If you’ve been considering building a property portfolio, then you’re in for an adventure that can potentially yield lucrative returns. A real estate portfolio is a collection of investment properties that you acquire over time. It’s like assembling a puzzle, with each property adding value and diversity to your overall financial strategy.

Let’s walk through the process of creating and growing your own real estate portfolio; we’ll cover all the essential steps, including consulting a local private money lender to set yourself up for success in the competitive world of real estate investing.

What Exactly Is a Property Portfolio?

What exactly is a property portfolio? Put simply, it’s a carefully curated collection of real estate investments that you’ve acquired over time. Think of it as your personal gallery, filled with properties that have the potential to generate income.

A property portfolio allows you to diversify your investment holdings and spread out any risks associated with owning just one property. By having multiple properties in different locations or sectors, you can mitigate the impact of market fluctuations and potentially increase your chances of financial success.

Each property within your portfolio serves a unique purpose. Some may be rental properties, generating monthly cash flow through tenant occupancy. Others may be fixer-uppers that you plan to renovate and sell for a profit down the line. The key is to strategically choose properties that align with your investment goals and overall strategy.

How to Create an Investment Portfolio

Creating an investment portfolio can be a lucrative way to secure your financial future. But where do you start? Here are some essential steps to help you build your real estate portfolio.

Perform Market Research and Seek Suggestions

Performing thorough market research and seeking suggestions should be the first step in building your real estate portfolio. This crucial process will help you make informed decisions about where and what to invest in.

Start by analyzing the local real estate market trends, such as property prices, rental rates, vacancy rates, and potential growth areas. Look for neighborhoods with strong demand from tenants or buyers.

Additionally, seek recommendations from experienced investors or professionals in the industry. Attend networking events or join online forums to connect with others who have successfully built their portfolios. Their insights and advice can provide valuable guidance in choosing the right properties to invest in.

Consult financial advisors or local private money lenders like Insula Capital Group to determine your budget and financing options. They can help you assess your financial situation and identify suitable loan programs for your investment goals.

Creating a Real Estate Business Plan

When it comes to building a real estate portfolio, having a solid business plan is essential. This document serves as your roadmap, guiding you through each step of the investment process. It outlines your goals, strategies, and financial projections.

To start creating your real estate business plan, begin by identifying your objectives. Are you looking for short-term gains or long-term passive income? Do you want to focus on residential properties or commercial buildings? Understanding what you hope to achieve will help shape the rest of your plan.

