Building in Florida’s booming real estate market? New construction loans can turn your vision into reality, whether it’s a dream home in Miami or a condo in Tampa. These loans fund your project from groundbreaking to completion, but the process can feel daunting. At Insula Capital Group, we’ve helped countless Florida builders navigate construction loans. This guide walks you through every step to secure new construction loans in Florida, ensuring your project starts strong. Let’s get your build off the ground!

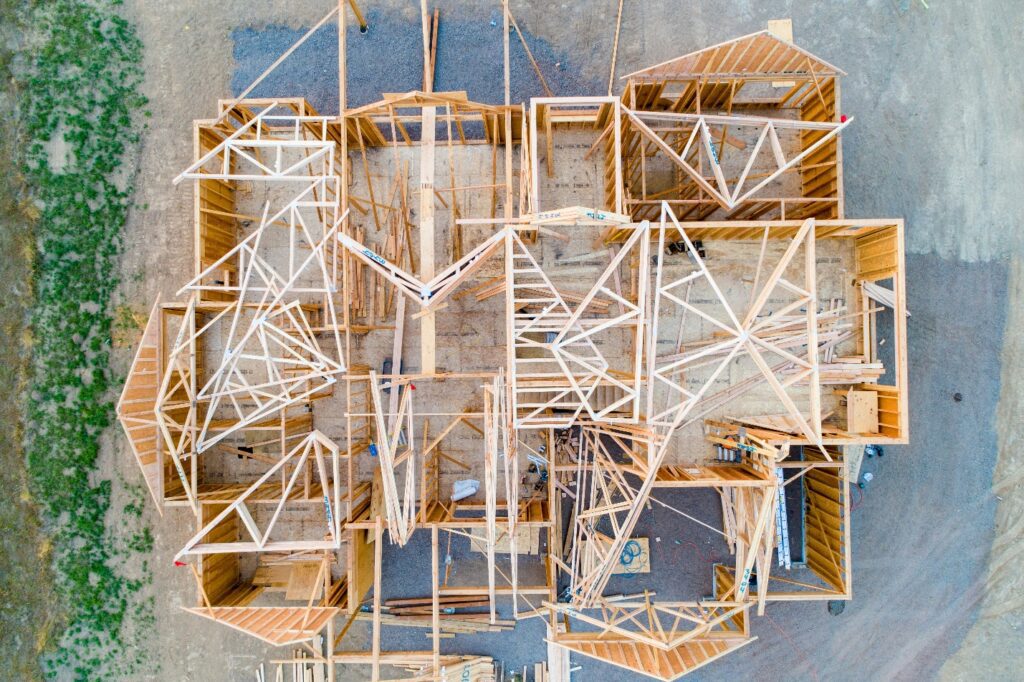

Step 1: Understand What Construction Loans Are

Construction loans are short-term, high-interest loans designed to cover building costs. Unlike traditional mortgages, they’re disbursed in stages (called draws) as your project progresses—think foundation, framing, and finishing. In Florida, new construction loans typically last 6-18 months, transitioning to a permanent mortgage once the property is complete. Insula Capital Group offers loans covering up to 90% of land costs and 100% of construction expenses, with competitive rates. Knowing how construction loans work—higher rates (10-14%) and flexible terms—helps you plan your budget and timeline effectively.

Step 2: Assess Your Project and Eligibility

Before applying, evaluate your Florida project. Are you building a single-family home in Orlando or a multifamily unit in Jacksonville? Define your scope, budget, and timeline. Lenders like us at Insula Capital Group look at the project’s feasibility, not just your credit score. You’ll need:

- A detailed construction plan and budget (including permits, labor, and materials).

- Proof of land ownership or purchase agreement.

- A down payment (10-20% of project costs). Self-employed or new builders in Florida? Our new construction loans in Floridarequire minimal documentation, making approval easier, but a solid plan is non-negotiable.

Step 3: Gather Your Financial Documents

Lenders need to see your financial picture, even for asset-based construction loans. Prepare these documents to speed up your application in Florida:

- Personal and business financial statements.

- Tax returns (1-2 years).

- Credit report (scores above 600 are ideal, but we’re flexible).

