Rental Property Loans in Pennsylvania

Are you looking to finance a rental property in the thriving Florida real estate market? At Insula Capital Group, we specialize in offering flexible and competitive rental property loans in Florida. As a private money lender, we understand the unique needs of property investors and provide tailored solutions that help you succeed in one of the nation’s most dynamic real estate landscapes.

Florida’s rental market is booming, with over 35% of the state’s population renting their homes. The Sunshine State is consistently ranked among the top states for rental property investments due to its strong population growth, favorable tax laws, and high demand for vacation rentals. Whether you’re investing in Orlando, Miami, Tampa, or smaller markets across the state, our rental property financingis designed to empower you to capitalize on these opportunities.

With Insula Capital Group, you can secure fast, reliable funding with terms that work for you, even if traditional financing isn’t an option. Partner with Insula Capital Group and let us help you make your rental property investments in Florida more profitable and sustainable.

Get in Touch

Partner with Reliable Private Fund Lenders in Pennsylvania!

At Insula Capital Group, we understand that securing a rental property loan in Pennsylvania can be a daunting process. That’s why our private lending services are designed to make financing straightforward and efficient. With our deep knowledge of Pennsylvania’s real estate market, we provide tailored loan solutions that allow investors to confidently navigate the complexities of property acquisition and renovation.

As trusted private fund lenders, we pride ourselves on offering flexible terms, fast approval processes, and personalized support. Whether you’re looking to expand your rental property portfolio or revitalize an existing property, our loans give you the financial agility to act quickly in this competitive market.

With Pennsylvania’s growing population and high rental demand, especially in urban centers, partnering with the right lender is essential for success. Insula Capital Group ensures you have access to the capital you need when you need it, so you can stay ahead of market trends and maximize your returns.

Choose a partner that understands your goals. Choose Insula Capital Group.

Maximize Your Returns with Rental Property Loans in Pennsylvania

Investing in Pennsylvania’s rental market presents exciting opportunities, and with a rental property loan from Insula Capital Group, you can fully capitalize on this potential. Here’s why:

Tap Into Pennsylvania’s Growing Rental Demand

Pennsylvania’s urban hubs like Philadelphia, Pittsburgh, and Allentown are seeing a surge in rental demand, making them prime locations for property investments. Our rental property loans equip you with the financial resources to secure properties in these thriving markets, providing you with consistent rental income opportunities.

Flexible Financing to Build Your Portfolio

Whether you’re investing in single-family homes or multi-unit properties, Insula Capital Group offers customized loan options that align with your investment goals. Our financing solutions are tailored to meet the unique dynamics of Pennsylvania’s rental market, giving you the flexibility to expand your portfolio.

Quick Approvals to Close Deals Faster

In a competitive market, timing is everything. With Insula Capital Group, you’ll benefit from fast approvals, allowing you to secure properties quickly and confidently. We streamline the process to get you the funds when you need them.

Maximize Profitability with Favorable Terms

Our rental property loans offer competitive rates and flexible repayment terms, ensuring you get the most out of your investment. We’re here to help you minimize costs and maximize returns.

Ready to seize the opportunities in Pennsylvania’s rental market? Partner with Insula Capital Group and start building your investment success today.

Check out Alarming Statistics from Pennsylvania’s Real Estate Market!

Are you looking for reasons to acquire rental property loans in Pennsylvania? Here’s an overview of the Pennsylvania real estate scene to help you make the decision:

- The Price to Rent Ratio is 12.97.

- The Median Rent Price is $1550.

- The appreciation on properties in the last one year were 4.1%

Rental Property Market Dynamics

12.97 million

State Population

$1550

Median Rent Price

4.1%

1-year Property Appreciation

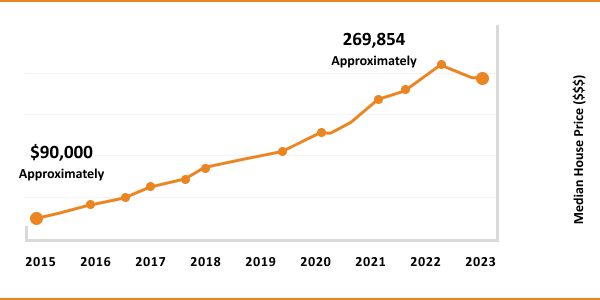

$269,854

Median Property Price

20.3

Price-To-Rent Ratio

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$224,250

After Repair Value$345,000

Renovation Budget$174,111

Loan TypeFix & Flip

- After Repair Value$345,000

- Renovation Budget$174,111

- Loan TypeFix & Flip

Lehigh Acres, FL

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

How Rental Property Loans Can Multiply Your Real Estate Investments

Rental property loans in Pennsylvania offer a smart way to grow your real estate portfolio, especially in Pennsylvania’s flourishing rental market. With Insula Capital Group’s tailored loan solutions, you can maximize your investment potential and achieve faster growth. Here’s how:

Leverage Your Existing Assets

By using the equity in your current properties, a rental property loan allows you to acquire additional properties without depleting your cash reserves. This strategic use of leverage helps you expand your real estate holdings in high-demand Pennsylvania markets like Philadelphia, Pittsburgh, and Harrisburg.

Seize More Opportunities

With rental property loans, you can quickly access capital to seize lucrative investment opportunities as they arise. Whether it’s a multi-family unit in a growing neighborhood or a single-family home ready for renovation, our fast approvals ensure you’re always ready to act.

Diversify Your Rental Portfolio

Financing options through rental property loans give you the ability to invest in different types of properties across Pennsylvania. From urban apartments to suburban homes, diversifying your portfolio helps mitigate risk while enhancing long-term profitability.

Boost Cash Flow and Long-Term Value

More rental properties mean more consistent cash flow. With rental property loans, you can build a steady income stream while increasing the overall value of your investment portfolio. Over time, these properties will appreciate, multiplying your returns.

Start multiplying your investments in Pennsylvania’s booming rental market with a customized loan from Insula Capital Group. We provide the financial tools you need to scale your success.

Ready to apply for a rental property loan?

Frequently Asked Questions

Insula Capital Group offers loans that are tailored to meet the unique needs of investors, with extremely fast approvals and market competitive rates to help you secure profitable rental properties quickly.

Insula Capital Group focuses on the value of the property and your investment potential, allowing for more flexible plans and easier funding.

Work with Expert Rental Property Lenders in Pennsylvania!

At Insula Capital Group, we pride ourselves on offering seamless, efficient loan processes and fast funding. Our team of expert lenders is ready to provide the financing you need to capitalize on rental property opportunities in Pennsylvania. Whether you’re looking to purchase or renovate rental properties, we’re here to support your investment goals.

To get started, reach out to our knowledgeable representatives between 9 AM and 5 PM. They’re available to answer all your questions and guide you through therental property loan process with clarity and confidence.

Let us help you turn your real estate vision into reality!