Private Money Lenders | Hard Money Loans in West Virginia

As hard money lenders specializing in West Virginia, Insula Capital Group is uniquely positioned to understand and cater to the nuances of the local real estate market. Our expertise, flexible financing options, and commitment to efficiency make us the ideal financial partner for those looking to capitalize on the promising opportunities within the Mountain state.

We illuminate the pathway to your success, offering comprehensive hard money loan solutions across Huntington, Parkersburg, Morgantown, Wheeling, and Charleston.

Get in Touch

Propelling Your Investment Journey with Diverse Loan Programs

To harness West Virginia’s real estate market’s potential, we offer diverse hard money loan programs, each crafted to meet your unique investment aspirations.

Transformative Fix and Flip Loans in West Virginia

Uncover hidden real estate gems in West Virginia with our fix and flip loans. Turn neglected properties into attractive, profitable investments and contribute to the revitalization of local communities.

Not sure if this is the right loan for you? Start by filling out our simple prequalification form.

New Construction Loans—Crafting West Virginia’s Skyline

Shape West Virginia’s skyline with our new construction loans. With our financial backing, your architectural dreams will rise from blueprints to impressive real-life structures.

For a deeper understanding of our loan structure, take a few moments and click here for more details.

Secure Your Financial Future with Residential Rental Loans

Tap into West Virginia’s thriving rental market with our residential rental loans. Build a stable, long-term income stream and grow your portfolio with high-value rental properties. As each investment opportunity emerges, be ready to seize it.

Navigating Transitions with Multifamily Bridge Loan Program

Keep pace with West Virginia’s fast-moving multifamily property market with our multifamily bridge loan program. Our bridge loans provide the financial agility you need during transitional periods or for short-term financing.

For more details, contact us and let our team guide you on the best steps forward.

The Strategic Benefits of Hard Money Loans in West Virginia

Hard money loans present a strategic avenue for real estate investors aiming to capitalize on the vibrant West Virginia market. Renowned for their swift funding, these loans bypass the prolonged processes synonymous with traditional financing methods, offering a rapid pathway from property purchase to profitability.

Insula Capital Group specializes in providing hard money loans based on property value, incorporating flexible terms to cater to a wide array of investors, including those navigating credit challenges. This adaptability is crucial in enabling investors to quickly transition through the buying, renovating, and selling phases, especially in West Virginia’s dynamic property market.

Our efficient online application and speedy approval process reflect our dedication to enhancing the success of varied real estate ventures, positioning us as an essential partner in your investment strategy. Whether tackling residential flips, commercial renovations, or new constructions, our hard money loans are structured to align with your project’s unique demands, ensuring swift execution and maximized returns.

Dive into West Virginia’s real estate opportunities with the confidence that Insula Capital Group’s hard money loans bring to your investment journey, transforming your real estate aspirations into tangible success.

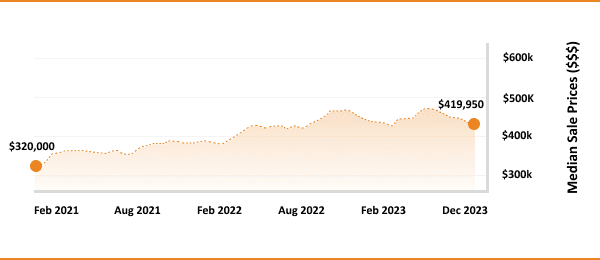

West Virginia’s Real Estate Market: Essential Insights for Hard Money Lending

West Virginia’s housing market in 2024 is a landscape where sellers have the upper hand, thanks to a tight inventory that’s fueling competition among buyers. This condition makes it a prime time for investors looking to enter or expand within the state’s real estate scene.

Core Statistics and Predictions for West Virginia’s Real Estate:

- Average Home Value:$154,979

- 1-Year Appreciation Rate:+3.6%

- Median Days To Pending Sale:10

- Active Listings:1,331

- Homes Sold Above List Price:1%

- Foreclosure Rate:One in every 11,459 homes

- Population:1,775,156

- Median Household Income:$50,884

- Unemployment Rate:3%

- Median Home Price:The average median home price in West Virginia is currently $286,000, showing a slight increase of 0.4% year-over-year.

- Sales Dynamics:Home sales have seen a decrease, with a 7.4% drop year-over-year as of September 2023.

- Rental Market:Rental prices vary across the state, with an average rent in Falling Waters at $1,850 and in Keyser at $541, indicating diverse investment opportunities in the rental sector.

- Market Liquidity:Homes spend an average of 39 days on the market, decreasing by 6 days from the previous year, suggesting a relatively quick turnover for properties.

- Supply and Demand:With an average supply of just 2 months, the demand in West Virginia’s market cannot be fully met, indicating a seller’s market condition.

