Private Money Lenders | Hard Money Loans in Pittsburgh, PA

If you need fast and reliable financing options for your real estate investments, look no further than Insula Capital Group. Our private money lending services are tailored to meet the unique needs of our clients, providing quick access to capital without the hassle of long procedures.

Find out more about our private money lenders in Orlando, FL.

Our loan programs are available for residential rental, fix and flip, and new constructions. We also offer a multifamily bridge loan program. Keeping the blooming economy of Orlando, Florida, we enable an expedited process for our clients to acquire the necessary capital to work on their ventures with our dedicated resources.

Get in Touch

BenefitsOf Utilizing Hard Money Loans For Your Investment Projects in Pittsburgh

Quick Approval Process

Time is of the essence in real estate transactions, and hard money lenders in Pittsburgh understand the importance of a swift approval process.

Unlike traditional lenders, which may take weeks or even months to approve a loan, hard money lenders can often provide financing in a matter of days. This rapid turnaround time allows investors to capitalize on time-sensitive opportunities and secure properties before competitors.

Flexible Approval Criteria

Traditional lenders typically rely heavily on the borrower’s credit history, income stability, and debt-to-income ratio when evaluating loan applications.

Meanwhile, hard money lenders focus primarily on the value of the property being used as collateral. This means that investors with less-than-perfect credit or unconventional income sources may still qualify for a hard money loan, making it an accessible financing option for a broader range of borrowers.

No Need for Extensive Documentation

Traditional mortgage lenders require borrowers to provide extensive documentation, including tax returns, income statements, and bank statements, to support their loan applications.

Hard money lenders in Pittsburgh often have simpler application processes with fewer documentation requirements. This streamlined approach allows investors to access financing more quickly and with less paperwork.

Asset-Based Lending

Hard money loans are secured by the value of the underlying property rather than the borrower’s credit history or income.

This collateral-based lending approach provides added security for lenders and allows investors to leverage their existing real estate assets to access additional capital.

Even if the borrower encounters financial difficulties, the lender can recoup their investment by foreclosing on the property and selling it to recover the outstanding loan balance.

Opportunity to Seize Lucrative Opportunities

Pittsburgh’s real estate market offers a range of investment opportunities, from fix and flip properties to rental properties and commercial developments.

Hard money loans provide investors with the flexibility and speed they need to capitalize on lucrative opportunities as they arise.

Whether it’s purchasing distressed properties at auction or acquiring properties in emerging neighborhoods, our hard money loans enable investors to act quickly and secure properties with confidence.

Visit our just-funded project section to find out more about our exciting loan deals.

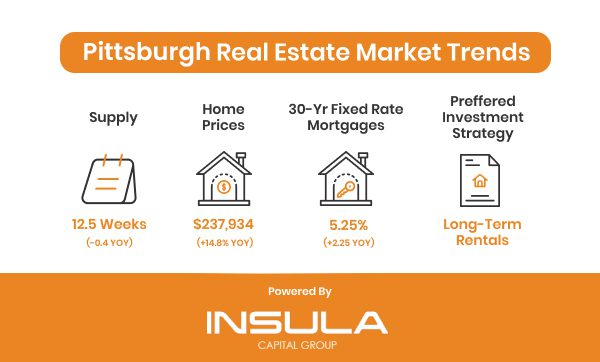

Pittsburgh Real Estate Market Overview

- Population: 301,942

- Median Home Value: $237,943

- Median List Price: $218,963

- Annual Appreciation Rate: +14.9%

- Median Days On Market: 56

- Median Rent Price: $826

- Price-To-Rent Ratio: 25.00

Pittsburgh Real Estate Landscape

301,942

Population

$218,963

Median List Price

$237,943

Median Home Value

+14.9%

Annual Appreciation Rate

$826

Median Rent Price

25.00

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Should You Invest In Pittsburgh Real Estate?

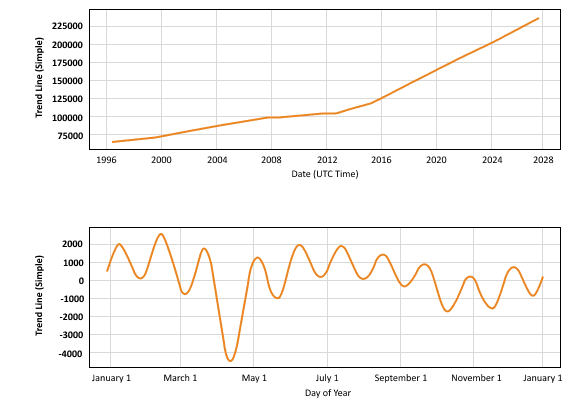

The real estate investment landscape in Pittsburgh is thriving, with no signs of slowing down in the near future.

Median home values are on the rise, and demand remains strong, indicating a robust market.

Moreover, despite current challenges, such as economic uncertainties, Pittsburgh’s real estate market appears resilient and well-positioned to withstand any turbulence.

Schedule a consultation with our team of seasoned experts for an insightful discussion about hard money loan options for making the most out of your investment in Pittsburgh.

Our comprehensive range of loan programs caters to various investment strategies, including new construction loans, fix & flip financing, multifamily mixed-use loans, and residential rental loans.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

Insula Capital Group is committed to offering investor-friendly loan programs, swift approvals, minimal interest rates, and flexible loan terms. Our seasoned experts are at your service, guiding you at each step of your investment journey.

Once you complete the online full application form, you’ll receive loan approval within twenty-four hours, and we’ll deliver the funds in five business days or less.

Hard money loans are much more beneficial than traditional loans since they allow much more flexibility and are easier to acquire. Additionally, hard money loans have easier-to-meet eligibility requirements and can be applied for even with a less-than-perfect credit score.

With a hard money loan, you get access to capital fairly quickly, and this is especially helpful for real estate investors like yourself because they help you meet tight financial deadlines.

Explore The Best Borrowing Options Offered by Pittsburgh's Leading Private Money Lenders

When you choose Insula Capital Group as your private money lender, you can expect top-class financing solutions which can help you fulfill your real estate ambitions. Your success is our priority, and we are here to ensure that you have the financial resources you need to complete your real estate projects successfully.

What sets Insula Capital Group apart is our flexible loan terms. We always prioritize our clients’ success and work closely with them to customize loan packages that align with their financial goals. Our dedication to transparency, integrity, and exceptional customer service has earned us a stellar reputation among investors in Pittsburg.

Our team of experts evaluates each investment opportunity thoroughly, ensuring that we provide competitive loan options with minimal interest rates. Our streamlined loan approval process enables investors to access funding quickly, empowering them to seize profitable opportunities in the market.

Schedule an appointment with us to capitalize on the opportunities presented by Pittsburgh’s dynamic real estate market with swift hard money loans.