Debt-Free Dreams: Using Cash-Out Refinancing to Pay Off Debt

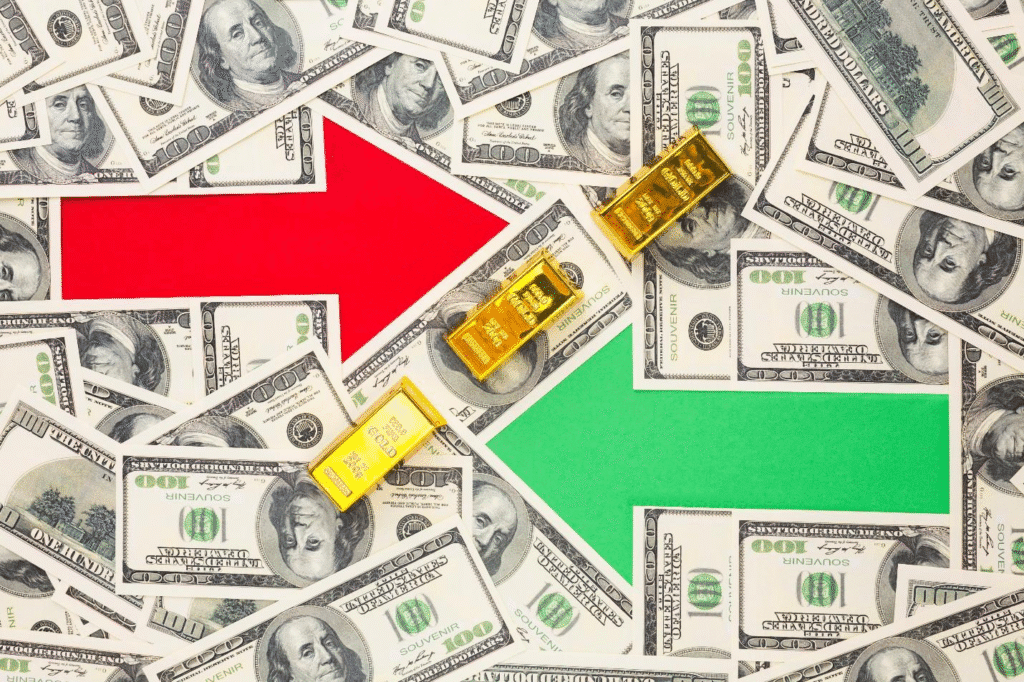

Debt can weigh heavily on anyone’s shoulders, especially when it’s coming from multiple sources—credit cards, personal loans, or medical bills—all with sky-high interest rates. Managing these various debts can be stressful, overwhelming, and financially damaging in the long run. But there’s a strategic solution that many homeowners are turning to: cash-out refinancing to pay off […]

Debt-Free Dreams: Using Cash-Out Refinancing to Pay Off Debt Read More »