Market Outlook for 2024:

The coming year is expected to bring sellers back into the market, particularly those who sat out in 2023. Predictions include a stabilization of mortgage interest rates in the latter half of the year and an increase in home buyer activity due to easing inflation and more reasonable rates. Home prices are expected to continue rising, with new home construction sales also expected to increase.

Is it a Buyer’s or Seller’s Market?

2024 is shaping up to be an excellent market for sellers in West Virginia. The low inventory and rising demand create conditions that favor those looking to sell.

However, buyers will also find opportunities with mortgage rates expected to stabilize and more listings anticipated to hit the market. The entrance of new constructions and baby boomers looking to downsize will add variety to the market, potentially making it more competitive for sellers while providing more options for buyers.

West Virginia’s real estate market presents a compelling opportunity for hard money lenders and investors. The state’s affordability, combined with a seller’s market condition, underscores the potential for profitable investment ventures.

*All West Virginia housing market statistics are as of Q2 2023.

West Virginia House Slipping Statistics

1,775,156

Population

1,331

Active Listings

$154,979

Average Home Price

+3.6%

1-Year Appreciation Rate:

One in every 11,459 homes

Foreclosure Rate

10

Median Days To Pending Sale

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$224,250

After Repair Value$345,000

Renovation Budget$174,111

Loan TypeFix & Flip

- After Repair Value$345,000

- Renovation Budget$174,111

- Loan TypeFix & Flip

Lehigh Acres, FL

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Discover Investment Opportunities in West Virginia’s Real Estate

West Virginia’s real estate market presents a unique investment landscape, marked by its affordability, economic resilience, and diverse quality of life. With its rich natural resources and growing sectors, this state stands as a promising ground for residential and commercial real estate investments.

Unlock Affordability & Economic Growth

- Affordable Housing Market: West Virginia is celebrated for its cost-effective living, offering immense value to investors and homebuyers.

- Economic Diversification: Transitioning from traditional sectors to burgeoning fields like tech and healthcare, driving job creation and housing demand.

Embrace Quality of Life Amidst Natural Splendor

- Breathtaking Landscapes: The Appalachian beauty and outdoor recreational activities enrich residents’ lifestyles.

- Community & Culture: From Charleston’s civic spirit to Morgantown’s educational hub, every city weaves a unique fabric of community life.

Strategic Advantages for Business & Investment

- Prime Location: Situated in the Mid-Atlantic, West Virginia’s infrastructure supports commercial ventures and logistics with ease.

- Infrastructure Investments: State efforts in highways and broadband expansion signal a future-proof environment for commercial real estate.

A Tapestry of Culture and History

- Historical and Modern Fusion: Cities like Harpers Ferry and Lewisburg blend rich history with contemporary living, offering niche investment opportunities in tourism and local businesses.

The Future of West Virginia’s Real Estate

- Market Evolution: Witnessing revitalization and demographic shifts, West Virginia’s property sector hints at untapped growth, backed by innovation and a startup culture.

Investing here means more than just transactions; it’s about becoming part of a region on the cusp of transformation, where affordability meets quality of life, all supported by a strategic vision for economic diversity and infrastructure development.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

At Insula Capital Group, we prioritize our clients’ individual needs. Our array of hard money loan programs is designed to be flexible and fast, enabling investors to seize opportunities in West Virginia’s dynamic real estate market.

We value your time and investment goals. Once we receive all necessary documentation and an appraisal is completed, we aim to close loans within 5 to 10 business days.

Absolutely. Our team is skilled in providing comprehensive market analyses. We can help you evaluate the potential ROI on a property, considering factors like location, property condition, market trends, and more.

No, you won’t incur any prepayment penalties when settling your hard money loan with Insula Capital Group ahead of the deadline. We prioritize flexibility and transparency in our lending practices, aiming to allow borrowers to manage their finances effectively.

Top Hard Money Lenders Loan Cities in West Virginia

Insula Capital Group—Your Gateway to MaximizingWest Virginia’s Real Estate Potential

Embarking on your real estate journey with Insula Capital Group means more than just securing a loan. It signifies partnering with a team that’s fully invested in your success, a team that walks with you every step of the way, providing the guidance and expertise you need to navigate West Virginia’s real estate landscape.

Our commitment to our client’s success is evident in the many real estate ventures we’ve helped actualize. You can discover these real-life success stories through our recently funded projects.

Are you ready to pioneer your unique path through West Virginia’s thriving real estate landscape? If you are brimming with ambition and dreams of carving out your own success in the real estate market, we’re here to provide the resources, knowledge, and support you need.

Don’t let uncertainty hamper your progress; reach out to us and schedule a consultation with our dedicated team, who would be thrilled to guide you through your options and plans.

We invite you to seize the opportunity and transform your dreams into tangible achievements, starting today.

For a detailed, custom-tailored assessment of your investment plan, don’t hesitate to fill out our comprehensive full loan application. Initiate a journey to write a new chapter of success in West Virginia’s vibrant real estate story.

The beginning of your adventure with Insula Capital Group starts here and now!