Single Family Rental Loans in Texas

Texas is a hotspot for real estate investors looking to grow their portfolios, particularly in the single-family rental market. With consistent population growth and a robust economy, investing in single-family rental properties in Texas can be highly profitable.

Insula Capital Group offers tailored single-family rental financing in Texas, making it easier for investors to seize opportunities, whether you’re a rookie in the real estate game or expanding a large portfolio. We understand the Texas market and the complexities that come with it. Our goal is to help you secure the financing that fits your specific needs while offering competitive rates, flexible terms, and exceptional support.

Our team has years of experience providing single-family rental property loans in Texas, and we use this expertise to provide guidance through every step of the financing process. Whether you’re dealing with fluctuating property prices or navigating local regulations, we’ll help you secure a loan that matches your investment strategy.

Get in Touch

Why Choose Insula Capital Group for Single Family Rental Loans in Texas?

In the world of real estate investment, choosing the right financing partner can make all the difference. At Insula Capital Group, we pride ourselves on being among the leading single-family rental loan lenders in Texas. Our strong connections with local lenders allow us to source the most favorable loan terms for our clients.

With our deep understanding of the Texas real estate landscape, we are well-equipped to offer loans that are customized for Texas’ thriving markets. Whether you’re dealing with competitive metropolitan areas or growing suburban neighborhoods, our single-family rental mortgage in Texas is designed to suit your needs.

Our lending team doesn’t just stop at securing a loan for you. We work with you to navigate the complexities of rental property management, including cash flow considerations and potential future investments. This allows us to build lasting relationships, ensuring that your real estate investments flourish in the long term.

Partner with us to take your real estate portfolio to the next level. Contact us now for more details.

The Benefits of Single Family Rental Loans in Texas

The Texas real estate market offers some of the best opportunities in the country for single-family rental properties. Here’s how single-family rental loans in Texas can help you:

Flexible Financing Options

Traditional loans often come with rigid requirements, but we tailor our single-family rental financing in Texas to your individual circumstances. Whether you’re looking for short-term solutions or long-term financing, our custom loans will work for your investment goals.

Competitive Rates

We offer some of the most competitive rates in the state. By partnering with a wide range of lenders, we can find the best possible interest rates for your loan, maximizing your profit potential.

Quick Approvals and Closings

In real estate, timing is everything. Our streamlined process ensures that you can secure your property quickly with minimal delays. Our efficient approval processes are specifically designed for investors who need fast access to capital.

Personalized Service

Every investment is unique. That’s why we take a hands-on approach to ensure you’re getting the best financing for your specific situation. Our team works closely with you to understand your objectives and challenges, crafting loans that help you grow.

Our team is always ready to help you achieve your goals in the real estate market. Connect with us to create a partnership that is mutually beneficial.

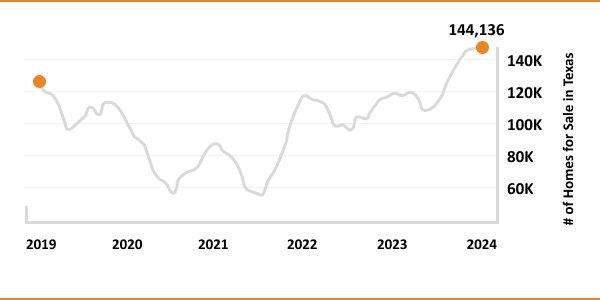

Insights into Texas’s Single Family Rental Property Market

Before diving into the Texas real estate market, it’s essential to understand the latest trends and market insights. Here are some statistics to guide your investment decisions:

- Median Rent Price in Texas: $1,904/month

- Average Home Appreciation in Texas: 5.2% annually

- Rental Vacancy Rate in Texas: 7.8%

- Price-to-Rent Ratio: 17.0

Single Family Rentals Statistics in Texas

$1904

Median Rent Price Per Month

$348,600

Median Single Family Home Price

27,921

No. of Homes Sold

17.0

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Securing Single Family Rental Mortgage in Texas: What You Need to Know

Securing financing for a rental property is about more than just interest rates—it’s about building a partnership that supports your long-term goals. Insula Capital Group is here to help you every step of the way. As single-family rental loan lenders in Texas, we provide tailored advice and competitive loans that fit your needs.

Here’s why investors choose us for their single-family rental property loans in Texas:

Deep Knowledge of Local Markets

We understand the Texas real estate landscape, from rising property values to areas with increasing rental demand. We’ll use our expertise to secure the best loan for your property.

Wide Range of Loan Options

Whether you’re looking for short-term bridge loans, longer-term fixed-rate options, or interest-only loans, we can customize a financing plan that works for you.

Strong Relationships with Lenders

Thanks to our established connections with various financial institutions, we can secure highly competitive rates and terms for your loan.

Hands-On Service

Our dedicated team is committed to providing personalized attention throughout the entire process. We’re not just here to close the deal—we’re here to ensure your long-term success.

Partner with Insula Capital Group for Your Single Family Rental Loans in Texas

When it comes to single-family rental financing in Texas, Insula Capital Group stands out as a trusted partner. Our commitment to offering single-family rental mortgage with flexible terms and competitive rates makes us the go-to lender for real estate investors.

Our process is simple and transparent, ensuring that you receive personalized attention every step of the way. We prioritize fast processing times and clear communication, helping you secure the funds you need without the hassle.

If you’re ready to invest in a single-family rental property in Texas, let us help you get started with the right financing plan. Contact our team today to schedule a consultation and learn how we can help you achieve your real estate goals.Visit our website now to learn more about our operations.

Ready to apply for a single family rental loan?

Frequently Asked Questions

We specialize in hard money loans which have a quick turnaround time and easy approvals.

Yes, we take into account Texas’ unique real estate market and customize our loans to ensure the best possible outcomes for investors.