Multifamily Bridge Loans

As a reliable multifamily bridge lender, developers and real estate investors can get short-term funding for purchases, extensions, or upgrades in the multifamily housing market via Insula Capital Group’s multifamily bridge loans.

Our multifamily loan bridging financing offers flexible terms, quick approval, and competitive rates, enabling immediate investment start-ups for permanent financing or property repositioning. Our multifamily bridge loans are designed to fit your unique needs and guarantee positive results.

Our team works directly with borrowers and investors in the real estate industry to offer financing choices that support their long-term goals. We do this by providing individualized, helpful advice.

Get in touch with our team right now to find out how we can assist you in obtaining the multifamily bridge loan that best fits your investment plan.

Partner with a Competent and Reliable Multifamily Bridge Loan Lender

For multifamily real estate developments, Insula Capital Group bridges the gap between long-term financing and investment choices with quick and trustworthy multifamily bridge loan rates

Our specialty is bridging finance for multifamily properties. We provide accelerated approval processes to enable timely capital acquisition in real estate markets where time is of the essence by using multifamily bridge loans with quick approval.

Each loan offered at Insula Capital Group is tailored to meet your specific needs thanks to our customization-friendly approach. Get in touch with us right now to learn how our multi-family bridge loans help advance your next project.

Reach out to our team for more information.

What Makes Multifamily Bridge Financing a Smart Choice for Real Estate Investors?

For real estate owners looking for short-term cash flow, finance for renovations, or property stabilization prior to long-term financing, multifamily bridge financing solutions are a great choice:

Flexibility and Speed: Due to their quick approval processes Multifamily bridge loan providers are essential for buying distressed assets or finishing value-adding upgrades because they save investors time and money.

Easy Private Financing: Compared to traditional banks, private lending bridging loan multifamily solutions provide investors more flexible terms and conditions that are frequently tailored to specific project demands.

Interim Financing: Multifamily bridge loan lenders provide interim funding for growth, enabling investors to migrate from short-term to long-term solutions, thereby closing the gap between permanent financing and property stabilization.

Better Cash Flow: By using multifamily bridging loans, investors can expedite the completion of improvements or property repositioning, which raises the rental revenue and value of the asset.

Working with a trustworthy multifamily bridge loan provider like Insula Capital Group can help you make strategic investment decisions using the right financing.

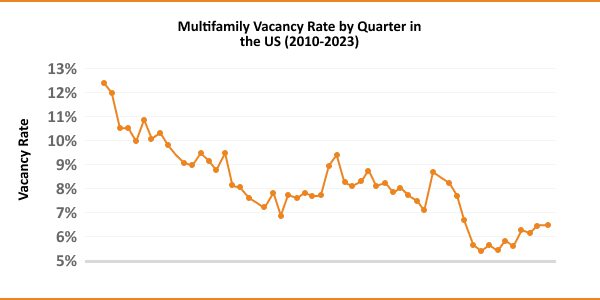

The Latest Multifamily Market Insights

Let’s look into the insights from the multifamily lending market in the US. Understanding these factors can help real estate investors make smart decisions and boost ROI:

- To meet demand, about 4.3 million new apartment units are expected to be built by 2035.

- Multifamily vacancy rates in the United States are predicted to average 5.1%.

- The average rent growth in major markets is expected to be 3.5%, with larger growth in high-demand locations.

Multifamily Real Estate Market Overview 2024

152,000

Units absorbed

Occurring by 2028

Loan Maturity Majority

5.87%

Average multifamily cap rate

31.4% of the total housing units in the US

Number of Multifamily Properties in the US

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

How Multifamily Bridge Loans Can Amplify Your Real Estate Investments

Real estate investors use multifamily bridge loans, which are flexible, short-term loans that bridge the gap between short-term capital requirements and long-term financing choices, to quickly increase their properties.

Availability of Instant Funding

Multifamily bridge loans give investors rapid access to capital for high-potential or time-sensitive initiatives like real estate repositioning, refurbishment, and property acquisition.

Increase the Value of the Property

Prior to securing long-term financing, multifamily bridge financing enables investors to finance expansions and modifications that will increase the property’s value, rental revenue, and sales.

Adaptable and Customized Solutions

Bridge loans for multifamily properties provide investors with flexibility by aligning financing with investment objectives, facilitating asset optimization, property transition, and maintenance of rental income.

How to Find the Best Rates for Commercial Loans

Insula Capital Group works with clients to provide specialized real estate solutions, competitive pricing, and customized financing options for multifamily financing.

Insula Capital Group evaluates the borrower’s financial situation, project objectives, and investment aspirations in order to provide flexible, affordable multifamily bridging loans.

Get in touch with us right now to see how we can assist you in obtaining the finest prices for the financing of multifamily properties.

Frequently Asked Questions

The following factors can affect multifamily financing rates:

- Loan-to-value ratio

- Property’s condition

- Credit score of the borrower

At Insula Capital Group, we provide multifamily financing with fast approvals so you can take advantage of opportunities that are time-sensitive in a matter of days as opposed to weeks.

Top Hard Money Lenders Loan Cities in Alabama

Reach Out to the Team at Insula Capital Group!

Take your real estate investments to next level with our flexible financing solutions. We will help you get multifamily bridge loans with fast approvals. Our services feature:

- Fix & flip loans

- Residential rental programs

- New construction loans

- Multifamily mixed-use loans

- Commercial Property Loans

Call us to line up a consultation between 9 am and 5 pm on business days. Contact us via phone call and let us provide you with the best multifamily bridge loans.