New Construction Loans in Colorado Springs, CO

If there’s one city in Colorado that every aspiring homeowner should know about, it’s Colorado Springs!

As the second-largest municipality in the state, Colorado Springs is home to some of the best natural landscapes in the US. It’s an ideal place for those who love nature and want to live near picturesque grasslands.

The housing market in Colorado Springs is also worth investing in for future homeowners. You can convert your vision of an ideal home into a reality here. Luckily, it’s also becoming easier for future property owners and builders to acquire funding in the city. You can enlist the help of Insula Capital Group and secure a new construction loan in Colorado Springs with ease!

Get in Touch

Finding Reputable Private Money Lenders in Colorado Springs

Due to the size of the Colorado Springs real estate market, finding trustworthy investors can be a little tricky. You will come across many lenders who claim to provide quality services, but how can you know which ones will live up to the promise?

This is where Insula Capital Group comes in. Our team consists of passionate and skilled lending experts who have a collective industry experience of over three decades. We have helped numerous investors and aspiring property owners secure the funding they need. Not every construction project has the same needs, which is something we always consider when creating specialized contracts for each client.

You can trust us for quick, efficient, and reliable financing services. Our previous clients can attest to how easy we make it for you to get a new construction loan in Colorado Springs.

Reach out to our team for more information.

Why Get a New Construction Loan in Colorado Springs

Whether you are an investor or a property owner, securing the construction funding you need can be nearly impossible on your own. The current housing market conditions call for hefty investments, making it difficult to finance large-scale construction projects individually.

There is a helpful solution to this problem, though – new construction loans! Getting a new construction loan in Colorado Springs can solve all your financial problems when building a home. You don’t have to wait for months to collect the funds required to kick off your project. Instead, you can apply for a new construction loan from a reputable private money lender and expedite the process.

With rising construction costs, you’ll need private financing to complete your projects efficiently. As a private lender in Colorado Springs, we understand the challenges you might face in acquiring capital for your construction projects. This is why you must get new construction loan deals with flexible terms.

Our team can analyze your financial conditions and provide a customized new construction loan deal in no time. With minimal interest rates and excellent repayment terms, our new construction loans offer a viable alternative for you to complete your construction projects without any financial hassle.

Find Out More About the Real Estate Market In Colorado Springs

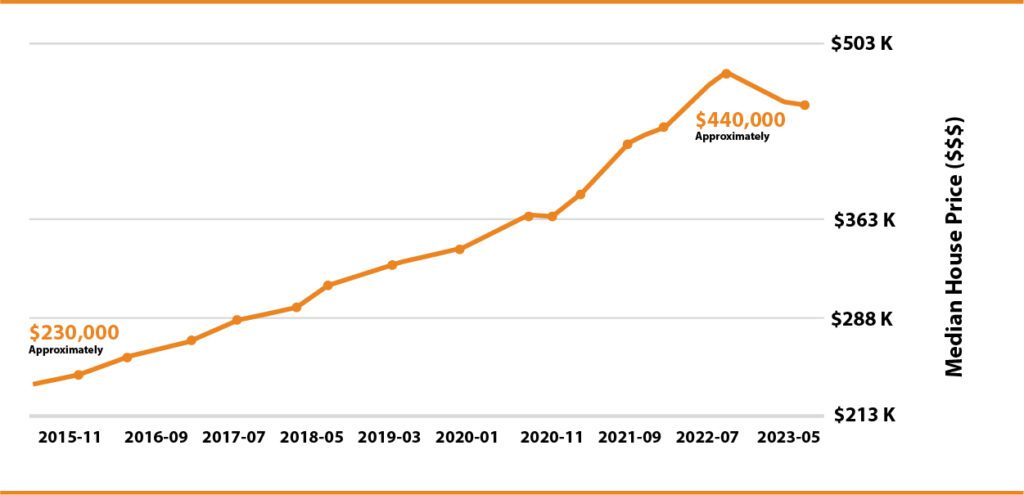

If you want to start a new construction project to give your property a new look and sell it for a higher price, consider conducting extensive market research. Here are some statistics that’ll help you with your research:

- Median Home Price: $293,500

- 1-Year Appreciation Rate: 8.8%

- Unemployment Rate: 5.1%

- Population: 439,886

- Median Household Income: $56,419

- Median Home Value (1-Year Forecast): 5.5%

- Median Rent Price: $1,500

The Real Estate Landscape In Colorado Springs

439,886

Population

$1500

Median Rent Price

$790,000

Median Home Sold Price

+8.8%

1-Year Appreciation Rate

$56,419

Median Household Income

$293,500

Median Home Price

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Is Starting A New Construction Project In Colorado Springs An Excellent Idea

The recent surge in the real estate market is an excellent opportunity for you to kickstart a construction project and earn hefty profits. With a rising population, low unemployment rates, and a rising demand for houses and commercial spaces, the city provides numerous opportunities for property developers and real estate investors.

Colorado Springs also has a supportive business environment with favorable regulatory policies and business incentives. Whether you’re planning to construct a residential building or a commercial complex, our team can help you finance various projects.

We offer funding for land acquisition, construction costs, or bridge financing for your properties in Colorado Springs. With competitive rates, quick approvals, and transparent terms, we’re your trusted partner for completing your construction projects without delays.

Ready to apply for a fix & flip loan?

Frequently Asked Questions

You can acquire a new construction loan by using our online application form.

We offer extensive hard money financing to help our clients. Here’s a list of our financing options you can use:

Get in Touch with Insula Capital Group!

We are available to answer any questions you might have from 9 am to 5 pm on all business days. You can contact us via phone call to schedule a proper initial meeting. This meeting will give us insight into your project requirements and we can learn how to help you best. Our underwriting team will analyze your financial paperwork to provide a customized new construction loan deal. If you want to start the process, you can use our website to start the online loan application.

Visit our website if you would like further information about our financing deals.

Get Quick Loan Approvals from Insula Capital Group

Whether you’re a seasoned investor or a first-time buyer, a hard money loan can provide the financial boost needed to capitalize on these opportunities. With the ability to close deals quickly, you’ll gain a competitive edge and seize profitable investments that may not be available with conventional financing.

Start applying by completing our online application form at your convenience! You can go through our FAQs and just-funded projects to learn more about our tailored lending services.