Hard Money Lenders

Tired of the lengthy conventional loan process? If yes, we’ve got the perfect solution for you. As a reputable hard money lender across the US, Insula Capital Group understands having access to quick and flexible financing is often the key to seizing lucrative opportunities in the fast-paced world of real estate investing.

We specialize in providing investors with the capital needed to navigate the dynamic landscape of property acquisition, rehabilitation, and resale. Get in touch so our team can assess your financial situation and help you acquire a tailor-made hard money loan deal with flexible terms and minimal interest rates.

Get in Touch

What Is Hard Money Lending?

Hard money lending is a type of private financing that uses the equity in your asset to provide capital. It involves the use of your existing real estate as collateral for the loan deal, and we’ll use your collateral property to secure the loan deal. We provide financing solutions for various projects, including new construction loans, fix & flip loans, residential rental loans, and multifamily/mixed-use loans endeavors. Experience a streamlined application process, quicker approval timelines, and considerable flexibility in terms when you choose our hard money loan services.

Why Should You Get Hard Money Loans?

Acquiring a hard money loan can be an excellent way to help you invest in the real estate market or build your dream property. The asset-based loan deal provides you with more autonomy over your financial decisions.

It means you can choose to take on debt when it’s best for your budget. It also means you’ll be able to prioritize what kind of debt you want to take on.

The flexibility in hard money loan deals makes it a perfect option for individuals in the US to solve their financial woes.

Traditional loan approval processes can be lengthy, potentially causing investors to miss out on time-sensitive opportunities. It’s no secret that hard money lenders specialize in quick approvals and rapid disbursement of funds, allowing investors to move swiftly in competitive markets.

Many investors prefer hard money loans because lenders aren’t looking for as much collateral from borrowers compared with banks or other institutions that require extensive collateral and a long list of requirements before giving out loans.

Hard money loans are one of the best ways to get the cash you need for your residential or commercial projects. They’re also an option that anyone can use, regardless of their credit history.

Talk to us for more flexibility in loan structures – negotiate terms that align with your specific project needs, including interest rates, repayment schedules, and loan durations.

Different Types Of Hard Money Loans

We’re aware that every client has unique financial requirements and objectives. This is why to help you achieve your financial goals we offer a wide range of asset-based loans. Here are some of our hard money loans you should know about:

Fix And Flip Loans

Our hard money fix and flip loans are a type of real estate financing that allows homeowners to buy houses in need of major repairs, fix them up, and resell them for a profit.Our loan deal has an initial duration of one year or less, so it’s best used for real estate projects with a quick turnaround.

New Construction Loans

If you want to finance the costs of building or remodeling your home, consider opting for our hard money new construction loans. Our construction loans can assist you in obtaining funding for your project without selling your assets or other properties.

Rental Loans

Want to borrow money to buy or repair your rental property? It’s time to apply for our hard money residential rental loans. You can use our rental loans for everything from fixing the roof to replacing the plumbing. Rental loans can help you afford repairs that will keep your property in good shape in the future.

Multi-Family Mixed-Use Bridge Loans

Looking to dive into the booming real estate market in the US? If yes, you must utilize our hard money multi-family mixed-use bridge loans as soon as possible. Our loan deals can help you purchase multi-family properties with five or more units, making it a viable option for property investors. Our loan term is spread out from twelve to three-sixty months, helping our clients get short and long-term financing for their investment projects.

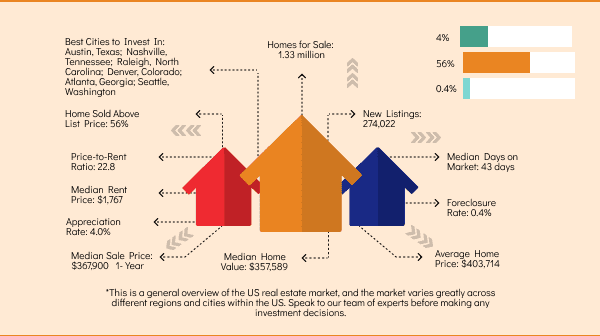

An Overview of Key Statistics

- Population:333.2 million

- Median Household Income: $67,521 Unemployment Rate: 3.9%

- Homes for Sale: 1.33 million

- New Listings: 274,022

- Median Days on Market: 43 days

- Foreclosure Rate: 0.4%

- Average Home Price: $403,714

- Median Home Value: $357,589

- Median Sale Price: $367,900 1-Year Appreciation Rate: 4.0%

- Median Rent Price: $1,767

- Price-to-Rent Ratio: 22.8

- Home Sold Above List Price: 56%

- Best Cities to Invest In: Austin, Texas; Nashville, Tennessee; Raleigh, North Carolina; Denver, Colorado; Atlanta, Georgia; Seattle, Washington

*This is a general overview of the US real estate market, and the market varies greatly across different regions and cities within the US. Speak to our team of experts before making any investment decisions.

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Insula Capital Group: Your Key To Agile, Flexibile, And Quick Capital

If you’ve been looking for a hard money loan, but aren’t sure where to go, Insula Capital Group can help. We can examine your requirements and financial goals to find the best possible lending solution.

We take pride in providing hard money loans to investors in different states across the country with the best possible rates and terms.We have been helping our clients in the real estate industry for over thirty years and we have built an amazing reputation over the years because we make it our priority to put our clients first.

Our team has experienced financial specialists who can provide. If you’re ready to get started on your next project or if this is just your first time acquiring a hard money loan, submit a loan application with details about the property, project scope, and financing needs.

We’ll work with you to find the correct loan for your financial requirements, and we’ll ensure you get loan approval quickly so you can jumpstart your projects. Visit our website for more information.

Our friendly staff will be happy to answer any questions that you may have about our exceptional hard money loans or other lending services. Check out our loan programs and just-funded projects for better insights.

Ready to apply for a Hard Money Loans?

Frequently Asked Questions

Unlike conventional financing, you can get approval for hard money loan deals with a low credit score too. All you need is an existing property as collateral for the loan.

You’ll have to apply for the loan from our website and submit the necessary documentation. After our team reviews the document, we’ll provide loan approval and inform you about the lending terms.

Yes, with flexible lending terms and quick approvals, hard money financing is a better alternative to traditional bank financing.

Top Commercial Property Loan Cities

- Alabama

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Mississippi

- Missouri

- Montana

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- North Carolina

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Let’s Partner Up!

At Insula Capital Group, we prioritize fast approvals, competitive rates, and exceptional customer service. Our team will analyze your financial needs and provide customized hard money loan deals. Our loans have various features, including quick approvals, no junk fees, minimal paperwork, no pre-payment penalties, and much more.

Check out our loan programs and just-funded projects for better insights and inspiration!