Elevating Your Real Estate Ventures with Alternative Financing Strategies

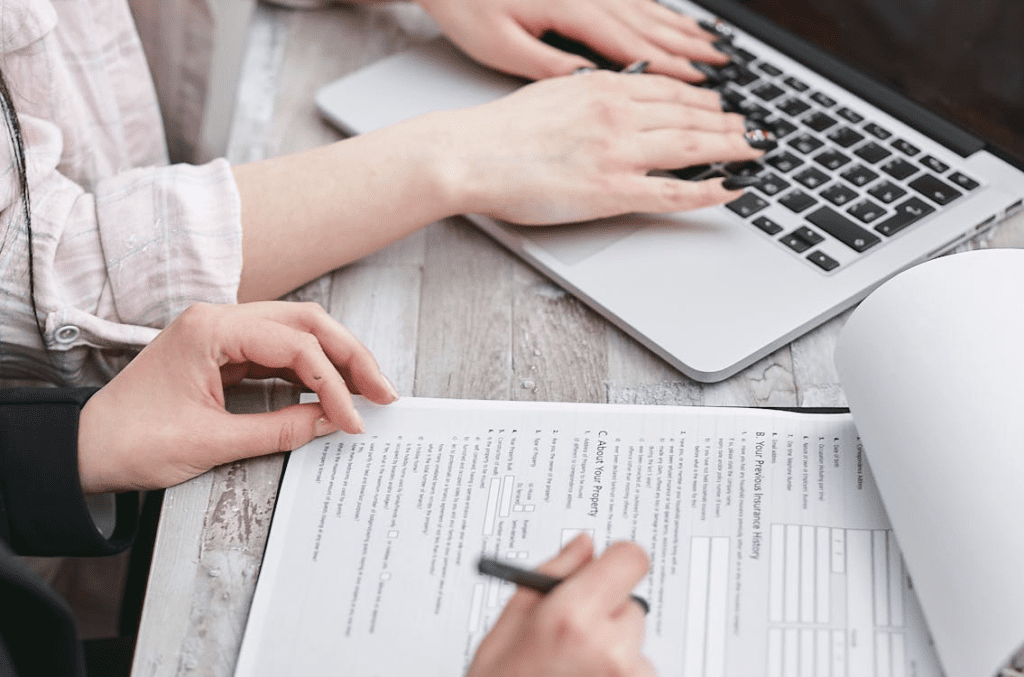

In the dynamic world of real estate investment, traditional financing methods may not always suffice to fuel ambitious ventures. Enter alternative financing strategies, offering creative solutions to fund new construction projects and elevate real estate ventures to new heights. In this comprehensive guide, we’ll explore various alternative financing options, with a focus on new construction loans […]

Elevating Your Real Estate Ventures with Alternative Financing Strategies Read More »