Fix & Flip Loans in California

Are you a real estate investor eager to capitalize on the lucrative fix and flip opportunities in California? Do you dream of renovating properties and turning them into profitable assets?

California’s diverse real estate market offers a wealth of opportunities for fix and flip investors. From bustling urban centers to picturesque coastal communities and everything in between, there’s no shortage of properties waiting to be revitalized and transformed.

If you’re on the hunt for a reliable lender to get fix & flip loans in California, you’ve come to the right place!

With years of industry experience and a commitment to excellence, Insula Capital Group has earned a reputation for delivering innovative loan products, competitive rates, and personalized service to clients across California. Whether you’re a seasoned investor or just starting out, we have the expertise and resources to help you succeed.

Why Choose Fix & Flip Loans in California

Quick Access to Capital

Fix & Flip loans provide investors with rapid access to the funds they need to purchase distressed properties and finance renovations.

Compared to traditional bank loans, which often involve lengthy approval processes, fix and flip loans can be approved and funded much faster, allowing investors to move quickly on promising investment opportunities.

Asset-Based Lending

Fix & Flip loans are typically asset-based, meaning the loan is secured by the value of the property being purchased and renovated. This reduces the emphasis on the borrower’s credit history and financials, making fix and flip loans accessible to investors with less-than-perfect credit or limited financial resources.

Potential for Property Value Appreciation

Fix & flip loans enable investors to leverage their capital and expertise to maximize returns on investment.

By acquiring distressed properties at below-market prices, renovating them to increase their value, and selling them at a higher price, investors can generate substantial profits from fix and flip projects.

The quick turnaround time of fix and flip loans allows investors to capitalize on short-term market opportunities and optimize their returns.

Enhanced Portfolio Diversification

Fix & flip loans provide investors with an opportunity to diversify their real estate portfolios by adding fix and flip projects to their investment mix.

Unlike long-term buy-and-hold investments, fix and flip projects offer relatively short investment horizons, allowing investors to spread their risk across multiple projects and market cycles.

Interested in making your real estate flipping dreams come true? Our seasoned experts are here to guide you at each step of your investment journey.

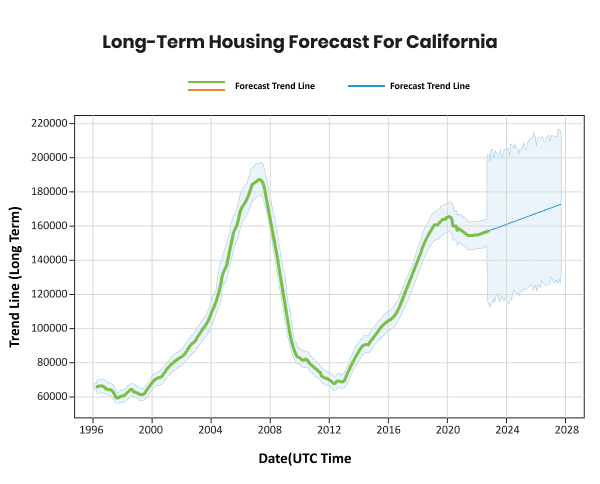

California’s Real Estate Market Insights

- Population: 39.24 million

- Average Home Prices: $743,435

- Average Rent Prices: $2750

- Median Days Before Sale: 31

- Median Sale Price: $793,400

- Annual Increase: 8.3%

- Homes Sold Above List Price:41.6%

- Foreclosure Rate: 0.02% increase

California Real Estate Landscape

39.24 million

Population

$743,435

Average Home Price

$2750

Average Rent Prices

8.3%

Annual Increase

41.6%

Homes Sold Above List Price

0.02% increase

Foreclosure Rate

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Why Insula Capital GroupIs Your Ideal Financing Partner For Your Ventures In The Golden State

Specialized Expertise

Insula Capital Group specializes in providing financing solutions tailored specifically for fix and flip projects in California.

Our team has extensive experience and in-depth knowledge of the local real estate market dynamics, regulations, and trends.

We understand the unique challenges and opportunities that investors face in California, allowing us to offer personalized guidance and support throughout the entire process.

Quick Approval and Funding

With Insula Capital Group’s private money lenders, you can expect quick approval and funding to seize lucrative investment opportunities without delay.

Our efficient approval process and expedited funding ensure that you can move swiftly on potential properties, giving you a competitive edge in the market.

Complete the online full application form to receive a loan approval in under five business days!

Transparent and Fair Terms

At Insula Capital Group, we believe in clear and honest communication with our clients, and we never charge hidden fees or impose prepayment penalties on our loans.

Our terms are fair and straightforward, allowing you to make informed decisions and plan your project budget effectively.

Dedicated Customer Support

Insula Capital Group prioritizes customer satisfaction every step of the way.

Our team of dedicated professionals is here to assist you with any questions or concerns you may have, from the initial consultation to the loan closing and beyond.

We strive to build long-term relationships with our clients based on trust, integrity, and reliability.

Proven Track Record

With a proven track record of success, Insula Capital Group has helped numerous real estate investors achieve their fix and flip goals in California.

Our satisfied clients testify to our professionalism, reliability, and commitment to excellence.

Whether you’re a seasoned investor or a first-time flipper, you can trust Insula Capital Group to be your trusted financing partner for your California fix and flip projects.

Frequently Asked Questions

Apart from fix & flip financing, we provide various financing options like residential rental programs, multifamily mixed-use loans, and new construction loans.

Our fix & flip loans start at $50,000, offering top-notch financial support for your fix & flip projects in California.

Once you apply for a fix & flip loan deal using our online full application form, we’ll analyze your financial paperwork and provide approval within twenty-four hours. Once you receive the loan approval, you can get the funding within five days.

Top Fix and Flip Loan Cities in California

Reach Out To Insula Capital Group to Jumpstart Your Fix & Flip Project In California

When looking to buy a fix and flip property, you must find a lender who understands your unique needs. That’s why we offer fast, friendly lending service and help clients at every step of the fix & flip lending process.

At Insula Capital Group, you can get top-class financial guidance and acquire exceptional loans for your project. We’ve helped various clients like homeowners, property developers, and real estate investors fulfill their financial goals by offering them flexible financing options for their real estate investments.

Our loans are tailored to fit your unique requirements, so whether you want to buy an entire property or renovate an existing property, we’ve got the correct loan for you. Visit our just-funded project section for inspiration.

Have questions? Reach out to our team for more information about our fix & flip loans in California.