How Builders Can Speed Up Project Timelines With Flexible Construction Financing

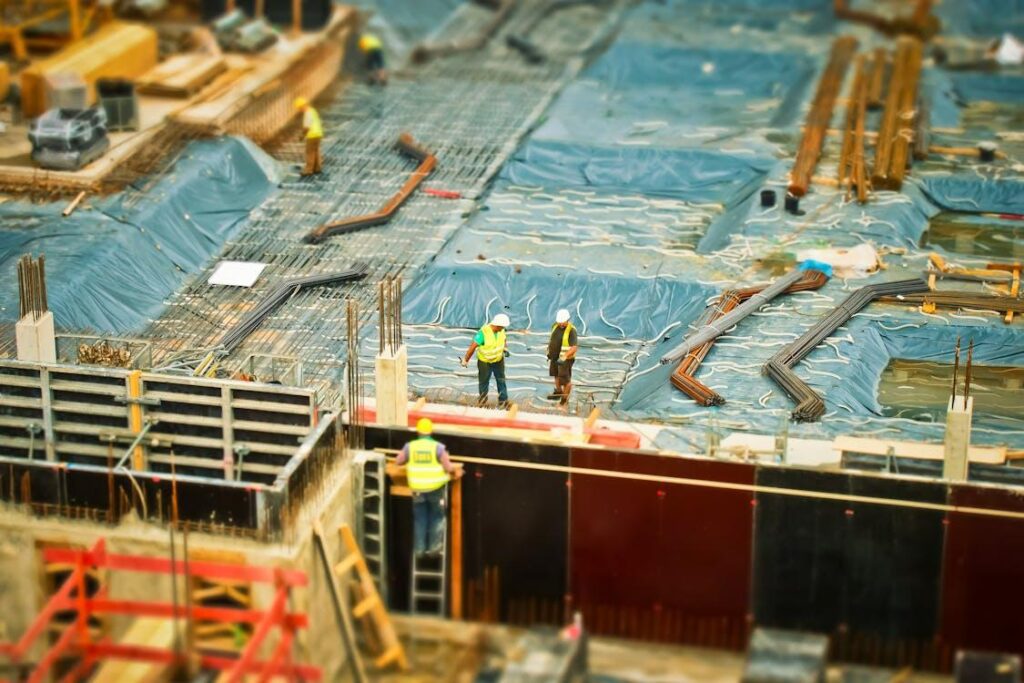

In construction, time is more than money — it’s momentum. Every delayed permit, stalled draw, or extended approval cycle compounds carrying costs and erodes return on investment. In today’s competitive real estate environment, builders who can move quickly hold a clear advantage. This is why fast construction financing solutions are becoming a priority for developers focused […]

How Builders Can Speed Up Project Timelines With Flexible Construction Financing Read More »