Private Money Lenders | Hard Money Loans in Virginia

If you need fast and reliable financing options for your real estate investments, look no further than Insula Capital Group. Our private money lending services are tailored to meet the unique needs of our clients, providing quick access to capital without the hassle of long procedures.

Find out more about our private money lenders in Orlando, FL.

Our loan programs are available for residential rental, fix and flip, and new constructions. We also offer a multifamily bridge loan program. Keeping the blooming economy of Orlando, Florida, we enable an expedited process for our clients to acquire the necessary capital to work on their ventures with our dedicated resources.

Get in Touch

Find Financial Solutions with Our Professional Hard Money Lenders in Virginia

As a private money lender based in Orlando, FL, we have an in-depth understanding of the local market dynamics. We leverage our local expertise to offer customized financing solutions for homeowners and investors. We offer highly competitive interest rates to ensure your borrowing costs remain affordable and within reach. Our transparent fee structure ensures there are no hidden surprises along the way.

Time is money, and we value both. Our streamlined approval process enables us to provide quick financing, often within days so that you can capitalize on your investment opportunities without delay. Our loan deals also have other exceptional features like no junk fees, extensive loan terms, no pre-payment penalties, and much more.

Reach out to us for more details.

Get Hard Money Loans In Virginia For Your Real Estate Projects

Hard money loans have emerged as a valuable financing option for real estate investors in Virginia. These loans offer a range of advantages that make them an attractive choice for individuals seeking swift funding for their real estate projects.

One of the most significant advantages of hard money loans in Virginia is the speed of loan approval. Traditional lenders often have lengthy approval processes, which can delay real estate transactions and cause investors to miss out on excellent opportunities. Fortunately, hard money lenders have streamlined procedures that enable them to evaluate loan applications quickly and deliver funds without any delay. This rapid turnaround can be critical in a fast-paced market in Virginia, which can help investors seize profitable deals before they slip away.

Traditional lenders tend to have strict criteria regarding credit scores and property conditions, which can disqualify many borrowers. Hard money lenders are concerned only with the value of the property being used as collateral. This is why individuals with low credit scores may still qualify for a hard money loan in Virginia. This flexibility opens doors for a broader range of investors who may not meet the strict requirements of conventional financing options.

Unlike conventional mortgages, which involve extensive paperwork and bureaucratic processes, hard money has simpler application procedures. It can make the borrowing experience more straightforward for investors.

Hard money loans can also be beneficial for real estate projects that require repairs. Traditional lenders may be hesitant to finance properties in need of extensive renovation because of the high risks. Hard money lenders are more willing to provide funding for such projects, as they focus primarily on the property’s potential value rather than its current condition.

If you want to take advantage of hard money financing in Virginia, consider joining hands with us.

Understand The Real Estate Market In Virginia

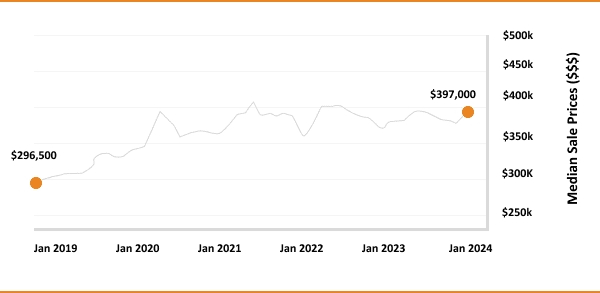

Financing any real estate project can be tricky with the rising prices and higher competition. If you want to make an informed decision, we recommend conducting thorough research beforehand. Here are some statistics that might help you make better investment strategies:

- Median Home Value:$291,233

- 1-Year Appreciation Rate:+4.5%

- Median Rent Price:$1,606

- Price-To-Rent Ratio:11

- Average Days On Market:62

- Unemployment Rate:9%

- Population:8,517,685

- Median Household Income:$68,766

- Foreclosure Rate: 1 in every 27,085 (0.3%)

The Real Estate Landscape In Virginia

8,517.685

State Population

$1,606

Median Rent Price

$291,233

Median Home Value

+4.5%

1-Year Appreciation Rate

$68,766

Median Household Income

62

Price-To-Rent Ratio

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$224,250

After Repair Value$345,000

Renovation Budget$174,111

Loan TypeFix & Flip

- After Repair Value$345,000

- Renovation Budget$174,111

- Loan TypeFix & Flip

Lehigh Acres, FL

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Invest In The Growing Real Estate Market In Virginia

Investing in real estate is a strategic move that requires careful consideration of various factors, including location and potential for growth. Virginia stands out as an attractive destination for real estate investment because of its growing economy and rising demand for residential and commercial properties.

The state’s economic stability leads to a consistent demand for housing, which makes it an ideal environment for real estate investors seeking long-term appreciation and rental income.

Virginia also offers a favorable regulatory environment for real estate investors. The state’s property tax rates are among the lowest in the nation, which reduces the overall cost of property ownership and increases the return on investment.

Virginia offers a high quality of life, attracting residents and entrepreneurs from all across the US. With its top-rated schools and top-notch recreational opportunities, the state consistently ranks as one of the best places to live in the country. This drives demand for housing and boosts property values.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

To apply for a hard money loan in Virginia, you must provide all documents, such as proof of income, bank statements, a purchase agreement for the investment property, and a detailed exit strategy. Check out the list of required documents here.

Yes! You can get pre-approved for a hard money loan in Virginia with Insula Capital Group.

Top Hard Money Lenders Loan Cities in Virginia

Contact Us Now!

Insula Capital Group is here to help you secure the financing you need for your investment property in Virginia. Contact us today to speak with one of our hard money lenders and learn more about how we can help you achieve your real estate investment goals.

Fill out our application now and take the first step toward securing your financing.