Investing in property can be both exhilarating and lucrative, especially in the fast-paced world of real estate flipping. For those tapping into this appealing market, short-term land loans for property flips offer an efficient way to quickly finance land acquisitions. These specialized financial products not only help you secure the property swiftly but also enable you to maximize your returns. This blog will explore how short-term land loans can expedite your property flipping endeavors and why they are an optimal choice for both seasoned and novice investors.

Incorporating short-term land loans for property flips into your investment strategy can lead to faster acquisitions and higher profits. The benefits of quick access to capital, coupled with streamlined processes, make these loans an attractive option for anyone looking to thrive in the real estate market. Whether in California, Texas, New York, or Florida, the right financing can be the cornerstone of your flipping success.

Understanding Short-Term Land Loans

Short-term land loans differ from traditional mortgages primarily in their duration and purpose. Where typical land loan options might span years, these loans offer financing typically for shorter periods. The primary allure of short-term land loans lies in their expeditious approval process. Investors often find that traditional land mortgage loans have stringent requirements and longer timelines for approval. By opting for quick land loans, you can bypass these delays, allowing you to act swiftly when profitable opportunities arise.

Speeding Up Property Flips

In the world of real estate, timing is everything. The effectiveness of your flipping strategy hinges heavily on your ability to secure properties rapidly and efficiently. Here, short-term land loans for property flips provide the competitive edge you need. Many experienced flipping enthusiasts have embraced these loans to speed up their acquisition processes, ensuring they can purchase land before competitors even have a chance to react.

Since these loans typically involve less paperwork and fewer hurdles than conventional financing, you can streamline your property acquisition process. This immediacy is crucial when you’re vying for properties that may not stay on the market for long.

Maximizing Returns

When investing in property flipping, your ultimate objective is to generate a significant return on investment (ROI). Utilizing land purchase loans wisely can play a pivotal role in meeting this goal. By securing a property rapidly with land loan financing, you’ll minimize holding costs and potential delays associated with more traditional financing routes.

One compelling strategy is to take advantage of lower land loan rates typically offered for short-term loans. When coupled with the speed of acquisition, this can substantially increase your profit margin when selling the flipped property. This type of financing can

transform your investment approach by reducing the duration you hold onto the property, thereby lowering overall costs.

Flexibility in Financing Options

Investors often overlook the diversity of land loan options available in the market. Depending on your specific needs, you can find various types of financing geared towards different purposes, whether they’re residential, commercial, or even agricultural investments.

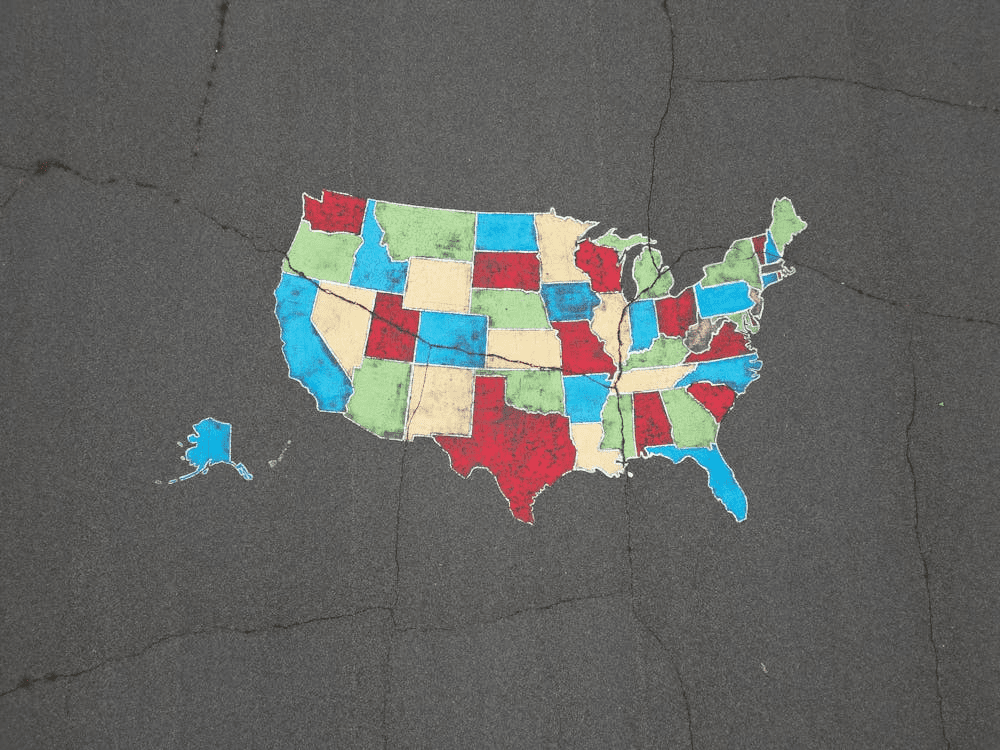

For commercial property flippers, commercial land loans provide tailored financing options, allowing you to invest in higher-value projects. New York, Florida, Texas, California, and other states have a range of specialized providers ready to assist investors in navigating these land loan requirements.

Further, land loan brokers can help simplify the process. By negotiating favorable land loan rates on your behalf, brokers allow you to secure financing that aligns with your investment strategy. This can be especially useful in competitive markets, where every moment counts.

Easy Application and Approval Processes

When it comes to land loan applications, the process is often more straightforward than traditional mortgage options. Many lenders offering short-term land loans for property flips are equipped with online tools aimed at expediting applications and approvals.

As a real estate investor, you undoubtedly appreciate how crucial it is to get the funding you need without hassle. This is where easy land loans shine. The streamlined approval process significantly reduces the time it takes to obtain the funds you require. Lenders typically assess the eligibility for land loans for investment efficiently, thus allowing you to focus on finding your next profitable flip.

Land Loan Eligibility and Providers

Understanding land loan eligibility can also enlighten your path to successful flips. Different lenders may have varying criteria based on the property type, location, and your financial history. However, because short-term land loans are designed for quick transactions, many lenders adopt more flexible eligibility requirements.

This flexibility is especially beneficial for investors in states with booming real estate markets like California and Texas. Loan providers in these regions often have tailored products to meet local demands, such as land loans in California, land loans in Florida, and even land loans in Pennsylvania. When exploring your options, it’s wise to compare various land loan lenders. This ensures you secure the best possible terms for your loans. You might find a reputable lender specializing in commercial land loans in California or land loan lenders in Texas that align with your investment strategy.

Making the Right Choice

With numerous land loan options at your disposal, choosing the right one will depend on your specific needs and goals. For example, if your aim is to quickly renovate and sell a property, you may want to consider investment land loans that allow you short-term access to capital. For those focusing on larger commercial projects, exploring commercial land loans should be prioritized.

Your choice of financing plays a crucial role in determining the success of your flips. Ultimately, whether you’re using land loans for investment purposes or seeking out

residential land loans, understanding the nuances will empower you to make informed decisions.

The Path Forward with Insula Capital Group

Are you ready to take your property flipping journey to the next level? At Insula Capital Group, we specialize in providing short-term land loans for property flips that can help you achieve your investment goals faster. Our experienced team will guide you through the land loan application process, ensuring a smooth and efficient experience. You don’t have to let financing hold you back; let’s secure the property you’ve been eyeing and maximize your returns together. Contact Insula Capital Group today to explore our flexible financing options tailored for investors like you!