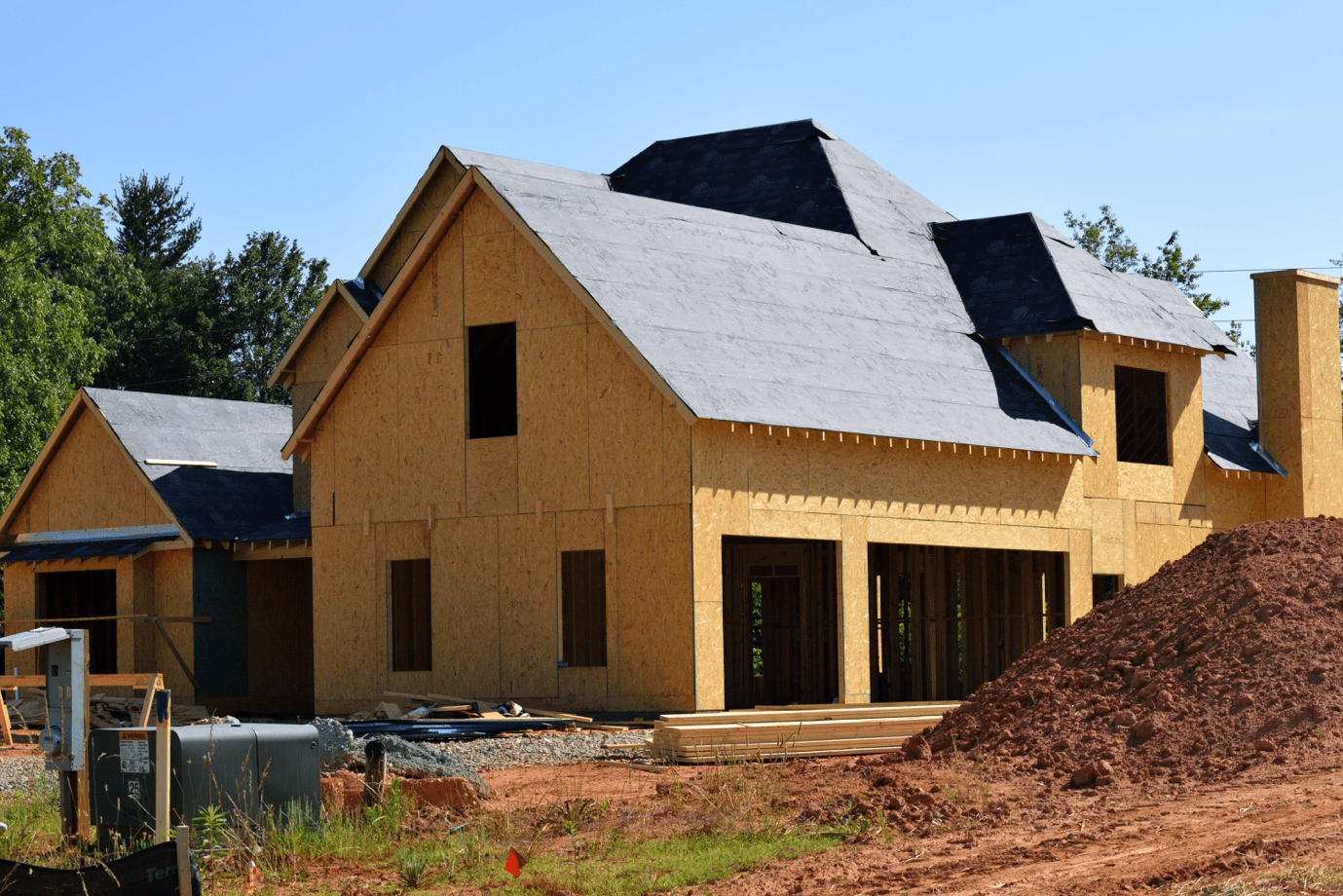

The construction industry in the United States is a dynamic and ever-evolving sector that plays a pivotal role in shaping the nation’s infrastructure. From residential developments to commercial complexes, the construction landscape is vast and varied.

However, navigating the complexities of budgeting for new construction projects can be challenging, often presenting hurdles that require careful consideration and planning.

Types of New Construction Projects

Before discussing the dos and don’ts of budgeting, it’s essential to understand the diverse types of construction projects.

These can range from residential single-family homes to large-scale commercial and infrastructure developments. Each project comes with its unique set of challenges and considerations, emphasizing the need for a tailored budgeting approach.

