Private Money Lenders | Hard Money Loans in Kansas City, MO

Apart from one of the best barbeques in the world, Kansas City’s strong local economy, affordable housing, robust employment market, low cost of living, minimal traffic, and diverse entertainment options attract many investors and homebuyers.

Whether you’re looking to shift or invest in the City of Fountains, Insula Capital Group can provide you with the financial support needed to leverage KC’s prosperous real estate market.

Our loan programs open up a whole world of investment opportunities for investors looking to skyrocket profits. Various features make our financial programs unique, including quick approvals, no junk fees, minimal paperwork, no pre-payment penalties, and much more.

Get in Touch

Kickstart Your Real Estate Investment Journey With Reliable Hard Money Lending Services In Kansas City, MO

Our adept team at Insula Capital Group is deeply invested in helping you succeed. Over the years, we’ve explored the unique dynamics of KC’s real estate market so we can tailor our financial solutions according to a broad spectrum of investment projects.

Check out our just-funded projects to find inspiration for projects you can undertake with our fix & flip financing, residential rental loans, multifamily mixed-use loans, or new construction loans offered exclusively in Kansas City, MO.

If you’re ready to embark on your investment journey in Kansas City, apply now through our easy online application. If you’re still in the early stages of the expedition, consider our prequalification form, or get in touch with us today to learn more about our bespoke financing solutions.

Why Should You Opt For Hard Money Lending Services in Kansas City, MO?

Hard money financing can be a strategic and beneficial option for your real estate projects in Kansas City. Unlike traditional loans from banks, hard money financing offers numerous advantages that can help you complete your real estate ventures.

It’s no surprise that conventional banks have a lengthy approval process, which can cause delays in securing the necessary funds for your real estate project. Hard money lenders are known for their quick decision-making and streamlined approval procedures. It allows individuals to get their hands on top-notch properties without any delay.

Hard money lenders focus on the potential value of the collateral rather than your individual’s credit history or financial standing. This flexibility helps financially struggling individuals who may not meet traditional lending criteria.

Hard money financing provides a solution for individuals facing unconventional real estate situations. Traditional lenders may be reluctant to finance projects that involve significant renovations. Hard money lenders are more open to financing these types of projects because of their high potential.

Hard money lenders understand the local market conditions and can provide tailored financing solutions that align with the specific needs of real estate projects in Kansas City. If you need viable financing solutions, you must connect with our team.

Overview Of The Growing Real Estate Market In Kansas City

Want to start a real estate project in Kansas City? We recommend focusing on extensive research before you decide. Have a look at some exciting statistics that can help you make an informed decision:

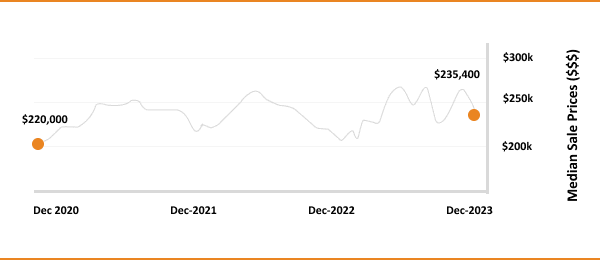

- Median Home Value: $230,647

- Median List Price: $419,667

- 1-Year Appreciation Rate: +15.5%

- Median Days On Market: 16

- Median Rent: $1,203

- Price-To-Rent Ratio: 15.97

- Unemployment Rate: 2.6%

- Population: 508,394

- Median Household Income: $56,179

- Total Active Foreclosures: 86

The Real Estate Landscape In Kansas City

508,394

Population

$1,203

Median Sale Price

$230,647

Median Home Value

+15.5%

1-Year Appreciation Rate

$56,179

Median Household Income

15.97

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Understand Kansas City’s Real Estate Market Landscape

If you’re looking for stable returns and long-term investment growth, you must consider joining Kansas City’s real estate market. With an exceptional economy and a growing job market, there’s a consistent need for residential and commercial properties. This increases property demand and presents an opportunity for investors to make money.

The cost of living in Kansas City is relatively lower, which makes it an excellent place for individuals and families looking to save money. The higher affordability leads to a steady entry of new residents, boosting the demand for housing and commercial spaces.

Understanding the complexities of the real estate market in Kansas City can be tricky and financing your projects can become a nightmare. In such circumstances, the team at Insula Capital Group can help you with flexible, hard money financing solutions.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

Getting a hard money loan from private money lenders is fairly simple. While traditional lenders require good credit scores and income verification, we prioritize your property value, overall plan, and exit strategy. If you’re unsure about eligibility, discuss your financial situation with one of our team members.

Yes, Insula Capital Group offers financing solutions for a wide range of new construction projects, including residential, commercial, and mixed-use developments.

At Insula Capital Group, we have a very straightforward loan process. You need to simply fill out one of the forms on our website (we have multiple, including full forms, quick applications, and prequalification forms). Once you’ve submitted the form and any essential documents, our team will get back to you with personalized assistance.

Let’s Partner Up!

With a strong focus on exceptional customer service, our team prioritizes clear communication, transparency, and responsiveness throughout the lending process. We’re your reliable partners to make your mark in KC’s thriving real estate market!

Schedule a consultation with our adept team for further information about partnering with one of the most cooperative private money lenders in Kansas City, MO.