing the right financing is crucial for success. Here’s how rental property financing in California from Insula Capital Group can help you achieve your investment goals:

Fast Access to Capital

- With private money loans, you can bypass the lengthy approval processes of traditional banks.

- Insula Capital Group offers quick funding, allowing you to secure properties before competitors.

Flexible Loan Terms

- We customize rental property loans based on your specific investment strategy.

- Enjoy flexible repayment options and terms designed to fit your unique financial situation.

Opportunities for Growth

- Our financing solutions enable you to expand your rental portfolio efficiently.

- Whether you’re acquiring new properties or refinancing existing ones, our loans empower you to grow.

Expert Guidance

- Work with a team that understands California’s real estate market.

- Get personalized advice and support tailored to your investment goals.

Insula Capital Group is here to provide the financial tools that help California investors succeed!

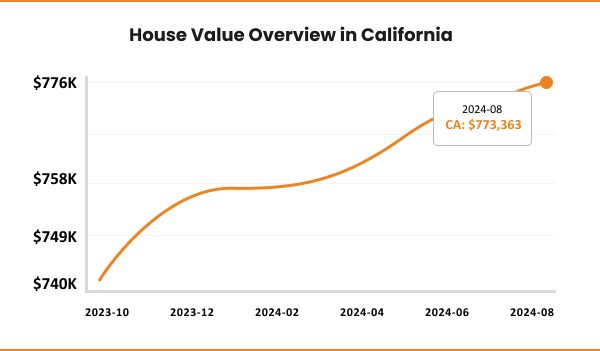

Understanding the Real Estate Market in California

Before committing to a rental property investment, it’s essential to understand the market dynamics and their potential impact on your returns. Here are some key statistics to guide your decision-making:

- The median rental property price is $773,363.

- The price to rent ratio in California is 32.2.

- The 1-year rent appreciation for the year for rental properties in California was 3.2%

Rental Property Statistics for California

$773,363

Median Rental Property Price

3.2%

1-year Property Appreciation

1.1%

Home Foreclosure Rate

32.2

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Choose California for Your Next Rental Property Financing Project

California offers a unique and lucrative environment for real estate investors, making it an ideal location for your next rental property financing project. Here’s why:

Strong Rental Demand

With a large population and a thriving job market, California consistently experiences high demand for rental properties, ensuring a steady income stream for investors.

Appreciation Potential

The state’s real estate market has a long history of strong property value appreciation, providing investors with long-term capital growth opportunities.

Diverse Markets

From bustling urban centers like Los Angeles and San Francisco to quieter suburban and coastal areas, California offers a wide range of investment opportunities to suit different strategies.

Investment-Friendly Climate

California remains one of the most robust real estate markets in the country, offering both stability and growth potential for investors with well-structured rental property loans.

Choosing California means tapping into a market rich with opportunity, and Insula Capital Group is here to provide the flexible financing you need to make your next project a success.

Ready to apply for a rental property loan?

Frequently Asked Questions

A rental property loan is a type of financing specifically for purchasing or refinancing rental properties. At Insula Capital Group, we offer flexible rental property loansto help you buy, renovate, or expand your rental investments. These loans can provide the financial support you need to grow your portfolio and generate steady rental income.

Qualifying for a rental property loan depends on factors like your credit score, the property’s value, and your investment goals. At Insula Capital Group, we simplify the process with more flexible requirements than traditional banks, making it easier for real estate investors to secure the funding they need. Reach out to our team, and we’ll guide you through the process!

Secure Reliable Rental Property Loans in California with Insula Capital Group!

Investing in rental properties can be a highly profitable venture, but it requires the right financial partner to help you navigate the process. Insula Capital Group specializes in offering private money lending services, providing customized rental property loansdesigned to suit your unique investment goals.

Our experienced team understands the complexities of acquiring rental property financing, and we are committed to offering streamlined loan solutions that are tailored to meet the needs of real estate investors. Whether you’re expanding your rental portfolio or looking to finance a new project, we provide expert guidance and flexible lending options.

With our team by your side, you can confidently secure the rental property loans you need in California. Reach out to Insula Capital Group today and take the next step toward a successful investment future!