The Challenges of Construction

Among the myriad challenges faced by real estate ventures, the acquisition of funds stands out as a critical factor. Without adequate financing, even the most well-conceived construction projects may struggle to get off the ground. Recognizing and addressing this challenge is the first step toward successful project execution.

Six Dos of Budgeting New Construction Projects

Here are the six dos of budgeting a new construction project.

1. Thoroughly Assess Project Scope and Requirements

Before creating a budget, it’s crucial to conduct a comprehensive assessment of the project scope and requirements. This includes understanding the specific needs of the construction, materials, labor, and any potential unforeseen expenses. A detailed understanding at the outset lays the foundation for an accurate budget.

2. Create a Realistic Contingency Fund

Construction projects are notorious for unexpected surprises. It’s wise to build a realistic contingency fund into the budget to account for unforeseen circumstances, such as material price fluctuations, weather delays, or unexpected design changes. This buffer can prevent budget overruns and ensure financial stability throughout the project.

3. Prioritize Quality Over Cost-Cutting

While it’s tempting to cut costs where possible, compromising on the quality of materials or labor can have long-term consequences. Prioritize quality over cost-cutting to avoid expensive repairs or replacements in the future. A well-constructed building not only stands the test of time but also enhances the property’s overall value.

4. Collaborate with Experienced Contractors and Suppliers

Building strong relationships with experienced contractors and suppliers is essential. Seek recommendations, check references, and collaborate with professionals who have a proven track record in the industry. A reliable team contributes to smoother project execution, minimizing delays and cost overruns.

5. Regularly Review and Adjust the Budget

A construction project is a dynamic undertaking, and circumstances may change throughout its duration. Regularly review the budget, compare it against actual expenditures, and be prepared to make adjustments as needed. This proactive approach helps to identify potential issues before they escalate.

6. Research Potential Lenders

Conduct thorough research to identify reputable private lenders with a track record of successful real estate financing. Consider their lending criteria, interest rates, and terms. Establishing a relationship with the right lender can lead to a smoother financing process.

Six Don’ts of Budgeting New Construction Projects

Now, here are the six don’ts of budgeting a new construction.

1. Failing to Monitor and Adjust the Budget

Creating a budget is only the first step. Failing to regularly monitor and adjust the budget in response to changing circumstances can lead to financial mismanagement and project delays.

2. Relying on a Single Supplier or Contractor

Dependency on a single supplier or contractor can be risky. If issues arise with that entity, it can significantly impact the project’s timeline and budget. Diversify your partnerships to mitigate these risks.

3. Neglecting Sustainability Practices

In an era where sustainable construction practices are increasingly valued, neglecting to incorporate eco-friendly measures may result in missed opportunities for long-term cost savings and market appeal.

4. Failing to Plan for Delays

Construction projects are susceptible to delays due to various factors such as weather, permit issues, or unexpected challenges. Failing to plan for these delays can lead to increased costs and strained timelines.

5. Poor Communication with Stakeholders

Clear communication is paramount in construction projects. Failure to maintain transparent and open communication with all stakeholders can result in misunderstandings, disputes, and budgetary discrepancies.

6. Don’t Overlook Due Diligence

One crucial “don’t” when acquiring a loan for a new construction project is to never overlook due diligence. Failing to conduct thorough research on potential lenders and the terms of the loan can lead to significant pitfalls.

It’s essential to carefully scrutinize the lender’s reputation, past transactions, and reviews from other borrowers. Ignoring due diligence can result in unfavorable loan terms, unexpected fees, or dealing with unreliable lenders, jeopardizing the success of the construction project. Always prioritize a diligent examination of all aspects of the construction loan agreement before committing to any financing arrangement.

We Are Your New Construction Partners!

Effective budgeting for new construction projects requires a meticulous approach that considers the project’s scope, challenges, and various dos and don’ts. Thorough assessments, realistic contingency funds, and sustainable practices are crucial for success.

For real estate ventures in need of reliable financing solutions and construction loans, we at Insula Capital Group stand as a trusted partner. With 30 years of experience, our easy and fast loan programs cater to the diverse needs of real estate businesses across the US.

Our loan requests are usually processed within 24 hours and we issue approval to real estate businesses seeking financial assistance. Within five days the funds are issued so you can quickly commence the operations at your new construction project site.

Consider Insula Capital Group for a seamless financing experience and apply for a new construction loan today. Your journey to successfully budgeting a new construction project awaits, get in touch with us now!