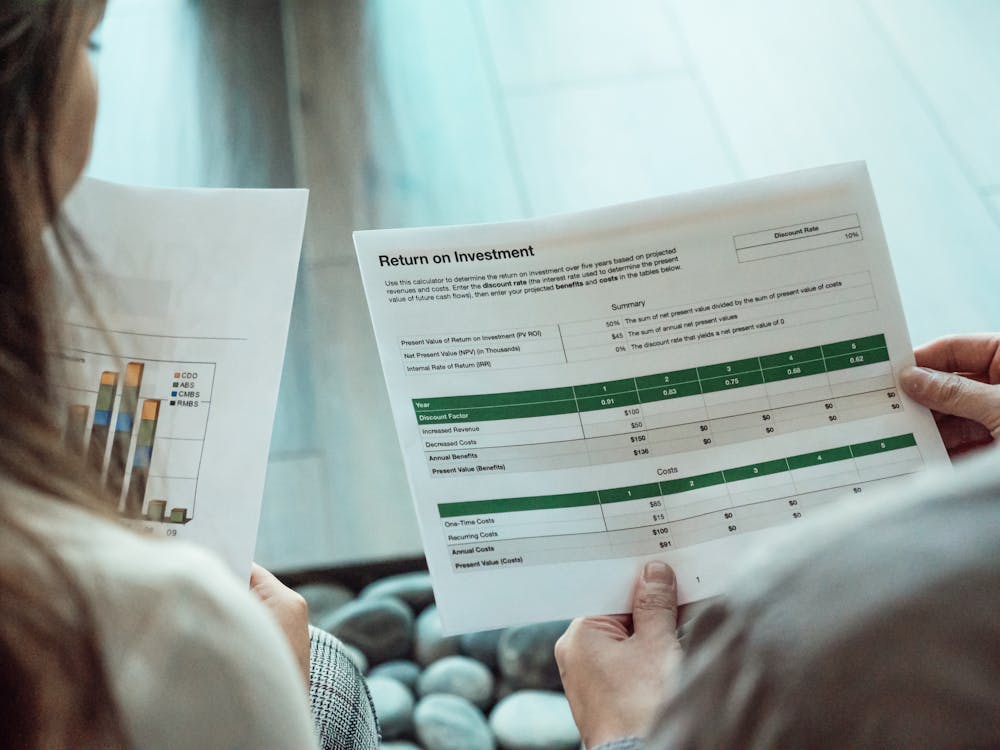

Once you have gathered this information, it’s time to outline your strategies for acquiring and managing properties. Determine how much capital you have available and identify potential sources of financing if needed. Consider factors such as property location, rental demand, and potential returns on investment.

In addition to these operational aspects, remember to include marketing strategies in your plan as well. How will you attract tenants or buyers? Will you work with real estate agents or utilize online platforms?

Remember that creating a thorough real estate business plan takes time and effort but is worth every minute invested upfront. It will serve as a guide throughout your journey towards building a successful real estate portfolio!

Buy Your First Investment Property

Congratulations! You’ve done your market research, sought advice from experts, and created a solid real estate business plan. Now, it’s time to take the next step in building your property portfolio: buying your first investment property.

This is an exciting milestone in your journey as a real estate investor. It’s important to approach this decision with diligence and consideration. Start by determining what type of property aligns with your investment goals – whether it’s residential or commercial, single-family homes or multi-unit complexes.

Next, conduct thorough due diligence on potential properties. Evaluate their location, condition, rental income potential, and future appreciation prospects. Crunch the numbers to ensure that the purchase price aligns with your budget and expected return on investment.

Once you’ve found a promising property that meets all your criteria, it’s time to make an offer. Work closely with professionals such as real estate agents and attorneys who can guide you through negotiations and help you secure favorable terms.

Financing is another crucial aspect of buying an investment property. Explore different options, such as traditional mortgages or financing through private money lenders, based on the specific needs of each deal.

As you close the deal on your first investment property, be prepared for ongoing responsibilities like maintenance and tenant management. Consider hiring professional property managers if needed to streamline these tasks.

Remember that investing in real estate is a long-term commitment; don’t expect immediate returns but focus on building equity over time while generating cash flow from rental income.

Buying your first investment property is just the beginning of growing a successful real estate portfolio.

Diversify Your Real Estate Portfolio

When it comes to building a real estate portfolio, diversification is key. By investing in different types of properties and locations, you can minimize risk and maximize your potential for returns.

One way to diversify your real estate portfolio is by investing in different property types. This could include residential properties such as single-family homes or multi-unit buildings, as well as commercial properties like office spaces or retail stores. Each type of property has its own set of advantages and considerations, so it’s important to do your research before making any investment decisions.

Another strategy for diversifying your portfolio is by investing in different geographic locations. By spreading out your investments across various cities or even countries, you can reduce the impact that local market conditions may have on your overall returns. Additionally, investing in areas with strong growth potential can help offset any downturns in other markets.

Remember that diversification does not guarantee profits or protect against losses – it’s simply a strategy aimed at reducing risk. It’s important to regularly review and adjust your portfolio based on changing market conditions and your own personal goals.

By taking steps to diversify your real estate portfolio, you position yourself for long-term success and increased resilience against economic fluctuations.

Choose a Professional for Help!

Building a successful real estate portfolio requires a strategic approach, and exploring financial partnerships can be a game-changer. For new investors, considering hard money lenders is crucial.

Private lenders for real estate investors, such as Insula Capital Group, provide tailored financing solutions, opening doors to diverse investment opportunities. By leveraging the expertise and resources of private money lenders, investors can navigate the real estate landscape with confidence, optimizing their portfolios for long-term growth.

Ready to take the next step? Contact Insula Capital Group today.