Rental Property Loans in Florida

Are you looking to finance a rental property in the thriving Florida real estate market? At Insula Capital Group, we specialize in offering flexible and competitive rental property loans in Florida. As a private money lender, we understand the unique needs of property investors and provide tailored solutions that help you succeed in one of the nation’s most dynamic real estate landscapes.

Florida’s rental market is booming, with over 35% of the state’s population renting their homes. The Sunshine State is consistently ranked among the top states for rental property investments due to its strong population growth, favorable tax laws, and high demand for vacation rentals. Whether you’re investing in Orlando, Miami, Tampa, or smaller markets across the state, our rental property financingis designed to empower you to capitalize on these opportunities.

With Insula Capital Group, you can secure fast, reliable funding with terms that work for you, even if traditional financing isn’t an option. Partner with Insula Capital Group and let us help you make your rental property investments in Florida more profitable and sustainable.

Get in Touch

Start Your Financing Journey with Expert Rental Property Lenders!

At Insula Capital Group, we take pride in being Florida’s go-to experts for rental property financing. Whether you’re a seasoned real estate investor or exploring your first property, our dedicated team is here to guide you through every step of the lending process. With extensive knowledge of Florida’s real estate market and a proven track record, we deliver tailored solutions that meet the unique needs of rental property owners.

What sets us apart?

- Specialized Expertise: Our focus on rental property loans in Floridameans we understand local market dynamics, from coastal vacation spots to urban rental hubs.

- Customized Lending Solutions: We provide financing options designed to meet the specific requirements of your investment, including short-term and long-term rental properties.

- Streamlined Process: We offer quick approvals and flexible loan terms, so you can secure the funding you need without the usual hurdles of traditional lenders.

Ready to take the next step in your investment journey? With Insula Capital Group, you’ll get the expert guidance and support you need to thrive in Florida’s competitive rental market.

Let’s turn your investment goals into reality—start your financing journey today!

Enjoy Fruitful Benefits of Acquiring Investment Property Financing in Florida!

Investing in rental properties can be a highly profitable venture, but securing the right financing is crucial to maximizing returns. At Insula Capital Group, we provide comprehensive rental property loans in Florida designed to help investors capitalize on the state’s booming real estate market.

Florida’s rapid population growth, combined with its status as a top tourist destination, makes it an ideal environment for rental property investments. However, navigating the financing process can often be a challenge, especially with the complexities of traditional lending. That’s where Insula Capital Group steps in.

Our private lending services cater specifically to real estate investors, offering flexible loan options that are quick to approve and adaptable to a range of investment strategies. We understand that each property is unique, whether you’re investing in short-term vacation rentals or long-term residential leases, and we structure our loans accordingly.

By streamlining the loan process and offering competitive interest rates, we make it easier for investors to secure high-yielding rental properties without the delays and restrictions of conventional lenders.

Insula Capital Group is committed to enhancing your investment potential with tailored solutions that help you grow your portfolio and increase your rental income, no matter where in Florida you choose to invest.

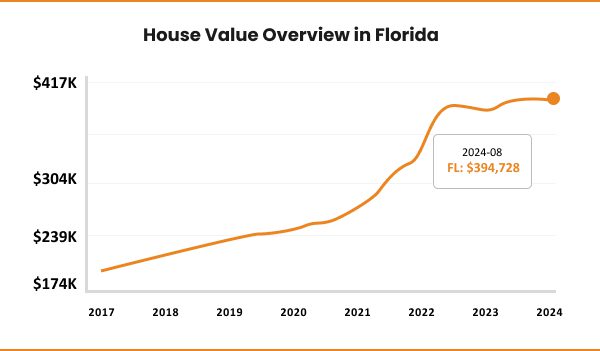

Explore Florida’s Booming Real Estate Market!

We understand that making a financial commitment takes a lot of insight. Let us help you come to a decision with the help of the following statistics:

- The Price to Rent Ratio is 18.3.

- The Median Rent Price is $12490.

- The appreciation on properties in the last year was 6.1%

Property Investment Statistics for Florida

22.24 million

State Population

$2490

Median Rent Price

6.1%

1-year Property Appreciation

$394,728

Median Property Price

18.3

Price-To-Rent Ratio

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$224,250

After Repair Value$345,000

Renovation Budget$174,111

Loan TypeFix & Flip

- After Repair Value$345,000

- Renovation Budget$174,111

- Loan TypeFix & Flip

Lehigh Acres, FL

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Future of Real Estate with Investment Property Loans in Florida!

Florida’s real estate market is rapidly evolving, providing exciting opportunities for investors. Here are some of the key trends shaping the landscape for rental property investments.

Surge in Short-Term Vacation Rentals

With Florida being a year-round tourist hotspot, demand for short-term vacation rentals has skyrocketed. Cities like Miami, Orlando, and Tampa are especially popular for platforms like Airbnb. Investors can benefit from higher yields compared to long-term rentals, as vacationers are often willing to pay a premium for well-located, furnished properties.

Growth of Suburban Rental Markets

The rise of remote work has driven many renters out of city centers and into more affordable suburban areas. Markets like St. Petersburg, Lakeland, and Cape Coral are gaining traction as desirable rental locations. For investors, these areas offer the potential for lower purchase prices with strong rental demand, making suburban investments a growing trend.

At Insula Capital Group, we monitor these trends closely to provide rental property financing in Florida that aligns with market shifts, helping our clients make smart, forward-thinking investments.

Ready to apply for a rental property loan?

Frequently Asked Questions

Insula Capital Group offers flexible financing solutions for both short-term vacation rentals and long-term rental properties. Our loans are tailored to meet the unique needs of investors, with fast approvals and competitive rates to help you secure profitable rental properties quickly.

Yes! As a private money lender, Insula Capital Group provides financing options even when traditional lenders cannot. We focus on the value of the property and your investment potential, allowing for more flexibility and quicker funding.

Contact Insula Capital Group and Work with Expert Hard Money Lenders!

Insula Capital Group is known for their seamless procedures and fast paced funds. Our hard money lenders are ready to provide funding to those seeking investment opportunities in Florida.

To book an appointment, get in touch with our representatives between 9AM and 5PM, and they’ll help you with all your queries and confusion!