The housing market is booming, and there’s a shortage of good properties up for grabs. In this time of hiked up prices and low inventory, buyers may be tempted to settle. But with smaller prices come large problems.

Here are some reasons you should think twice before investing in cheap real estate.

Questionable Neighborhood

The first and most key factor to consider when investing in the real estate market is the property’s location. A rule of thumb for investors is to think like a resident when thinking of buying a property.

As a potential resident, do you still think the investment is a desirable choice? If your answer is no, then you should rethink the decision to close on that property.

The neighborhood makes a big impact on how well your property can be rented or sold for profit. A study revealed taxes in poor areas are also higher. A beautiful house in a bad neighborhood won’t sell well, but an average looking home in a good neighborhood will be snatched up in a heartbeat.

Moreover, if the location has declining property values, this will come back to haunt the investor when they plan for an exit strategy. As an investor, always investigate the crime rates and amenities in the location or, better yet, speak to the neighbors. No one will be able to tell you about the area better than those living in it.

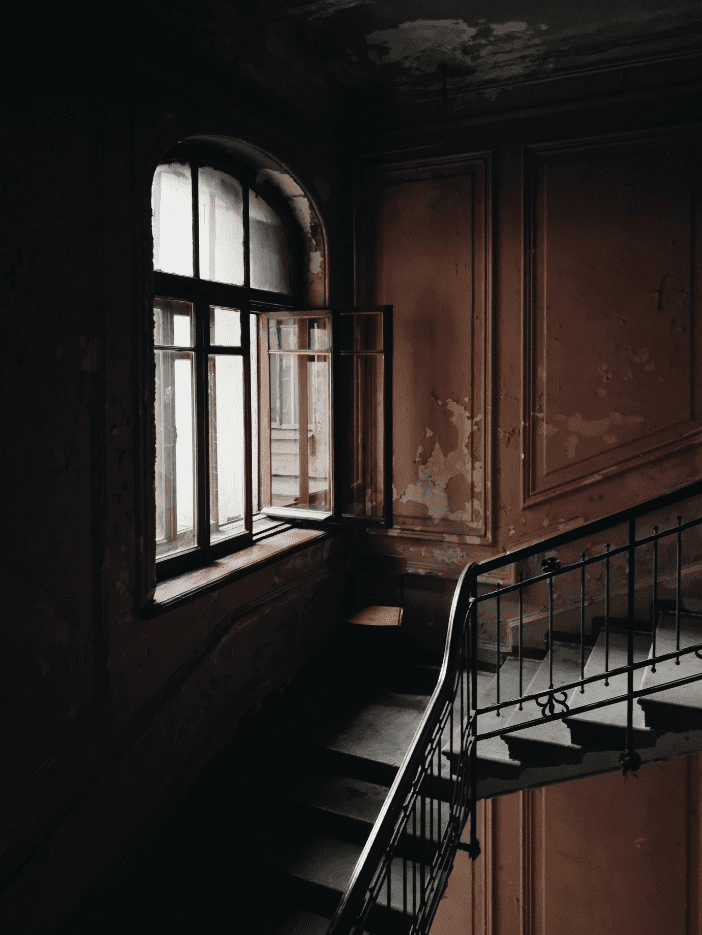

Structural Problems

Buyers sometimes invest in what they think is a steal only to find structural and foundation problems. There can be rotten corners that can lead to floor sagging down the line or create other major troubles.

Older houses may have wiring or drainage issues which can further lead to disasters. Little issues can turn into big ones quickly. The remedies don’t come cheap either.

Substantial Rehab Costs

A cheap property is synonymous with a property not taken care of. Investors will inherit someone else’s problems with a cheap house. The seller may have put a band-aid on the neglected problems instead of replacing or fixing it.

Here professional home inspections are necessary to ensure you’re not taking on more than you can actually handle. The rehab costs with structural problems add up quickly and may end up costing investors more than the actual worth of the property.

Low Value

The overall value is usually reflected by its price tag. Real estate investors always look for the best price and think that’s the most important thing about investing. Most of the time, they think the best choice is getting the lowest priced one.

However, that’s not the case. The value of the property is determined by what the market will pay for it. Buying cheap doesn’t mean it will return that investment back with increased value. Selling such properties is also difficult.

Hard to Rent or Sell

Cheap properties usually don’t fall in the median price range. Such houses are not notoriously difficult to rent out or sell. Properties may be priced so cheaply because they are unsellable.

Invest Right, Not Cheap with Insula Capital Group

The cost of ownership and fixing up the cheap house may cost you more. Don’t invest cheap; invest right! Insula Capital Group is a leading private lending company specializing in real estate financing and hard money lending. Our team of experts has the right financing option for all your needs.

Get in touch with us or visit our website to explore more!