- Project budgetand timeline, including contractor bids. Insula Capital Group streamlines this process, requiring less paperwork than banks. We focus on your project’s potential, like a home’s after-construction value in Naples, ensuring new construction loans align with your goals. Organized documents mean faster approvals—often within days.

Step 4: Choose the Right Lender

Not all lenders are equal for construction loans in Florida. Banks often have strict requirements and slow approvals, delaying your build. Private lenders like Insula Capital Group offer speed and flexibility. We provide:

- No prepayment penalties.

- Funding in 10-15 days.

- Loans for residential or commercial projects. In Florida’s competitive market, where land prices rose 8% in 2024, per recent data, our quick funding helps you beat competitors in cities like Sarasota. Compare lenders’ rates, terms, and experience—choose one who knows Florida’s real estate, like us.

Step 5: Submit a Strong Application

Your application is your pitch. Submit a detailed plan showing how your Florida project—say, a townhome in Fort Lauderdale—will succeed. Include:

- Architectural plans and permits.

- Contractor agreements (licensed in Florida is a must).

- A clear draw schedule for funds. Insula Capital Group’s team reviews applications quickly, focusing on the property’s value post-construction. We don’t charge application or processing fees, keeping costs down. A complete, honest application boosts your odds for new construction loans in Florida, getting you to closing quicker.

Step 6: Get an Appraisal and Finalize Terms

Lenders require an appraisal to estimate your project’s completed value. In Florida, this considers local market conditions—high demand in Miami means higher appraisals. Insula Capital Group works with appraisers to assess your build’s potential, ensuring your construction loan covers costs. Once approved, you’ll review the terms: interest rate, loan amount, draw schedule, and repayment plan. Our terms are transparent—no hidden fees, and we customize loans for projects from Pensacola to Key West. Sign the agreement, and you’re ready to break ground.

Step 7: Manage Draws and Build Your Project

Construction loans release funds in draws tied to milestones (e.g., foundation poured, roof installed). In Florida, you’ll request draws through Insula Capital Group, and we’ll verify progress with inspections. This keeps your build on track and funds secure. For example, a Tampa builder might get 20% after framing. Stay organized:

- Pay contractors promptly to avoid delays.

- Stick to your budget to prevent shortfalls.

- Communicate with us for smooth draw approvals. Florida’s weather—hurricanes or heat—can impact timelines, so plan contingencies. Our team supports you in keeping your project moving.

Step 8: Transition to Permanent Financing

Once your Florida build is complete, your construction loan converts to a permanent mortgage or gets paid off if you sell. Insula Capital Group guides you through this transition, whether it’s a home in St. Augustine or a commercial property in Orlando. You can:

- Refinance with a traditional lender.

- Sell the property for profit.

- Keep it as a rental with our rental property loans. In 2025, Florida’s median home prices are up 4.2%, making it a seller’s market. We help you plan your exit strategy to maximize returns.

Step 9: Avoid Common Pitfalls

Securing new construction loans in Florida isn’t without risks. Avoid these mistakes:

- Underestimating costs—add 10-15% for surprises.

- Hiring unlicensed contractors can void permits in Florida.

- Missing draw deadlines, delaying funds. Insula Capital Group’s experience in Florida’s market—where we’ve funded projects from Gainesville to Miami—helps you dodge these issues. We offer expert advice to keep your build on budget and on time, ensuring success.

Step 10: Plan for Long-Term Success

Getting your Florida construction loan is just the beginning. What comes next—maintenance, renting, or selling—can shape your long-term financial return. Think beyond the build:

- Will you rent it out? Set up property management

- Selling? List strategically—spring and early summer bring more buyers to Florida.

- Keeping it? Plan insurance, taxes, and upkeep from day one.

At Insula Capital Group, we don’t just fund builds—we support your real estate goals even after construction ends. Whether it’s portfolio growth or reinvestment, we’re here for the next step.

Build Your Florida Dream with Insula Capital Group!

Ready to start your Florida construction project? At Insula Capital Group, we make new construction loans fast, flexible, and hassle-free. From single-family homes in Tampa to multifamily units in Jacksonville, our tailored financing turns your vision into reality. Don’t let delays hold you back—contact us now to secure your loan and break ground today!