How to Finance Large-Scale Development Projects with Loans

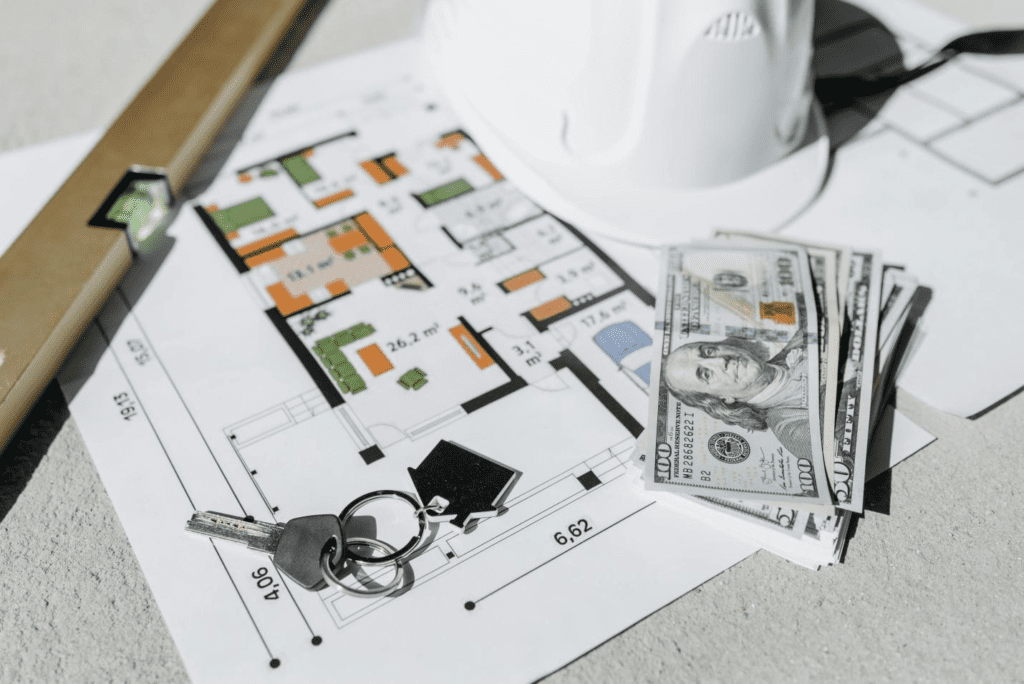

Did you know? The U.S. Census Bureau reported that construction spending on development projects reached around $1,621.4 billion in 2023. Large-scale development projects such as apartment complexes and mixed-use developments are booming, yet securing the right financing remains a daunting task for many developers. With massive budgets, long timelines, and high stakes, choosing the right development […]

How to Finance Large-Scale Development Projects with Loans Read More »